Nasdaq plans to launch PureStream, a volume-based trajectory trading solution in Europe as Cboe Global Markets also intends to offer a service allowing participants to source and match liquidity at a forward benchmark price in the region.

In Europe Nasdaq owns and operates trading venues, or MTFs, in seven Nordic and Baltic countries. Henrik Husman, president of Nasdaq Helsinki & head of European equities at Nasdaq, told Markets Media that Nasdaq intends to launch PureStream in the first quarter of 2025, subject to regulatory approval. At the same time Nasdaq will also expand coverage of European Union stocks to offer about 2,000 listed companies for trading .

“It will be exciting for Nasdaq to have a pan-European scope and to offer this new way of trading,” said Husman. “I have been in the industry for 27 years and it is rare to launch new ways of trading in cash equities.”

Trajectory crossing has been available in the US and Canada for some years. PureStream matches indications of interest (IOIs) using volume-based trajectory trading logic. Traders can find counterparties to their interest and execute a specified percentage of market volume over time at volume-weighted average price (VWAP).

Nasdaq technology has been powering the PureStream alternative trading system (ATS) which launched in the US in 2021. In the following year Nasdaq Canada added a PureStream order type.

Husman said trajectory crosses, based on multiple time points, have been popular in the US and Canada due to the increase in passive and index-based trading.

“We have a lot of interest from firms who are actively using PureStream in North America, so it will be very easy for them to embrace the European version,” he added. “This is another example of the automation of equities trading in Europe, but it also showcases the increasing amount of passive trading.”

Armando Diaz, chief executive of PureStream, said in a statement that the firm is fully committed to advancing streaming globally. He added: “We are very excited about Nasdaq’s introduction of PureStream in Europe which marks a significant milestone.”

Cboe has also said it is launching Cboe BIDS VWAP-X, a trading service allowing participants to source and match liquidity at a forward benchmark price, in Europe before it is extended to other geographies. The service is scheduled to launch on 21 October 2024, subject to regulatory approvals.

Stephen Berte, president of BIDS Trading, the independent subsidiary of Cboe Global Markets, told Markets Media last month that the service is initially being launched in Europe due to the significant first-mover advantage, and the belief that systematic trading will continue to grow in the region.

“In Europe we want to be the leading trading solutions provider for those going down that path,” Berte added. “The US is probably next in line and we have a lot of demand from our users and participants in Canada.”

PureStream

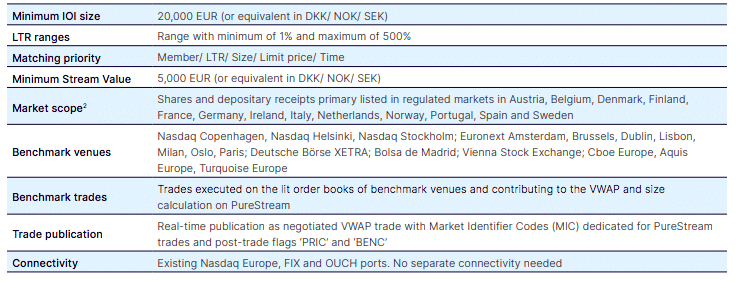

Husman said the PureStream order type collects trading interests for larger blocks of shares and then matches them based on a number of parameters.

“It becomes special as clients can choose a ‘liquidity transfer rate,’ (LTR) which can be anything from 1% to 500%, and this determines the share of volume from future trades that PureStream will execute,” he added.

Once the interests match, clients wait for trades done by others in the lit books, and they take a percentage based on the LTR of the traded volume. Nasdaq collects all these trades over time and once a minimum threshold is reached, the exchange creates an on-exchange off-order book trade report with pricing based on VWAP (volume weighted average price).

For example, two IOIs are up in a stream with an LTR of 15% and volume of 20,000 shares. A PureStream trade is executed when the total volume executed on lit venues across at least two trades, multiplied by the LTR, reaches the minimum stream value threshold of €5,000. The stream continues until the full volume is traded, the limit price of one of the IOIs crosses the price of one of the benchmark trades, or one of the IOIs is cancelled.

“The fact that we are offering this mechanism on-exchange means users can interact with a different level of liquidity from internal solutions, so we believe this will be actively used and embraced by the buy side,“ added Husman.

PureStream does not take part in actual price formation, so market impact is very contained, according to Husman. Nasdaq will also introduce a reputational scoring mechanism to ensure that participants are really using the service to trade, and exclude a participant from the service if their behaviour does not meet the requirements. Husman believes Nasdaq has found a way to really improve execution quality in terms of minimizing market impact, and found a flexible way of executing trades based on the future VWAP prices.

“In contrast to Cboe BIDS VWAP-X, PureStream does not tie execution to a specific time frame,” Husman added. “Users have the flexibility to determine the time window depending on the liquidity of the stock and their urgency by setting a liquidity transfer rate.”