Nasdaq and Amazon Web Service (AWS) have expanded their existing partnership in order to offer its financial services clients new cloud-based solutions.

Adena Friedman, chair and chief executive of Nasdaq, said on the first quarter results call on 24 April 2025 that the firm’s move to the cloud has enhanced its ability to navigate the current environment successfully due to the increased and instant scalability of its market infrastructure, including its matching engines, resulting in enhanced resiliency and efficiency.

“Through our expanded partnership with AWS, we plan to leverage the learnings and expertise gained from our transition as we continue to modernize the global financial ecosystem,” said Friedman.

“We’re really proud of the results that we delivered this quarter,” says Nasdaq CEO @adenatfriedman. https://t.co/2C0iTjKIaA

— Squawk Box (@SquawkCNBC) April 24, 2025

She argued that the combined power of AWS and Nasdaq will enable market operators to modernize in a cost effective manner, while mitigating transformation risk as they retain data sovereignty. Nasdaq demonstrated this can be done by migrating its own options markets to the cloud, while maintaining high levels of performance, security and resilience.

The initial phase of the new partnership focuses on providing market operators with public and hybrid cloud infrastructure, software, and services offerings through Nasdaq Eqlipse to deliver cloud-ready capabilities and data intelligence across the full trade lifecycle. Nasdaq Eqlipse Intelligence will allow the industry to deploy AI at greater scale, recognizing its potential to transform how marketplaces operate.

For the first time, global market participants will have access to compute services from AWS in close proximity to the core exchange complex and their own co-located trading systems. In addition, AWS will provide low-latency, high bandwidth connectivity for global applications while enabling operators to retain overall control of their data.

Nasdaq’s Nordic markets will be among the first markets to migrate to the managed infrastructure model powered by the new partnership, subject to regulatory approval. The company has also expanded its modernization partnerships with both the Johannesburg Stock Exchange (JSE) and Mexico’s Grupo BMV.

Matt Garman, chief executive at AWS, said in a statement: “Together, we are helping market operators provide seamless connectivity for markets and investors anywhere in the world, with a blueprint for modernization and innovation, and the ability to unlock new opportunities for innovation and growth in capital markets.”

Friedman continued that market infrastructure providers around the world want to have incredible scalability; they want to be able to organize their data in a way that allows them to bring more functionality and AI capabilities into their markets over time, which will be a driver of growth for them; and they have to maintain hyper-resilient, hyper-secure infrastructure. They also want to attract foreign investors, so they want to be adaptable in terms of their technology and the way that their markets work so they are more standardized, and want to easily bring in new products, asset classes or capabilities .

“As a solutions provider we can help them with that adaptability, modernization and also in driving more standardization,” she added. “AWS creates modern infrastructure that underpins all of that so they have the benefits of cloud, security, scalability and modern data capabilities.”

Friedman believes creating connectivity across markets will allow investors to allocate capital flows more efficiently, effectively and faster across markets over time.

In a continuation of the trend of modernising markets, modernization megatrend, Nasdaq’s capital markets technology business signed multiple strategic deals in the first quarter completing 25 upsells and market technology signing 17 upsell. Market technology also had a cross-sell to nuam, a consolidated market operator spanning Peru, Chile, and Colombia, who chose Nasdaq’s newly launched trade, clearing, and central securities depositories (CSD) intelligence solution.Total revenue for the financial technology division was $432m in the first quarter, up 10% from a year ago.

Verafin’s financial crime management technology revenue growth reflected momentum across both enterprise and small-and-medium bank clients, while AxiomSL’s regulatory technology achieved solid growth as its solutions helped clients navigate elevated market activity according to Nasdaq.

Nasdaq said it has secured 19 cross-sell wins since the Adenza acquisition across solutions including surveillance, AxiomSL and Verafin. Nasdaq added that it remains on track to surpass $100m in run-rate revenue from cross-sells by the end of 2027. At the end of the first quarter, cross-sells accounted for over 15% of financial technology’s sales pipeline.

Index business

Friedman said the index business delivered another “outstanding” quarter as revenue of $193m grew 26% in the first quarter of this year. Nasdaq had $86bn of net inflows in the index business over the trailing twelve months and $27bn in the first three months of this year. Half of the inflows in the first quarter were not related to Nasdaq 100 index products, according to Friedman.

