Today, different forms of digital money are being developed including central bank digital currencies (CBDCs), stablecoins, and tokenized deposits by public and private institutions, across public and private blockchains. However, to buy an asset on one chain and transfer it to another, or move it offchain, can require multiple transactions. Thus, in order for the financial industry to gain the full benefits of the new forms of digital money, chains need to be interoperable both with one another, and with existing financial market infrastructures.

As crypto-native assets like BTC and ETH can be volatile, stablecoins were developed in order to maintain a stable value relative to a specified peg, which can be a fiat currency or assets such as short-dated Treasury bills. The total capitalization of crypto assets was $2.7 trillion at the end of May 2024, with stablecoins comprising just 6%, or $161bn, of the market according to The Bank for International Settlements (BIS).

Banks and traditional payment service providers have started to use stablecoins for their activities and BIS gave the example of Société Générale launching a euro-denominated stablecoin, EUR CoinVertible, to settle onchain securities.

“These initiatives show that stablecoins are no longer the sole domain of crypto asset providers and may boost the uptake of stablecoins for payments outside the crypto ecosystem,” added BIS.

In contrast to digital money issued by private institutions, central bank digital currencies are a direct liability of a country’s central bank. BIS said in June 2024 that 94% of the 86 central banks in its survey are exploring a CBDC after a sharp increase in experiments and pilots last year. Payments could take the form of retail CBDCs, to be used by households and firms for everyday transactions. Commercial banks can also issue tokenized deposits, where transfers are recorded at the individual bank level and settled automatically using a CBDC.

In contrast, wholesale CBDCs are intended to be used between financial institutions, similar to the current reserves or settlement balances held at central banks. Using wholesale CBDCs will allow institutions to benefit from new functionalities enabled by tokenization, composability, and programmability.

BIS said: “Overall, the likelihood that central banks will issue a wholesale CBDC within the next six years now exceeds the likelihood that they will issue a retail CBDC.”

Many central banks plan to make their (potential) wholesale CBDC interoperable according to BIS, and two-thirds of central banks are likely to establish interoperability with their existing domestic payment systems. Angie Walker, global head of banking and capital markets at Chainlink, which provides infrastructure for the tokenized asset economy across blockchains, also stressed the importance of digital money integrating with existing payment rails.

“The financial industry is not going to change decades of infrastructure and billions of dollars of investment in existing markets at the flick of a switch,” said Walker. “The coexistence of blockchain-based infrastructure, alongside existing infrastructures like central bank circulatory systems, is absolutely vital.”

Walker also highlighted that not all parts of financial markets are destined to migrate to blockchain. For example, trading of highly liquid, high-frequency, low-latency instruments, such as equities, will likely continue to be primarily traded via matching engines and central limit order books. Even for assets that are represented on a ledger, many aspects of post-trade settlement will continue to be satisfied offchain until digital money in the form of CBDCs or stablecoins become mainstream.

As a result, Chainlink has built an abstraction layer into its Cross-Chain Interoperability Protocol (CCIP) to connect with legacy infrastructure and integrate the traditional world and the new onchain world through one single standard.

“We provide seamless integration into new and existing infrastructures and present the customer with a single normalized blockchain interoperability protocol,” said Walker. The interoperability protocol allows systems to talk to each other irrespective of the underlying technology.”

Users therefore have complete flexibility over which blockchain to use for each stage of the trade lifecycle. Importantly, they can also seamlessly step offchain if they need to interact with a traditional financial market infrastructure, and then come back onchain to continue the lifecycle. Chainlink has enabled the transfer of over $15 trillion in total value for onchain markets.

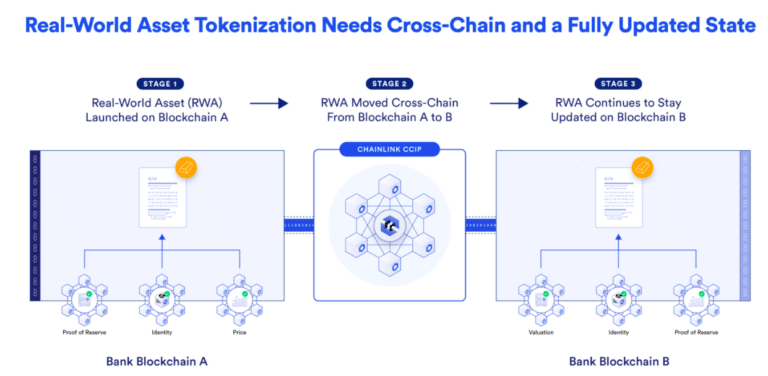

Walker also highlighted the importance of transferring both the tokenized asset and key asset data within its smart contract at the same time as it moves across chains during its lifecycle.

“The financial industry needs to solve the data problem, the cross-chain connectivity problem, and the synchronization problem,” she added.

In order to solve these problems, Chainlink collaborated in 2023 with Swift, the traditional payments infrastructure, as well as financial institutions, and other market infrastructures to securely connect the Swift network to the Ethereum Sepolia network. Chainlink CCIP provided the Swift network with secure interoperability between the source and destination blockchains as the experiment simulated the movement of tokenized assets between two wallets on the same public ledger; between two wallets on different public blockchains; and between a public and private blockchain network. In a statement at the time, SIX Digital Exchange (SDX) said that interoperability is critical to realize the promise of blockchain for institutional business and build a multi-party, regulated, global, digital, asset-agnostic trading, settlement, and asset servicing 24/7 infrastructure for issuers and investors.

In the traditional financial system, value and information move separately. In the new world of tokenization and digital money, value and instructions can move together and be packaged as a single atomic transaction. Chainlink has developed Programmable Token Transfers, which enables smart contracts to transfer tokens cross-chain along with instructions for the entire trade lifecycle.

Critical to this functionality is the implementation of unified golden records—a verifiable, persistent, updateable, and interoperable data container that lives on a blockchain and is embedded within a tokenized asset’s smart contract. It serves as a single source of truth for the asset, which can be referenced by all market participants, including investors, banks, asset issuers, asset managers, and FMIs.

“If the tokenized asset and the unified golden record become separated, you are just left with a digital representation without any of the dynamic data that is necessary to define the asset and support programmability,” said Walker. “It is no good tokenizing an asset if it becomes an inert object that cannot drive the automation of servicing that asset over time.”

Programmability brings real value by making an asset dynamic and interoperable across chains and with legacy financial market infrastructure. Walker anticipates that digital assets will potentially coexist with traditional technology for decades to come, so interoperability is critical for onchain finance to scale.

“Programmable Token Transfers is unique to Chainlink and intrinsic to the way that we designed CCIP,” she added. “The smart contract is wrapped around the asset, which gives the ability to drive actions and events to maintain the obligations of assets in their journey over time and across chains.”