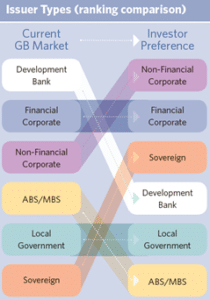

There is a supply and demand mismatch in the green bond market as investors want more corporate issuance, but financial and non-financial firms represent less than half of current outstanding green bonds.

Climate Bonds Initiative held a webinar this morning to discuss its first green bond investor survey which found that 93% of respondents expressed a preference for corporates, followed by development banks and sovereigns.

Caroline Harrison, research analyst, markets at Climate Bonds Initiative said on the webcast: “There is a mismatch between demand and supply and more corporate issuance should be encouraged by policy makers.”

She continued that development banks, financial corporates and non-financial corporates are each responsible for about a fifth of green bond issuance by value.

“Development banks could more effectively support the market’s growth indirectly rather than as green bond issuers themselves, through initiatives such de-risking tools, anchor investing and providing technical assistance,” she added.

The investor-focused not-for-profit organisation surveyed 48 of the largest Europe-based investors because the region appears to have the most established pool of dedicated green bond and environmental, social and governance asset managers. The survey was sponsored by the Luxembourg Stock Exchange, Credit Suisse, Lyxor AM and Danske Bank.

Emerging markets

Harrison added that investors also wanted more sovereign green bonds, especially from emerging markets, as 81% of sovereign issuance has been from developed markets.

Respondents with 1% or more of their assets under management in green bonds are three times more likely to include sovereigns as they are typically larger in size.

Most investors, 82%, can buy emerging market bonds but two thirds are currency restricted by currency. Climate Bonds Initiative said less than half, 42%, of outstanding emerging market green bonds was in G10 currencies at the end of April this year.

Harrison suggested that emerging market governments could issue more green bonds in G10 currencies.

“Credit enhancements available from multilaterals and/or public sector entities was the most frequently selected option for making investing in EM green bonds more attractive and bring scale to the market,” she added. “More than half consider it important or very important.”

Climate impact

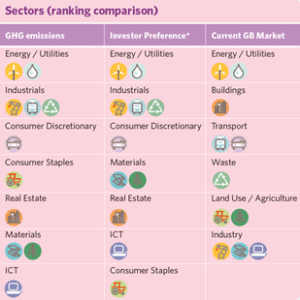

Miguel Almeida, research analyst, markets at Climate Bonds Initiative said on the webinar that greater sector diversity is needed in the green bond market.

Almeida said investors want more issuance from the following five sectors – industrials; utilities; consumer discretionary; energy for renewable projects and materials.

Scott Freedman, credit analyst and portfolio manager at Newton Investment Management, said in the survey: “We would welcome more green bonds from sectors such as capital goods, healthcare, and basic industries to enable greater diversification. Green bonds could enable capital markets to support companies from these sectors in their transition to low carbon business models.”

Almeida continued that there is a broad positive correlation between the level of interest in sectors and their greenhouse emissions. “This is likely due to the higher need for green investment being precisely in the most polluting sectors, and the fact that green bond issuance is severely lacking in some high-emission sectors like industrials and metals/mining,” he added.

The survey also found that all else being equal, the most important factor for making an investment decision is satisfactory green credentials at issuance.

“79% of said they would definitely not buy a green bond if the proceeds were not clearly allocated to green projects at issuance,” added Harrison. “In addition, 55% would definitely sell if post-issuance reporting was poor.”

Standardization

Respondents view policy as the most effective way to scale up the green bond market, with standardisation of definitions being a priority.

Marisa Drew, chief executive, Impact Advisory and Finance Department at Credit Suisse, said in a statement: “Investors remind us in this survey, that improved transparency, standardization, clear linkages of proceeds to green outcomes, and the inclusion of a wider issuer universe are all key to unleashing the full potential of green finance markets. This will require a concerted effort from issuers, underwriters, ratings agencies, regulators and policy makers.”

The need for standards was also highlighted in a report from Liquidnet, the institutional liquidity pool, in September this year.

The survey, Sustainability Redefining ESG & What this Means for Asset Management, said 61% of responding firms believe that industry-wide norms, frameworks and standards would be useful.

Start of far bigger changes ahead for the #finservices industry in terms of investments, liquidity and trading – read more here @Liquidnet https://t.co/jb3yyncXGK and https://t.co/eqCZWIhyXM as #ESG moves mainstream https://t.co/jJzS2LPcUx

— Rebecca Healey (@_RebeccaHealey) November 27, 2019

“Much of the terminology is often misinterpreted and used interchangeably by portfolio managers and end investors alike,” added Liquidnet. “The lack of standardization of definitions means the interpretation of what individual investment strategies actually represent can diverge greatly, making it a) more difficult to track performance; b) demonstrate compliance; and c) more likely for further regulation.”

Volumes

Climate Bonds Initiative said on its blog that green bonds issuance so far this year is $223bn, and has estimated a record $250bn by the end of this year. Last year issuance reached $170.9bn.

Sean Kidney, co-founder and chief executive of Climate Bonds Initiative, said in a statement: “But $200bn or $400bn a year is not enough to address the climate emergency and provide the capital at the scale urgently required for large scale transition, adaptation and resilience. From here on, every year in the 2020s must be a record year for green finance.”