Adam Tooze, the Shelby Cullom Davis chair of History at Columbia University and Director of the European Institute, warned that if US Treasuries no longer offer a safe haven, this could lead to a “truly existential financial crisis.”

Tooze said on his Substack: “This scenario is more serious than 2008. The Treasury market is a deeper foundation of the financial system than the privately issued asset backed securities that imploded during the mortgage crisis.”

Nicholas Colas, co-founder of DataTrek Research, said in a report that S&P 500 index is down 12% over the last four days, but 10-year Treasury yields have also risen.

He added: “Long-dated Treasuries are not doing what they are supposed to do when stocks swoon. This is highly unusual and removes an important counter-cyclical impulse whenever equities start to discount recession.”

Citi on yesterday's "mysterious rise" in Treasury yields:

"This could be an early sign that investors are looking to liquidate positions even in high-quality assets to raise cash." pic.twitter.com/8DGVyzq1DG

— Tracy Alloway (@tracyalloway) April 8, 2025

Colas said the CBOE Volatility (VIX) index, dubbed Wall Street’s “fear gauge”, closed at 52.3 on 8 April, a new high for the current selloff and only matched by levels in 2008 – 2009 and 2020. He added that in 2008 and 2020, the VIX peaked at 80-81.

“US trade policy uncertainty has snowballed into concerns about global financial stability and the possibility of a destabilizing worldwide recession,” he added.

He gave three possibilities for the steep decline in stocks not driving capital into safe assets such as Treasuries – lower demand from overseas buyers due to higher tariffs reducing trade with the US; large international owners of Treasuries (China has $761bn) selling some of their Treasuries as part of a broader trade war and finally, hedge funds selling Treasuries to deleverage.

“The last explanation – hedge fund deleveraging – makes the most sense, but we are mindful that the others also fit the current market narrative,” said Colas.

Treasury skew with a sharp reversal as volatility and yields rise. pic.twitter.com/CQdaoAXBxp

— CME Group Interest Rates (@Interest_Rates) April 9, 2025

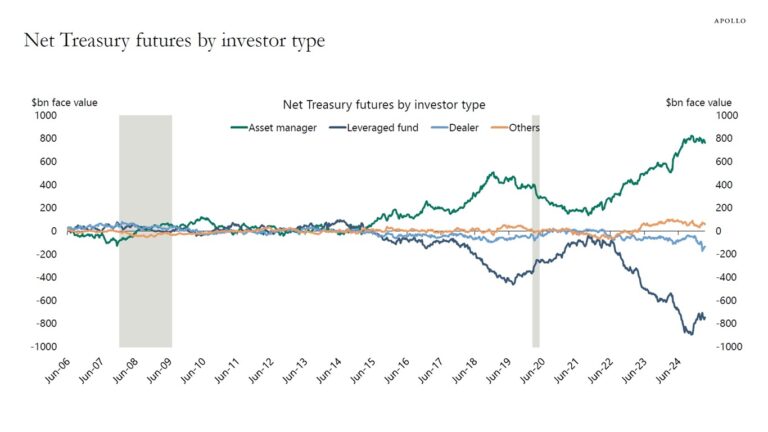

Torsten Sløk, chief economist at alternatives manager Apollo Global Management, said in a blog that it very unusual for long-term interest rates to rise 20 basis points despite stocks going down. He said one potential reason is an unwind of the basis trade, the difference in price between a Treasury security and a Treasury futures contract with similar characteristics. Hedge funds can put on leveraged positions, sometimes up to 100 times, on cash-futures basis trades so they are a potential source of market instability if they need to be quickly unwound.

Sløk said: “The basis trade is currently around $800bn and an important part of the $2 trillion outstanding in prime brokerage balances. It will continue to expand as US government debt levels continue to grow.”

The unwind would have to be absorbed by a broker-dealer and hamper the firm’s ability to provide liquidity to the secondary Treasuries market for and to intermediate for repo borrowing and lending. During Covid, the Federal Reserve was buying up to $100bn in Treasuries every day according to Sløk.

Bank of England

The Bank of England’s Financial Policy Committee is led by Andrew Bailey, Governor, and meets to identify risks to UK financial stability and agree policy action. The committee met on 4 and 8 April 2025 and its minutes said the Bank will continue to monitor leverage and concentration in core markets, as well as trading strategies that have the potential to amplify any stress. The FPC added that in the US, hedge fund repo borrowing to finance US Treasury cash-futures basis trade positions has been elevated in recent years.

“Any forced or rapid unwinding of leveraged positions, particularly when concentrated, could amplify price shocks and create financial stability risks,” added the committee. “For example, the unwind of the US Treasury cash futures basis trade had previously contributed to dysfunction in the US Treasury market in March 2020.”

The committee agreed it was important for the Bank to monitor leverage and concentration in core markets as well as highly leveraged trading strategies that had the potential to amplify any stress.

The FPC added that asset managers’ long positions and hedge funds’ short positions in US Treasury futures remained large but had declined ahead of the sharp moves in financial markets since 2 April. In addition, some hedge funds had, in part, de-risked their portfolios ahead of US tariff announcements on 2 April, and so were less impacted by subsequent price volatility.

“While the margin calls faced by funds following 2 April had been significant, they had so far been able to meet them without taking actions which would further amplify the market volatility,” said the FPC.

Hedge funds were responsible for 27% of weekly dealer-client volumes so far in 2025, up from 17% in 2018, according to the committee, which discussed the use of leveraged strategies in UK government bond markets.

“The FPC noted that much of the recent increase in leverage could be accounted for by hedge fund net gilt repo borrowing, which had increased from £4bn at the start of 2024 to £61bn as of March 2025,” said the minutes. “This was within the top percentile of the historical distribution of hedge fund net positioning (going back to 2017), with much of the borrowing concentrated in a small number of funds.”

The committee also commented on private markets, and noted that following the US announcement on trade tariffs on 2 April, the share prices of some of the largest private equity fund managers headquartered in the US fell by more than the S&P 500 US equity index.

“Such developments have the potential to interact with the vulnerabilities identified by the FPC around high leverage, valuations uncertainty, credit market interconnections and the exposure of insurers,” said the FPC. “In addition, these vulnerabilities could amplify shocks to highly indebted UK corporates or investor confidence and potentially affect UK financial stability.”