There are more record years ahead for assets invested in exchange-traded funds according to the Brown Brothers Harriman (BBH) Global ETF Investor Survey, as the financial services group said it remains confident of its prediction that ETF assets will reach $30 trillion by 2033.

Assets invested in ETFs rose 27.7% last year to $14.7 trillion due to strong market performance and significant cash flows according to the report. BBH surveyed 325 ETF investors in US, Europe and Greater China and 63% had ETFs as their top targets for fresh capital, followed by stocks and bonds at 51%, and mutual funds at 49%

“Our survey findings point to more record years ahead,” said BBH.

In its 2023 survey, BBH predicted that ETF assets would reach $30 trillion by 2033. Following record inflows and excellent market performance last year, BBH said it is “convinced” that it will reach this target.

Detlef Glow, head of EMEA research at data provider LSEG Lipper, said in a blog: “If the European ETF industry is able to maintain net inflows at the same level for January and February for the rest of the year, it would hit an all-time high for annual inflows on a totally different level than before.”

Glow said in a report that February 2025 was another month with strong inflows of €33.8bn for European ETFs, much higher than the rolling 12-month average of €23.5bn), which may indicate that the region’s ETF industry is set to continue to grow above average over this year.

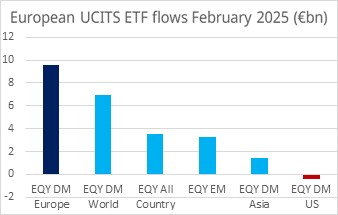

European fund manager Amundi highlighted in a report that ETF investors withdrew €400m from US strategies in February this year and allocated almost €10bn to European equity UCITS ETFs in a reversal of recent trends. During 2024, US equities had accounted for more than half of the total net new assets in ETFs.

“European equities accounted for almost one-third of overall ETF inflows in February 2025,” added Amundi. “Total ETF inflows in February 2025 were more than double those of the same month in 2024.”

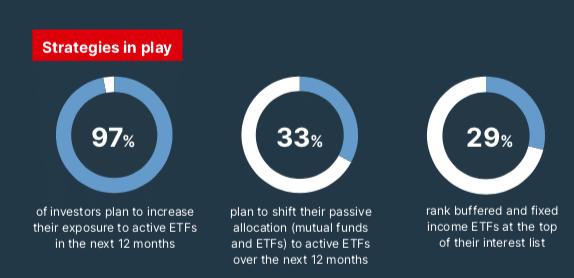

The BBH survey said nearly all, 95%, of investors intend to increase their ETF allocations over the next 12 months, up from 82% in last year’s survey, due to the emergence of more active strategies in the ETF wrapper, as well as derivative-based, alternative and crypto ETFs. The most common reasons for buying ETFs was portfolio outperformance through tactical, niche, or narrow sectors of the market, and benefitting from long-term portfolio growth through efficient, lower-cost core exposures.

“Our survey indicates a thirst for new categories that will fuel future growth,” added BBH. “An ETF market established on the foundation of passive investment is seeing a marked shift in allocations towards specialized investment strategies and managers.”

Active ETFs

For the second consecutive year the survey found that defined outcome, or buffered ETFs, were top of investors’ target lists, as BBH said the strategy appeals to allocators who may be more focused on limited downside protection than growth potential.

Andrea Murray, vice president, ETF services, investor services at BBH, said in the report: “A lot of investors believe that US equity markets are overvalued and are looking to manage risk accordingly through buffered ETFs.”

Last year actively managed ETFs had net inflows of $374bn which increased assets to a record $1.17 trillion, according to the survey, but still only represent 8% of the assets of the total global ETF market. BBH found that nearly all, 97%, of investors plan to increase their exposures to active ETFs over the next 12 months, up from 78% last year.

“This could serve as a sign that investors are preparing to nimbly reposition themselves in volatile markets, using actively managed ETFs to seek relative outperformance,” added BBH.

State Street ETF Servicing team has also predicted in its 2025 Outlook Report that active ETFs in the US will collect over 30% of all inflows in the US and eclipse total assets under management of $1 trillion by the end of the first quarter of this year.

Private markets

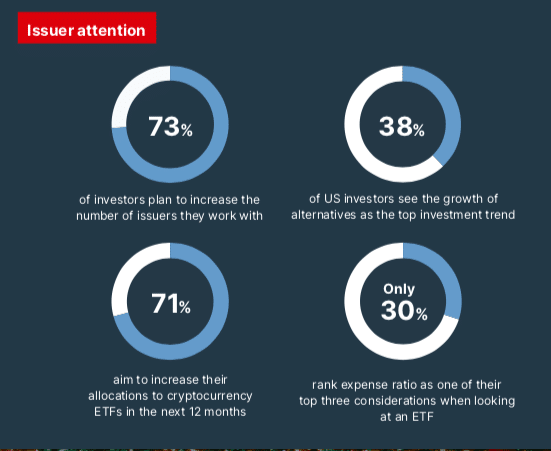

One quarter, 26%, of investors in the BBH survey expect alternative assets to continue as an area of interest in 2025.

Jeff Dorigan, managing director, alternative fund servicing at BBH, said in the report that ETFs are a new way to democratize access to private market investments without investors locking up their capital or being restricted by the high levels of minimum investment.

“At the same time, we are working with clients through other considerations, including potential liquidity mismatches and valuation practices – particularly during periods of market turbulence and uncertainty,” said Dorigan.

For example, State Street Global Advisors and Apollo Global Management have launched a private equity ETF in February the year but the US Securities and Exchange Commission has raised concerns about how the fund will maintain liquidity and value the private debt holdings.

The State Street report said the private credit ETF got the industry talking and the interesting part of the filing (and other subsequent filings) was the portion of the fund set aside for actual investment in private credit.

“There is work to be done both operationally and from a regulatory perspective, including liquidity rules, valuation policies for a daily net asset value (NAV) fund holding a position that does not typically price daily, transparency expectations and market making impacts,” added State Street. “This is one we are keeping a keen eye on throughout 2025.”

Crypto ETFs

Nearly three quarters, 71%, of allocators expect to increase their investments in cryptocurrency-focused ETFs over the next 12 months, according to the BBH survey, mostly being driven by performance. Many investors also want a more efficient exposure to crypto funds without setting up a digital wallet and without storing assets at crypto exchanges.

“Although there have been some well-publicized cryptocurrency ETF launches over the last 12 months, there are not that many products available on the market,” said BBH. “This could be an opportunity for issuers to capitalize on.”

State Street highlighted that in 2024, digital asset ETFs had $64bn of inflows, excluding Grayscale’s converted assets, and ended the year with US$118bn in assets. In contrast, US actively managed ETFs took 11 years to eclipse $100bn.

“2025 will bring spot multi-coin ETFs expanding beyond bitcoin and ethereum,” added State Street. “We also see in-kind trading of these products on the horizon allowing even more efficiency.”