Liquidnet, the agency execution specialist, introduced SuperBlock Matching in April this year in Europe, Middle East and Africa to help members transact their larger, more difficult trades this year and the functionality has now been rolled out globally.

The firm was founded in 2001 to allow institutional investors to anonymously trade large blocks of stocks electronically as the average size of equity trades has been falling across the industry. Rob Cranston, global head of equities product at Liquidnet, told Markets Media that SuperBlock Matching helps members with their most difficult trades, such as a very large position by value or large number of shares against average daily volume through disclosing more information.

“We have completed over $1bn in trading globally since we first launched SuperBlock Matching and member feedback is very strong,” added Cranston.

Alan Polo, head of equity sales and trading, Americas, at Liquidnet told Markets Media that the first discussion about the idea of SuperBlockTM Matching was in Liquidnet Labs, the research and development innovation hub, in February 2023. A number of firms said they were looking to enhance their trading experience by sharing a bit more information in order to help execute very large trades.

Liquidnet began rolling Superblock Matching out to clients just under a year after the first conversation about it and Asia Pacific is the final region to complete the global offering following the US and EMEA.

We’re live! This week SuperBlock Matching was turned on for our US Members, hot on the heels of the EMEA launch where we have already seen a total principal traded of over 250M USD in a few weeks (single counted). Discover the SuperBlock initiative: https://t.co/0L6r0bBu4X pic.twitter.com/vnEZgnBMMx

— Liquidnet (@Liquidnet) June 14, 2024

“Clients have always trusted us to handle their orders with care and consideration,” Polo said “Anonymity is very important for traders to be able to move these larger blocks.”

Matching functionality

Minimum sizes for SuperBlock Matching have been set for every stock, based on market cap. There is a bit of variance between regions but Cranston said approximately 10% of trades are eligible for SuperBlock Matching, which may increase as the largest asset managers use the functionality.

“It is not relevant for most trades, but very relevant to the larger, more difficult positions,” added Cranston. “We offer very critical functionality when finding liquidity in the small and mid-cap space through our global distribution. SuperBlock matching builds on this by offering increased value.”

SuperBlock Matching has also been used for significant trades in mega-cap or large-cap stocks.

One of the biggest trades that used SuperBlock Matching was more than 900% of average daily volume according to Cranston. Another transaction in Europe involved trading percentages of the company and Cranston said the the two buysides were “ecstatic” about getting the trade done.

If the trade meets the size criteria, SuperBlock Matching pops up in a trader’s front-end. If both parties agree to SuperBlock Matching, they agree to release more information, such as more certainty on size. If they both agree, there is a commitment to trade which Liquidnet will police, with penalties if the trade does not consummate.

“Two different heads of trading have said they are reevaluating the way their team is using block crossing networks because of the differentiation and service level we have provided,” said Cranston. “Analytics show that the value of trading a large block is still significant.”

Polo added that members have said they will stick around a few seconds longer within the Liquidnet platform to see if there is an opportunity to do bigger size with this new functionality.

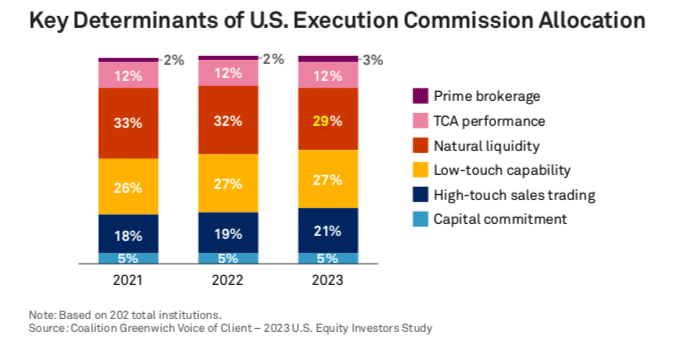

Nearly one third of asset managers, 29%, said sourcing natural liquidity is the primary determinant of commission allocation, though it has been trending down from 32% in 2022 and 33% in 2021 according to a survey from Coalition Greenwich.

The consultancy’s report, U.S. Equity Markets 2024: Trends and Opportunities, also found that high-touch sales trading, often used to source such liquidity, increased to 21% from 18% in 2021 and 19% in 2022.

“Ease of system use, reliability, and high-quality technical support remain paramount criteria for selecting these platforms,” added Coalition Greenwich. “The industry’s clear emphasis on these factors may point to a maturation in electronic trading, further signaling a departure of the ‘speed arms race’ among brokers.”