Rob Cranston, global head of equities product at Liquidnet said the the agency execution specialist is looking at the next innovation of SuperBlock Matching, which helps members transact their larger, more difficult trades.

Liquidnet first introduced SuperBlock Matching in April last year in Europe, Middle East and Africa and it was rolled out globally in July 2024. The functionality helps members with their most difficult trades, such as a very large position by value or large number of shares against average daily volume through disclosing more information.

Cranston told Markets Media that the response to rolling out SuperBlock Matching globally has been very positive. He said: “We have traded more than $1bn since it launched, as it has added value to trading larger deals and reduced friction.”

Minimum sizes for SuperBlock Matching have been set for every stock, based on market cap. If the trade meets the size criteria, SuperBlock Matching pops up in a trader’s front-end. If both parties agree to SuperBlock Matching, they agree to release more information, such as more certainty on size. If they both agree, there is a commitment to trade which Liquidnet will police, with penalties if the trade does not consummate.

“We are reviewing the next innovation and whether SuperBlock sized executions could be applicable to other workflows,” Cranston added. “We want to offer algos to the buyside for an end-to-end workflow from order initiation to the tail so they have more ways of execution on tap.”

Cranston also argued that Liquidnet is well positioned to use artificial intelligence to adapt to the major changes in trading in the next few years and offer operational and execution efficiency to clients.

In addition to adapting to the increasing use of AI, Liquidnet also launched a new multi-asset service last year and set up a multi-asset desk in Europe. Cranston described the offering as “another string to our bow” as buy-side clients are creating desks which cover a wide range of asset classes.

“Our goal is for Liquidnet to act as a single point of contact across these asset classes,” added Cranston.

U.S. equity trading

Sourcing natural liquidity continues to be the top priority when it comes to allocating commission according to annual research from consultancy Crisil Coalition Greenwich with hundreds of U.S. institutional equity investors.

Jesse Forster, senior analyst at Crisil Coalition Greenwich market structure & technology and author of U.S. equity market trends report, wrote:“Despite the buy side’s increasing reliance on electronic trading, they still value the role of high-touch sales traders in locating hard-to-find liquidity and working complex orders. It’s a delicate balance between technology and human touch, and traders are still grappling to find the sweet spot.”

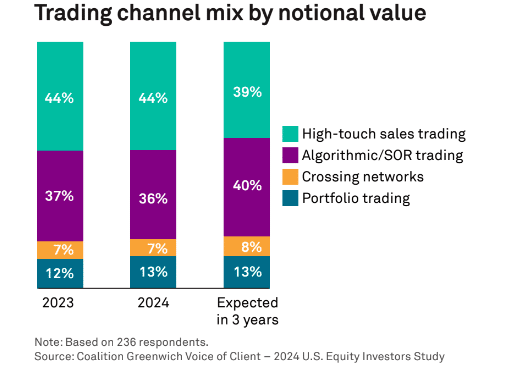

Crisil Coalition Greenwich said the U.S. equity market continued its migration toward electronic trading in 2024, with 44% of overall trading volume executed electronically (including algorithmic strategies and crossing networks). The survey found that managers expect electronic trading to increase to nearly half of their flow within three years, at the expense of high-touch trading, which they anticipate will account for only 39% of their flow by then.

“Buy-side traders remain resolute in their dual mandate of finding liquidity for their clients while exploring opportunities for automation within their firms,” said Forster.