David Schwimmer, chief executive of London Stock Exchange Group, said its new intermittent trading venue is ready to launch but waiting for approval from the UK’s Financial Conduct Authority.

Schwimmer spoke at the Financial Markets Quality Conference on 15 November, hosted by the Psaros Center for Financial Markets and Policy at Georgetown University.

“We are ready to go but waiting for regulatory approval from the FCA and they are working diligently to get that for us,” he said.

LSEG’s intermittent trading venue will allow private companies to periodically provide both new and existing shareholders with the opportunity to transact via a controlled and efficient public trading functionality. A private company can notify the market on the dates that it will be available for public trading and provide a disclosure document in advance. During the designated windows it will be traded using public market infrastructure and then return to being a private company.

Schwimmer said the growth in private markets was a result of two decades of abnormally low interest rates, which has pushed the total assets under management to $11 trillion. However as the interest rate cycle shifts and capital becomes more expensive, change is coming to this opaque, illiquid and, occasionally, highly leveraged world.

The venue is intended to create a continuum between private and public companies.

“It will help early stage investors recycle their capital, employees realise the value of their shares, reduce the cost of providing shareholders with liquidity and it will give investors access to a broader universe of companies,” Schwimmer added.

The group has aspirations to make the new venue accessible to private companies all over the world, but the initial stage may involve a nexus with the UK.

The growth in private markets is one of the three trends that the group is focussing on, alongside artificial intelligence and the free flow of data across borders.

Artificial intelligence

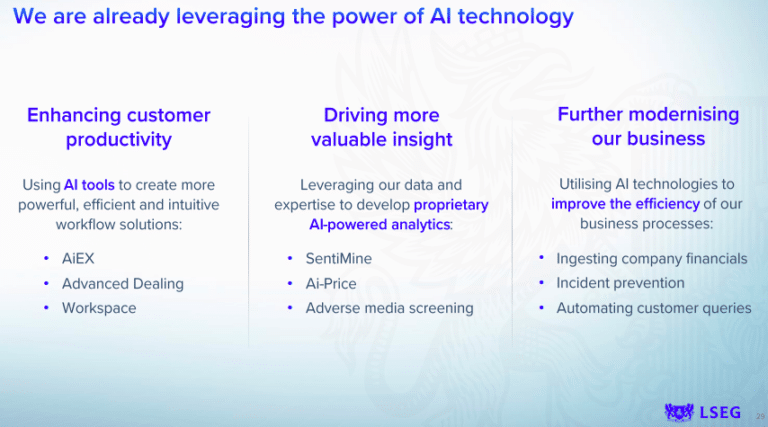

The group has been using AI and machine learning in its business for a while but Scwimmer said there have been fast-moving advances in this space over the last year, especially with regard to generative AI.

Schwimmer said: “Generative AI is leading to a step change in the financial world.”

LSEG is building AI functionality into its platforms and workflow to enhance customer productivity and create more valuable insights through proprietary analytics. In addition, it can use the vast amount of data that it ingests to train large language models. However, Schwimmer also highlighted the risks posed by AI. For example, AI hallucination is the idea that AI may perceive non-existent patterns and produce inaccurate outputs which raises very serious questions for financial services.

“Our industry relies on pinpoint accuracy,” Schwimmer said. “If I were to tell our customers that our data and analytics were 95% accurate, that’s simply not good enough.”

In order to use AI responsibly, LSEG is ensuring the accuracy and reliability of its data and making sure it is internally consistent to ensure the integrity and lineage of the inputs to its models.

“We are building auditability into our AI-enabled products so that our customers can easily verify the source of information,” he added. “Meeting these conditions is critical for the responsible use of AI and will be central to our approach as we leverage the depth and breadth of our data to meet our customers’ needs.”

Fragmentation

Another trend is the challenge to free flows of data across borders, which Schwimmer said has put the digital economy at risk as they facilitate the orderly and efficient operation of financial markets.

