Two thirds of the buy side, and 40% of market participants, have not yet started planning for the reduced equities settlement cycle in North America in 2024, despite the Securities and Exchange Commission setting the final implementation date.

The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, by one day to T+1. In February this year the Securities and Exchange Commission adopted final requirements for a 28 May 2024 implementation date, which is earlier than anticipated. The regulator said the change will reduce latency, lower risk, promote efficiency and greater liquidity in the markets.

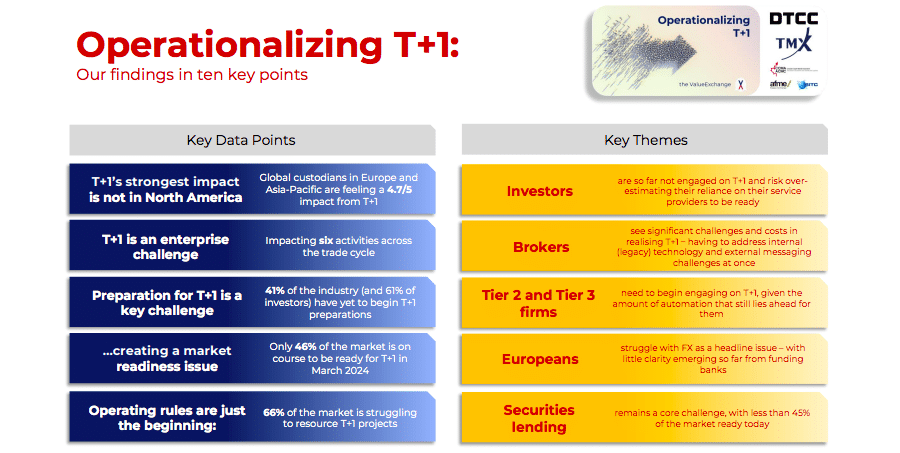

After the SEC set the the implementation the DTCC partnered with industry groups to sponsor a ValueExchange survey on industry readiness which covered more than 280 organizations across the global investment cycle. The survey found that more than 41% of respondents have not yet begun planning for T+1 and 61% of buy-side firms unprepared for the transition, primarily across mid-tier and boutique organizations.

To discuss the survey and the challenges of accelerated settlement, the DTCC’s hosted a webinar as part of its ongoing “Accelerating to T+1” series.

Barnaby Nelson, chief executive of ValueExchange, said on the webinar that it is concerning that the 41% represents people who are not yet even in the room. He added: “A large number of Tier 2 and Tier wealth managers and fund managers are also not in the room yet.”

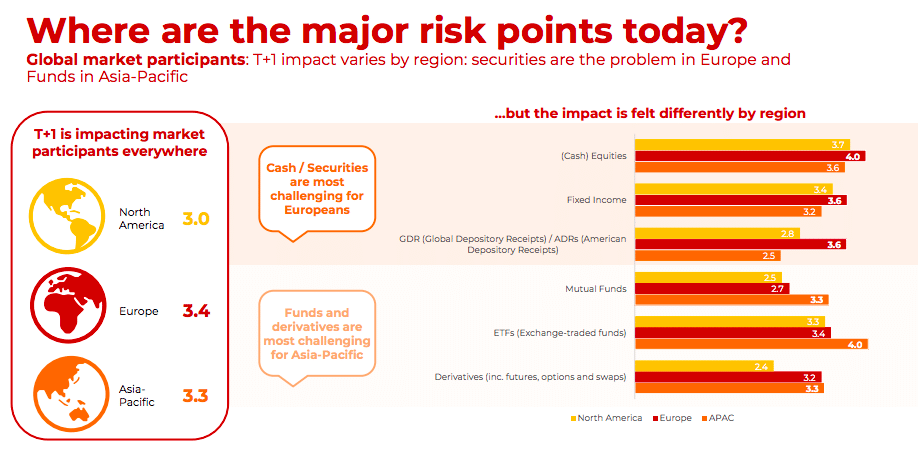

T+1 is not purely a settlement issue according to Nelson, but really an enterprise wide issue that starts in the middle office and runs through funding, settlement, securities lending and corporate actions. He highlighted that foreign exchange and securities lending are areas where readiness is extremely low.