“We’ve executed against a very defined strategy of bringing new products to market, expanding the index franchise beyond the Nasdaq 100, growing our international clientele and also expanding into the institutional clientele,” she added.

Average ETP assets under management linked to the index business reached $662bn, for a sixth consecutive record quarter, despite a more volatile market backdrop. Nasdaq launched 30 new index products in the first quarter, including 10 international products, seven in the institutional insurance annuity space, and 16 launched in partnership with new index clients.

“New product launches have been a strong growth driver for index and products launched since 2020 have accounted for 33% of net inflows over the last five years,” added Nasdaq.

Friedman argued that the index business will continue to perform, even if markets fall, due to new product launches, derivatives volume and data revenue.

“That obviously showed up in the 26% growth in the business, even with an 8% decline in market values in the first quarter,” she added. “We are still seeing inflows in April, so we are very excited about that.”

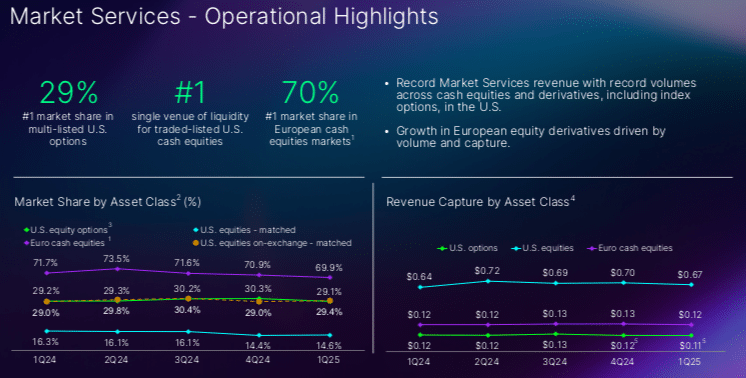

Market Services

The market services division reported record net revenues in the first quarter due to record cash equities and derivatives volumes in the U.S, including in equity options, including index options, as well as growth in European equity derivatives. First quarter revenue increased 19% from a year ago to an all-time high of $281m.

Friedman said volatility at the start of the second quarter of this year led to unprecedented levels of message traffic and volume. For example, the US cash equities markets experienced five of the six highest trading days in industry history, and the US options markets had four of the six highest trading days during this period.

“Nasdaq’s markets performed extremely well as we managed enormous volumes and inbound and outbound message traffic, including our most active day ever on April 7, which exceeded 550 billion messages,” she added.

In comparison, Nasdaq has around 200 billion messages per day in early 2024.

European cash equities markets also experienced unprecedented activity in the first two weeks of April, delivering the seven highest traffic days on record.

Nasdaq aims to expand U.S. market access to 24/5 trading in the second half of 2026, subject to regulatory approval and alignment with the industry participants.

“The planned launch of 24-hour trading on the Nasdaq Stock Market will broaden investor access and wealth-building opportunities globally, including in Asia, where demand for Nasdaq-listed stocks is accelerating,” added Nasdaq.

Last month Nasdaq said it plans to open regional headquarters in Dallas, Texas. Meanwhile the Texas Stock Exchange, backed by BlackRock and Citadel, has allied for regulatory approval to launch and ICE has already opened an office in the state. Nasdaq has about 700 clients in Texas, according to Friedman, which includes banks, brokers, investors, corporate clients and around 200 listed clients.

“We are expanding our presence in Texas because the clientele has really expanded through all the work that we’ve done in the financial technology division,” she added. Public companies based in Texas want to have that great local presence, but they also want access to a global market, and we can provide both.”

Financials

Nasdaq reported first quarter net revenue of $1.2bn, an increase of 12.5% over the same period in 2024.

Sarah Youngwood, chief financial officer of Nasdaq, said on the results call that Nasdaq delivered one of its strongest quarters yet, with all three divisions achieving robust revenue growth and contributing to “stellar” earnings per share growth.

“We generated 9.5% of alpha driven by new and existing clients, product innovation as well as excellent market services execution in this volatile market,” added Youngblood. “Meanwhile, beta factors contributed 3% this quarter driven by higher valuation in Nasdaq indices and higher overall volume in both index derivatives and market services.”

Youngwood continued that Nasdaq has an “incredible” organic work path in front of the firm and that is where it is focused.

I