Euronext, the pan-European exchange operator, launched a new market at the start of November as its European bond trading platform, MTS, was recognized as an interdealer platform for the implementation of electronic market making on European Union issued debt instruments.

MTS EU launched on 1 November 2023 and Euronext said it has shown very dynamic initial activity for both traded volumes and participants.

Stéphane Boujnah, chief executive and chairman of the managing board of Euronext, said on the third quarter results call on 9 November that the European Commission’s NextGenerationEU program aims to issue about €750bn of new sovereign debt.

“The fact that MTS is recognized as an interdealer platform for the implementation of electronic market making for these instruments is the result of the successful integration of MTS in Euronext,” he added. “EU programs already represent the third largest bonds on MTS after Italy and Spain.”

MTS became majority owned by Euronext in 2021 as part of the acquisition of Borsa Italiana. In December last year MTS sold its US subsidiary, MTS Markets International, after a strategic review of the integration of Borsa Italiana and the decision to divest from non-core assets.

Boujnah continued that Euronext spent months in discussions with the European Commission explaining the benefits of creating an electronic secondary trading platform as the Commission initially wanted to operate a traditional primary dealer type system.

“Over time they realised that with the size of the issuance and the necessity to be careful on spreads, that an MTS-type platform was the right platform,” he added. “We are very enthusiastic because it is a perfect fit for us, solved an identified problem for the European Commission and we have been positively surprised by volumes.”

Euronext Clearing

Boujnah said he was proud to announce the completion of the first step in the expansion of Euronext Clearing to all of its markets.

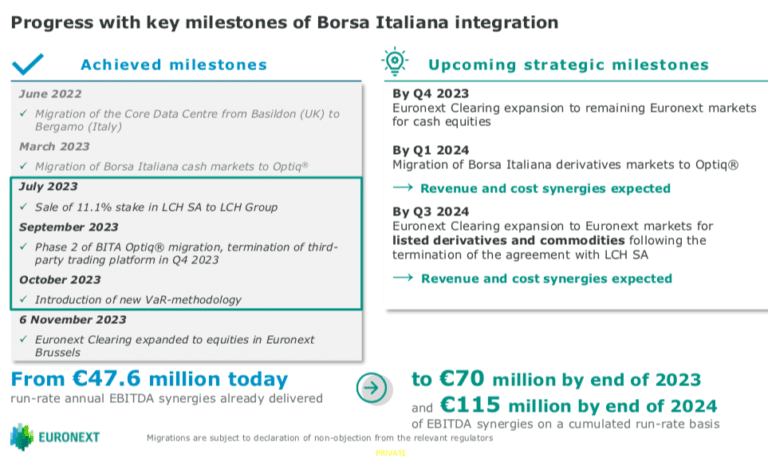

Since 6 November Euronext Clearing has become the default clearing house for equity trading in Brussels, and the remaining equity markets will follow this month. Euronext Clearing will expand to listed derivatives and commodities following the termination of the agreement with LCH SA in the third quarter of 2024.

Euronext also completed the second phase of the trading migration of Italian cash markets to Optiq, its proprietary trading platform. As a result cash markets from all of the group’s seven exchanges in Europe are now integrated on the same trading platform, allowing the decommissioning of a technology vendor.

Borsa Italiana derivatives markets are scheduled to migrate to Optiq in the first quarter of 2024.

Financials

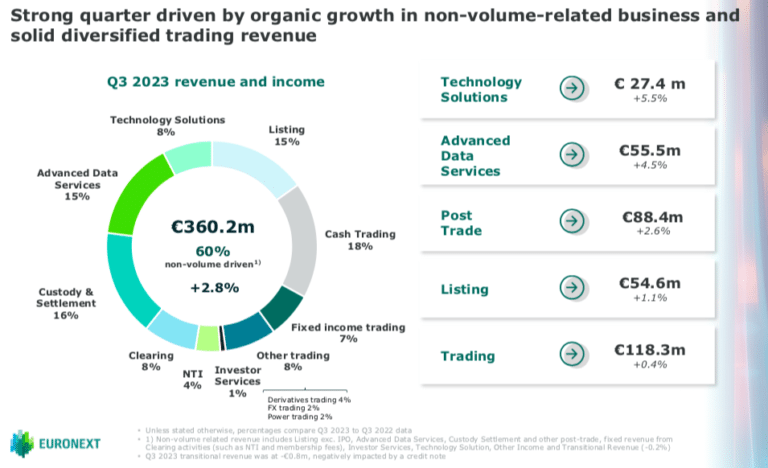

Boujnah said that Euronext’s third quarter results demonstrate the success of the group’s diversification strategy as non-volume-related revenue accounted for 60% of the total €360.2m group revenue, a 2.8% year-on-year increase.

Organic growth across non-volume related businesses and double-digit growth in power and fixed income activities more than offset negative FX impacts and softer cash trading activities according to Euronext.

In addition, Boujnah said Euronext is on track to deliver €70m of run rate synergies this year, more than the €60m anticipated during the acquisition of Borsa Italiana.

Listings

Boujnah continued that Euronext has strengthened its position as the leading venue for equity listings in Europe, with 72% of the new equity listings in the region in the third quarter. He acknowledged that 2023 had been a dry year for listing in Europe as firms have postponed initial public offerings due to market conditions but said that, as a result, 2024 has a strong pipeline.

In a softer environment in equity trading, Boujnah said Euronext remained the go-to trading venue in Europe with a market share averaging 66.5% over the quarter and an increased revenue capture.

“Our leadership in cash trading has been achieved thanks to the excellent work of our cash team led by Simon Gallagher,” he added. “I am thrilled to announce that Simon Gallagher will continue to drive client centricity in the City and across Europe as newly appointed head of global sales for Euronext and chief executive of Euronext London.”