“In terms of hotspots, you have got those who are not in the room, and then a couple of core processes which really need a lot of advancement in the next 12 months,” he said.

Overseas concerns

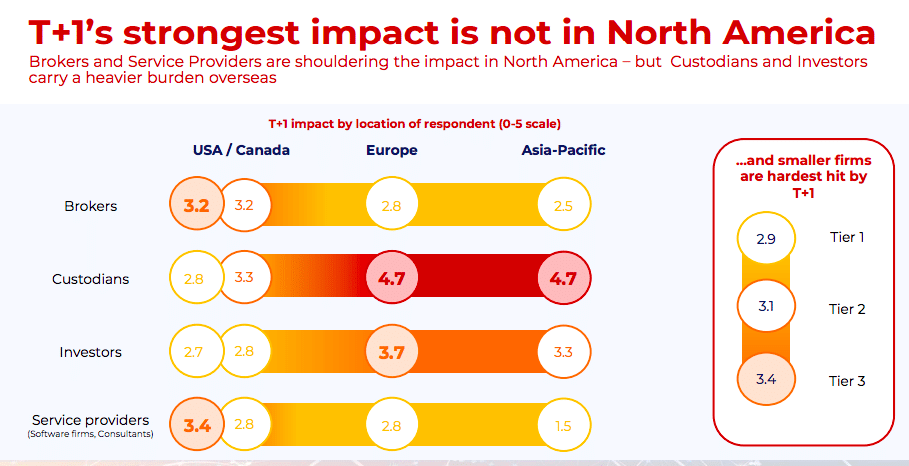

Nelson continued that the biggest impact of T+1 will be felt in Europe and Asia Pacific, which escapes a lot of people. For example, as soon as US dollar settlement moves across the Atlantic there is a time difference and an FX leg.

“These two things are a major driver in terms of why Europeans especially are going to be very hard hit,” he added. “This impacts location strategy so the entire approach to T+1 needs to be very nuanced.”

Market participants at the FIX EMEA Trading Conference in London on 9 March said the deadline of May had “caught everyone on the hop.” As a result there is little time to implement new technology and tactical patches are likely to be required to be put in place.

Although the move seems like a change for US markets, there are extraterritorial implications. Overseas investors own global baskets of ETFs which include US components, with for example, two-thirds of the MSCI World Index being made up of US stocks.

#FIXEMEA2023 T+1 move by SEC will not just impact US but global trading & by default liquidity – FX issues, legacy tech, funding, credit lines, #UCITS breeches & #ETFs will be hit hardest – it is not a small issue to solve & will require a global collaborative post trade response pic.twitter.com/R6f2BsLXYF

— Rebecca Healey (@_RebeccaHealey) March 9, 2023

In addition, approximately 40% of investment in US markets comes from overseas investors. Trades will fail if any errors are not resolved on the day of the trade due to time zone differences. As a result buy-side firms may need to build up their US operational teams or outsource settlement functions, which will be difficult for smaller asset managers.

The DTCC survey found that more than than 50% of European and Asia-Pacific market participants have not defined their plans to manage critical areas such as foreign exchange and securities lending.

British perspective

There are concerns for the UK market about T+1 according to a report from Torstone Technology, a SaaS platform for post-trade securities and derivatives processing, and Firebrand Research, a provider of capital markets research and advisory services. The concerns include a high level of uncertainty about the feasibility of the implementation date in May 2024.

