Technology provider Digital Asset and post-trade services provider Euroclear have launched an initiative to improve collateral mobility using tokens on a blockchain, adding to the number of projects announced in the space this year.

On 24 February 2025 Digital Asset and Euroclear said they were launching the first phase of a tokenized collateral mobility initiative to define how Euroclear’s collateral management experience can be applied to the digital and crypto markets using the Canton Network. The network describes itself as the financial industry’s first and only public chain that can achieve on-chain privacy, control, and interoperability making it the most suitable network for institutional assets. It was initially built on technology from Digital Asset but the network’s controls, governance, and app development have been open-sourced and decentralized.

Kelly Mathieson, chief business development officer at Digital Asset, said in a statement: “The Global Collateral Network has the potential to revolutionize collateral management by enabling real-time, compliant, and interoperable asset mobility across both traditional finance and digital markets. This is a significant step toward unlocking the full potential of tokenization across new crypto capital markets.”

Eurex

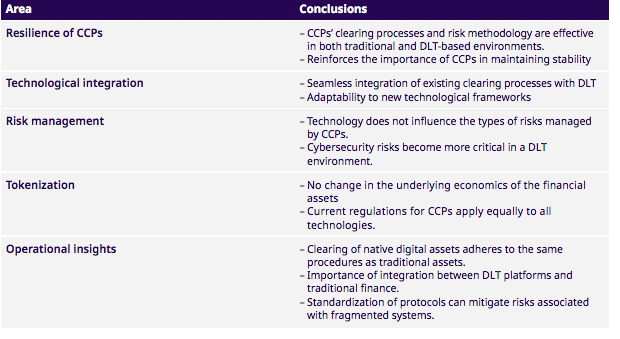

In a white paper, The Role of Central Counterparties in a DLT Environment, Deutsche Börse’s Eurex Clearing and law firm Linklaters said the integration of distributed ledger technology (DLT) with existing processes of CCPs creates a significant advantage for the market. DLT enables real-time collateral transfers which allows CCPs to manage liquidity more effectively, ensuring that collateral is available precisely where and when it is needed, which could reduce the need for clearing members to pre-fund client-related margin and/or transfer risk for clients.

“This may lead to intra-day margin calls from the CCP for clearing members to deposit cash or securities or requests from clearing members to withdraw cash or securities from the CCP,” said the white paper.

Eurex Clearing has designed and tested a service that facilitates the posting of margin collateral by CCP members through the HQLAx digital ledger to Eurex Clearing’s traditional collateral location, Clearstream Banking Luxembourg, which is due to be launched in the second quarter of 2025. HQLAx was formed by a consortium of financial institutions to improve collateral mobility.

J.P. Morgan is planning to participate as the pilot clearing member. Helen Gordon, global head of derivatives clearing, at J.P. Morgan, said in a statement that the bank was early to identify the benefits of using traditional assets in digital form to move cleared derivatives collateral.

Gordon said: “We look forward to the next phase of implementation and realizing the risk and optimization benefits associated with improved collateral mobility for us and our clients.”

SIX

In another initiative in Europe, SIX launched the Digital Collateral Service (DCS) in February 2025 which allows financial institutions to post selected cryptocurrency assets as collateral alongside traditional collateral. SIX provides and operates financial market infrastructure for the Swiss and Spanish financial centers,

David Newns, Head of SIX’s digital asset arm, SDX, said in a statement that this allows financial institutions to embrace crypto collateral on a larger scale. He added: “Our new and fully integrated solution empowers product issuers, traders, brokers, and market makers to optimize their collateral usage, whether it’s crypto or traditional securities, with built-in risk management safeguards.”

DTCC

The Depository Trust & Clearing Corporation (DTCC), the US post-trade market infrastructure, launched ComposerX, a complete, end-to-end suite for managing digital assets through their full lifecycle on 4 February 2025.

Nadine Chakar, global head of DTCC Digital Asset, told Markets Media in an email: “We support the tokenization of real-world assets (public and private) – as well as the tokenization and automation of functions such as collateral management and lending, for example. We’re seeing more regulatory clarity and industry collaboration, which is spearheading a powerful surge toward tokenization.”

ComposerX has three core platforms which have been designed with integration and harmonization in mind as DTCC believes that the financial industry will, at least in the shorter-term, require a hybrid approach to adoption – with traditional and digital systems living in harmony.

For example, LedgerScan helps firms track and manage tokens representing any asset from any source spanning any network – reconciling all activity across systems and integrating with legacy accounting and custodial models.

“Our intention is to unlock mobility and enable those assets to be used in the rapidly expanding landscape of tokenized applications, while maintaining access to the deeper liquidity pool of the traditional assets,” added Chakar.