“Governments around the world are asserting greater data sovereignty through laws and regulations that are threatening to fragment the world’s open data ecosystem and this could have a very negative effect,” Schwimmer added.

He cited estimates that show that data flow restrictions could lower the GDP of some countries by between 0.5% and 2%.

Schwimmer said: “Governments can, and must, come together to advance international cooperation and trust on digital governance issues. We should have a coordinated global effort to ensure that cross border data flows can be used safely to drive innovation and growth.”

Data and analytics

Schwimmer also highlighted that the London Stock Exchange contributes just 3% of group revenues. In contrast nearly three quarters, 70%, of group revenues come from data and analytics, which includes the FTSE Russell index business, risk intelligence and anti-money laundering.

In addition to equity trading, the group has an execution venue for foreign exchange and is the controlling shareholder in Tradeweb, a fixed income electronic execution venue based in New York. The post-trade division includes LCH, the clearing arm, which Schwimmer said is one of the world’s most systemic institutions, especially for clearing interest rate swaps.

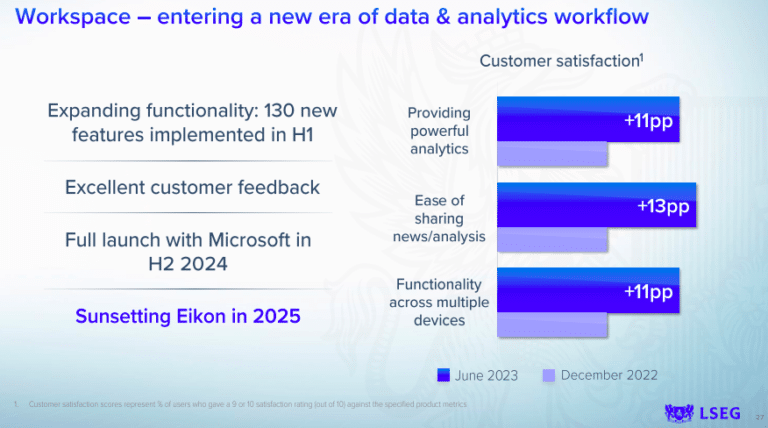

In December last year LSEG announced a long-term strategic partnership with Microsoft and the technology company took a 4% stake in the group.

“There are a few different areas where we are building products together,” Schwimmer said. “ One is that we are embedding our data and analytics and desktop platform into Microsoft 365.”

In addition, LSEG is moving its databases into an integrated architecture within the cloud environment at Microsoft, which will make it much easier for customers to access LSEG data and mix with their own proprietary data. LSEG is also building a modelling infrastructure which Schwimmer described as effectively an app store for analytics or models.

“With the combination of our data, models and the Microsoft cloud environment, we will make our models available for anyone who wants to use them,” said Schwimmer. “That is what I mean by creating an app store for models.”

He argued there is an increasing convergence between big technology companies and cloud companies and finance.

“Big technology companies are unlikely to want to move into areas where they will be regulated from a financial sector perspective,” said Schwimmer. “There is a bright line beyond that where we are seeing a massive convergence between market infrastructure, information services and technology.”

In its third quarter results Schwimmer said LSEG delivered another quarter of strong, broad-based growth and the group is confident that results for the full year will be towards the upper end of the 6% to 8% guidance range.

Analysts at Berenberg, the German financial services group, said in a report that in the short-term, growth will continue to be supported by remaining revenue synergies from the Refinitiv acquisition as well as continued pricing power due to greater consumption.

“The acceleration of growth beyond FY 2024 reflects the partnership with Microsoft and other benefits (including in the post trade business),” said the report.

Berenberg continued that LSEG plans to launch products related to each of the main Microsoft partnership development areas during the first half of next year, earlier than expected

“While revenues are still unlikely to build before 2025, consistent with past guidance, this provides a better time to build customer momentum and support existing momentum in key business lines,” added Berenberg. “Targets and guidance related to the cost of the partnership are unchanged, but progress has been faster than expected so far, enabling earlier product launches.”