Over 90% of participants in a Torstone Technology & @FintechFire study see increased risk of trade failures, penalties & market inefficiencies with shorter settlement cycles given legacy technology challenges.https://t.co/1MICjsjXCh#posttrade #tplus1 #researchreport pic.twitter.com/olvkTrFo2B

— Torstone Technology (@TorstoneTech) March 23, 2023

“Given the international nature of the markets, pre-funding, foreign exchange and liquidity management will need to be carefully considered as North America makes the move,” said the report. “This is one of the largest areas of focus for firms outside of the region in the run up to May 2024 and there is a lot of pressure on global custodians in particular to coordinate across their global operations.”

The UK government has set up an Accelerated Settlement Taskforce to review shortening the UK settlement cycle to T+1, which is due to report at the end of this year.

Virginie O’Shea, chief executive and founder of Firebrand Research, said in a statement: “Cost, time zones, and a lack of buy-side engagement are just some of the complex aspects that require significant collaboration across the industry.”

The study,‘The British Perspective on T+1’, represents perspectives from buy-side, sell-side, and service provider market participants and was conducted in March 2023. It found that the combination of T+1 plus ongoing changes relating to the Central Securities Depositories Regulation (CSDR) could be extremely painful .

“Settlement penalties have been much higher than most in the industry anticipated,” added the report. “Firebrand’s research indicates that even small penalty payments have been painful to deal with from an operational perspective and large firms are paying anywhere between around €1m and €2.8m a month in penalties.”

As a result there could be higher costs for the investment community in the UK as brokers and custodians would have to pass-through some of the costs., and they could potentially lose business to European providers, and trading volumes could also decline in the short term.

Automation

In order to accelerate settlement, post-trade agreement and affirmation need to happen faster, which will need increased automation in the allocation, confirmation, and affirmation processes.

Brian Collings, chief executive of Torstone Technology, said in a statement: “This report shows that operational and technological issues must be addressed as soon as possible to facilitate the US move to T+1, which in turn will help the global industry move towards potential domestic moves elsewhere.”

However, he highlighted that there is an opportunity for firms that embrace automation and digital transformation to prepare for the shift to enhance their middle- and back-office systems and gain a competitive edge.

Ana Lotharius, director of DTCC ITP product management & Americas industry relations, said on the webinar that in the move to T+2 firms largely relied on adding more resources and making tweaks to their processes.

However, the consensus is that the move to T+1 is fundamentally different as firms have just one day to allocate, confirm and affirm trade to send it to DTC for settlement by the cut off time of 9PM ET. In addition, there are dependencies on counterparties, custodians, vendors and other service providers that introduce another level of complexity

She added: “For asset managers to do that for the bulk of their executions really won’t be possible if they continue to rely on manual processes, especially for the smaller firms that have historically struggled to automate.”

Lotharius continued that the buy side cannot solely rely on their service providers as they have their own regulatory obligations so they need to keep a close eye on their operational efficiency and whether they are doing all they can to automate in preparation for T+1.

Firms should prioritize straight-through-processing (STP), especially as the SEC is emphasizing same-day affirmation as an enabler for STP. The new best practice submission time for allocations is 7 PM ET, and affirmation needs to happen by the DTC cutoff time of 9 PM ET in order for trades to be sent directly to DTC for settlement in an STP fashion.

Lotharius highlighted that affirmation has not been an area of focus, particularly outside the US, where buy-side firms rely on their custodians or agents to affirm trades on their behalf.

“Given the SEC’s focus on affirmation as an enabler for straight through processing, it is a step that all global clients trading in the US cannot ignore anymore,” she added.

David Kirby, DTCC executive director, head of Americas relationship management/global account management, said on the webinar: “Adopting higher levels of straight-through processing and automation in post-trade operations will help ensure a seamless, orchestrated, and responsible implementation in the move to T+1.”

DTCC has prepared a nine-month testing schedule for 21 bi-weekly cycles between 14 August 2023 until 31 May 2024. Firms can also do freeform testing based on their individual needs. Most firms are not expected to use all 21 test cycles but DTCC recommends their test schedule includes the implementation weekend and testing for bank holidays.