Investors view the current environment as a golden age of private credit due to its potential for strong performance, with market share at a cyclical high, according to a report from M Capital Group.

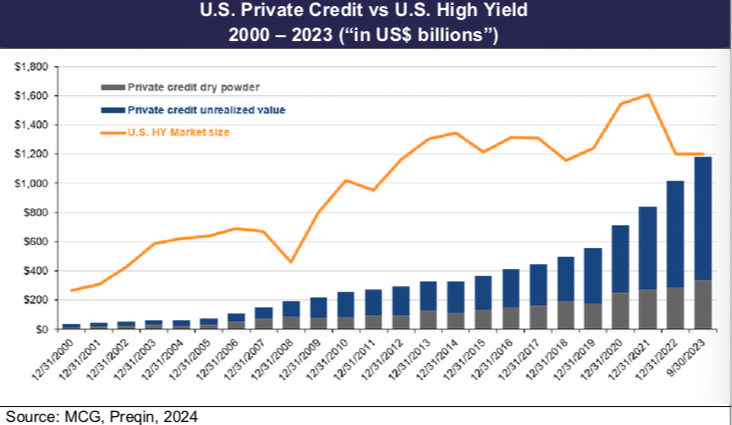

The firm, which focuses on merchant banking, global advisory and asset management, said in a report, Private Credit – Transition Beyond Conventional Banking, that private credit is currently benefiting from the macro environment, including higher interest rates, and the use of floating-rate structures. The private credit market has grown from an estimated $1 trillion four years ago to $1.7 trillion in 2023, according to the report.

“With an estimated market value of $1.7 trillion in 2024, private credit is expected to reach $2.8 trillion by 2028,” said the report.

Christian Mouchbahani, managing partner at M Capital Group, said in a statement that the positive outlook for the private credit markets is driven by its flexibility, customizability, and attractive investor-risk returns of over 10%, compared to other asset classes, while addressing borrowers’ needs and demand. In addition, the illiquidity premium has allowed private credit to maintain a spread of approximately 200 to 300 basis points more than leveraged loans and high-yield bonds.

“These trends and favorable conditions present opportunities for investors, lenders, and borrowers alike,” Mouchbahani added.

The majority, 58.9%, of investors surveyed for the Investor Outlook H2 2024 from data provider Preqin said private debt had met their expectations in the past 12 months, and 27.5% said the asset class had exceeded expectations. In the next 12 months, 41.9% of investors are maintaining allocations to the asset class and nearly half, 49.9%, are committing more capital.

Acquisitions

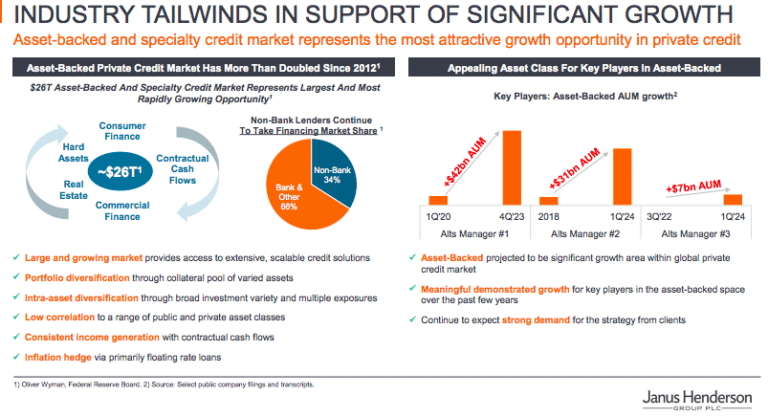

The demand for private credit was highlighted by US active manager Janus Henderson, announcing an acquisition of a 55% stake in Victory Park Capital on 12 August 2024.

Janus Henderson said it was buying the Chicago-based private credit fund manager with $6bn in assets to complement its securitized credit franchise and expertise in public asset-backed securitized markets, and to further expand capabilities into private markets for its clients. The acquisition marks another expansion ofJanus Henderson’s private credit capabilities following the asset manager’s announcement of an acquisition of the National Bank of Kuwait’s emerging markets private investments team, NBK Capital Partners, which is expected to close later this year.

Ali Dibadj, chief executive of Janus Henderson, said in a statement: “Asset-backed lending has emerged as a significant market opportunity within private credit, as clients increasingly look to diversify their private credit exposure beyond only direct lending. VPC’s investment capabilities in private credit and deep expertise in insurance align with the growing needs of our clients, further our strategic objective to diversify where we have the right, and amplify our existing strengths in securitized finance.”

Preqin noted that other fund managers have expanded their private debt capabilities by acquiring specialist firms. For example, Arrow Global acquired Iberian private and real estate debt manager Amitra Capital from CPP Investments in May, and German real estate manager Interboden in June.

In addition, Paris-headquartered Sienna Investment Managers bought Italian credit manager Ver Capital in April, bringing their combined private debt assets under management to approximately $3bn.

Preqin’s 2024 Global Report: Private Debt forecast that private debt assets under management will reach $2.8 trillion, by 2028 but said this may be conservative if banks continue to be cautious in extending loans.

Geographical growth

M Capital Group noted that assets under management in private credit in the US have grown from $40bn in 2000 to $1.2 trillion this year. US public high-yield markets have shrunk by nearly 25% since 2021, which led investors to turn to private capital as an alternative funding source.

“Although nearly 30% of assets under management remains as dry powder – capital raised but not yet deployed – the growth and its implications for the credit markets are substantial,” added M Capital.

In emerging markets banks currently provide approximately 90% of corporate funding. M Capital said this could shift, as Asian banks may reduce their appetite for new credit and seek to offload distressed assets, which presents opportunities for alternative lenders.