The Investment Association, the trade body for UK fund managers, is aiming to widen the discussions following the release of the the final report from the Technology Working Group on the industry’s use of artificial intelligence.

On 10 October the UK government published the final report from the Technology Working Group, consisting of policymakers, regulators and market participants, which was set up to identify how the UK investment management industry could harness the potential of innovative new technologies.

The report, Artificial Intelligence: Current and Future Usage Within Investment Management, follows the task force’s previous work on the use of distributed ledger technology (DLT) and tokenization.

Michelle Scrimgeour, chief executive of Legal & General Investment Management and chair of the Technology Working Group, said in a statement that the implementation of analytical AI has been foundational in algorithmic trading and anti-money laundering monitoring.

“However, the use of AI is evolving at great pace and the advent of generative AI is a capability that marks a real paradigm shift for our industry,” she added. “When paired with the promise shown with tokenization, the new technological innovations outlined in this report have the potential to redefine how we think about asset management over the next decade.”

John Allan, head of innovation and operations at IA, told Markets Media that the tokenization blueprint was important because it put the UK on a firm footing to start the conversation and as a result, the FCA joined Project Guardian to help learn lessons from Singapore.

“We hope this report on AI will ensure that the UK is able to position itself as an innovative jurisdiction,” said Allan.

He continued that there is now an opportunity, as the trade body had with the previous report on tokenization, to widen the group of members who are involved in discussions beyond the taskforce.

“I think the report was a sober assessment of where we have got to,” Allan added. “It is a very practical and realistic vision of where AI could take us in the future as it is potentially transformational.”

AI can have a transformational role in asset management, for example, by providing quick access to almost any data point to provide actionable insights for portfolio managers. However, Allan highlighted there are still some downsides in terms of Gen AI’s propensity to hallucinate, and giving probabilistic answers when the asset management sector needs very accurate, deterministic outputs. In addition, the sector is highly regulated and regulators’ have objectives in terms of consumer protection and avoiding consumer harm.

“Potential risks and the governance framework have a lot of interest from members because they are very practical in nature, and we have set some fairly ambitious targets in terms of timeframes,” added Allan.

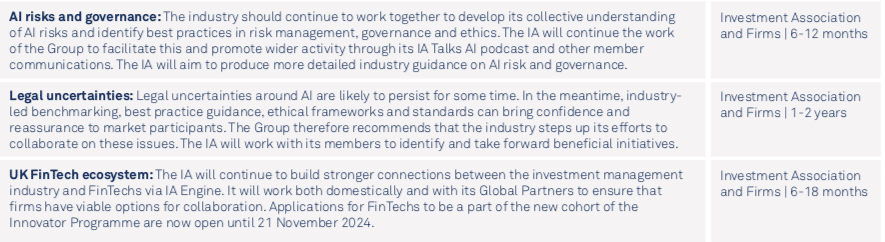

The Investment Association is owner of recommendations from the report around AI risks and governance; legal uncertainties and the UK fintech ecosystem.

Key recommendations from the report include stabilizing regulatory clarity and consistency to enable developers and users of AI to plan and invest with confidence; building a UK fintech ecosystem with strong international connections; joint public and private sector action on AI-enabled fraud; managing systemic risk through collective understanding and identifying best practice in risk management.

Combining blockchain and AI

Allan continued that the combination of blockchain and AI is one of the really interesting discussions.

“It’s certainly not something that is happening today or in the very near future but it is part of the really exciting piece that we could see over a longer timeframe,” he added.

The Investment Association believes that personalization and the power of AI will change the nature of the fund, and has called this new world Investment Fund 3.0 (IF3.0). It consists of a single digital record on a shared blockchain, rather than multiple agents along the value chain running separated record-keeping systems and processes.

Allan gave the example of AI being used to perform tasks that are otherwise performed by humans while DLT provides trust in a trustless environment and said that pairing the two together can be a significant and powerful tool for providing better, more efficient and effective services for consumers.

For example, smart contracts could rely on external data sources that have been assisted by AI.

“That feeds into our wider agenda about modernising the infrastructure for investment funds and to providing better services for consumers who are used to operating in a digital environment,” he said. “We would advocate looking at the two in tandem as they progress over the next few years, rather than seeing them as silos that never overlap.”

There are ongoing discussions about how to get explainability on AI, and how that would fit in with the FCA’s senior manager regime, which identifies individuals in firms who are accountable for certain functions, according to Allan. He said the IA has always advocated that firms should not need a designated officer for artificial intelligence, because it is just a technology.

“For example, if AI is being used in the investment process, then the investment officer is responsible,” he added.

The World Federation of Exchanges, has also published a paper on the opportunities and challenges surrounding AI and suggested three foundational principles – principles-based regulation;

a risk-based framework and alignment of regulatory standards.

Richard Metcalfe, head of regulatory affairs at the WFE, said in a statement that a failure to strike the right balance in the regulation puts more than growth at risk.

“More advanced machine learning models and generative AI has opened new avenues for enhancing operational efficiency, improving market surveillance, and managing risk,” added Metcalfe. “Policymakers must take care that regulatory changes don’t leave investors more exposed to risk, with overly broad regulation stifling the use of AI in safeguarding markets.”

The full WFE paper can be read here.