Market participants are keen to see an alignment of settlement cycles in all major jurisdictions to reduce complexity and cost, according to consultancy Firebrand Research.

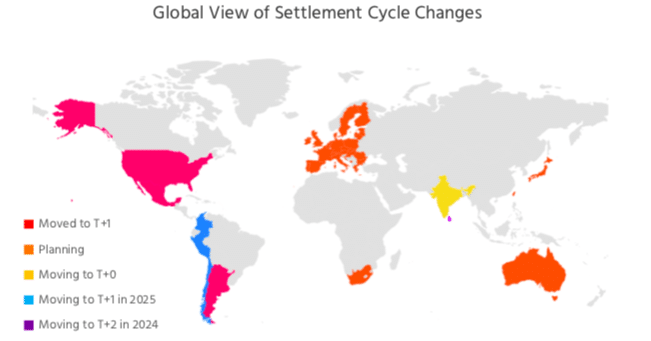

On 28 May this year the US, Canada, Mexico, Argentina, and Jamaica shortened their settlement cycle for equities, corporate bonds and municipal securities to one day after the transaction date (T+1) from T+2. As a result other jurisdictions, including the UK and the EU, are also reviewing shortening their settlement cycles to align with the US market. In Asia the Australian exchange is consulting on T+1 and Japan, Singapore and Taiwan are also looking to move to reduce the challenges from this misalignment.

Virginie O’Shea, founder of Firebrand Research, said in a report: “Challenges include higher costs of trading on certain days of the week for international investors on different settlement timeframes, higher foreign exchange costs, greater spreads for exchange traded funds with mixed basket underlying equities and numerous asset servicing and securities lending timeframe complexities to navigate.”

For example, Jim Goldie, head of ETF (exchange-traded fund) capital markets and indexed solutions, EMEA, at asset manager Invesco, said at a hearing held by ESMA, the European Union financial regulator, in July this year that the US migration to T+1 has led to more operational complexity.

The misalignment of settlement cycles has led to a funding gap which manifests itself through higher spreads of a basis point or more. It has become more expensive to create US ETFs on a Thursday and hedge the underlying basket which settles T+1 on a Friday. Funding is required over the weekend so an ETF trade can cost investors an additional four or five basis points, according to Goldie.

O’Shea added that the misalignment of settlement across major markets means that there is increased potential for exceptions and settlement failures for cross-border transactions. As a result, some firms have moved staff from Europe or Asia to North America to handle settlements within short timeframes. Others have established pre-funding measures to ensure trades can be settled within the requisite shortened time frame according to the report, and the cost of these activities has been carried on their balance sheets.

“Rather than running funding and FX cycles at the end of day, firms must now run these intraday to support the compressed time frame for settlement activities,” said o’Shea. “This has increased scalability pressures on internal systems in areas such as securities lending, where numerous legacy platforms tend to coexist alongside manual processes.”

Technology is necessary for the migration and market participants feel artificial intelligence (AI) will be important in automating the post-trade process according to attendees at The Network Forum annual meeting in Warsaw, Poland in June this year.

“This, of course, means more investment by custodians in their internal technology assets as well as the solutions that they sell to their client base,” said O’Shea. “T+1 and related regulatory changes to market infrastructure and market practices could therefore represent an important opportunity to present a business case for change to support long-term growth.”

Migration

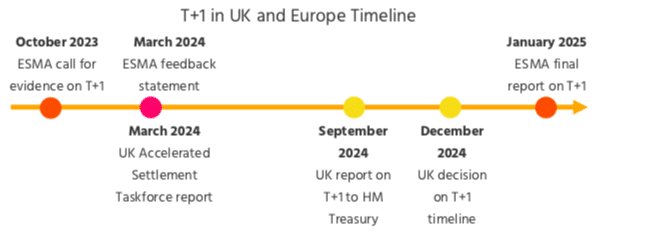

There is an expectation that Europe will move to T+1 within the next five to 10 years according to Firebrand Research. The report said that a majority, 55%, of attendees at The Network Forum felt that Europe will move within this timeframe and only 6% believe the shift will never happen.

“The UK and Switzerland have stated willingness to consider moving to T+1 at the same time as the EU, but this is contingent on political agreement on the right date for the move,” added O’Shea.

Firebrand highlighted that numerous decisions need to be made by European and UK authorities over the coming months in order to co-ordinate their migration to T+1.

O’Shea added there is also a global regulatory discussion about whether the long-term goal should be T+0 or instant settlement.

For example, India moved to T+1 in a phased approach ending in 2023 and is now planning to move to a voluntary T+0 or instant settlement cycle by 2025 according to Firebrand. In addition, Japan, Australia, Taiwan, Korea and Singapore are also considering potentially shortening their settlement cycles o T+0 or instant settlement at some point.