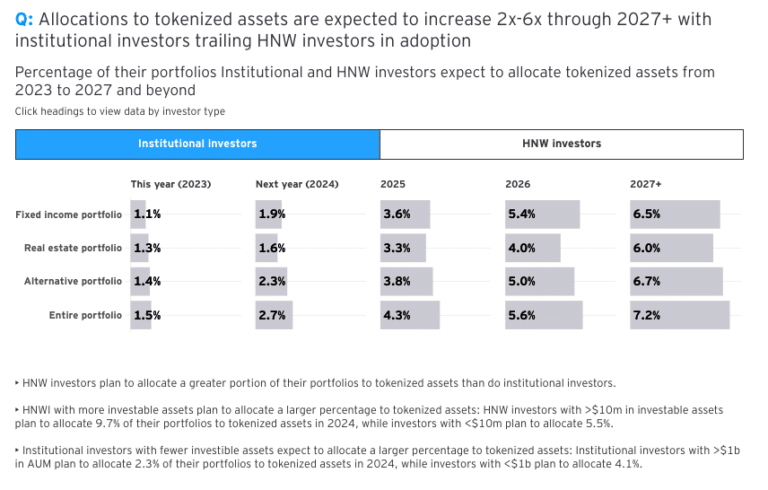

Institutional investors are projected to allocate 5.6% of their portfolios to tokenized assets by 2026, but regulatory uncertainty and the lack of trusted infrastructure remain barriers to growth of the market.

The finding comes from surveys by EY-Parthenon, the global strategy consulting arm within Ernst & Young, of 251 accredited/high net worth investors and 78 institutional asset investors in the United States in May this year.

Tokenization is the process of using blockchain technology to convert an asset or ownership rights of an asset to digital form. Putting assets on chain could revolutionise traditional markets by allowing instant settlement and the ability to rapidly transfer assets, reducing risk and increasing liquidity.

Prashant Kher, digital assets strategy lead at EY-Parthenon told Markets Media that less than 1% of assets that are currently tokenized.

He said: “Our personal view is that it will be a three to five-year tourney before tokenisation reaches scale and many of the benefits are realised. It is not a quick turn of a switch.”

Texture Capital, a FINRA and SEC registered US broker-dealer focused on securities, including securities token and real world assets, also conducted a survey of 40 executives in the summer. The survey also found that tokenization of real-world assets is likely to see increased adoption over the next 24 months. Real estate was widely seen as the most popular asset class that participants would like to see tokenized on chain.

Richard Johnson, founder & and chief executive of Texture Capital, took part in a webinar, Tokenization of Real-World Assets, with the Wall Street Blockchain Alliance on 7 September and said that more than half of his pipeline for securities tokens is related to real estate funds.

“Real estate is a massive asset class and it is very hard for investors to get exposure through public markets so there is a lot of opportunity,” he added.

EY-Parthenon’s survey also found that investing in tokenized alternative assets, particularly real estate and private equity, is the area of most interest for both institutional and high-net-worth investors.

In addition, one third of institutional investors have plans to invest in tokenized bonds by the end of 2024, particularly high-yield corporate bonds according to EY-Parthenon. The report said: “This grows significantly through 2026, during which an impressive 91% of high net worth investors and 83% of institutional investors anticipate allocating funds to tokenized bonds.”

The majority, 80%, of institutional investors want a higher yield for tokenized bonds, with the majority expecting a 5 to 10 basis points increase over traditional bonds.

“The requirement for higher yield may stem from the perception that tokenized assets are more operationally efficient, and, as such, investors expect some amount of operational savings to be passed on in the form of lower fees or higher yield,” added EY-Parthenon.

Opportunity for traditional intermediaries

Both institutional and high net worth investors prefer to access tokenized assets through traditional intermediaries such as brokers/dealers, exchanges and wealth managers according to EY-Parthenon. This preference for established distribution channels indicates the importance of leveraging existing infrastructure and trusted intermediaries to facilitate the integration of tokenized assets into investment strategies.

“I am excited by the level of interest that investors have shown in tokenized assets,” added Kher. “The strong preference for distribution of tokens through traditional intermediaries is a big call to action.”

He continued some banks, asset managers and payment networks have been public about launching tokens but no organisation is yet tokenization at scale.

Banks are exploring the tokenization of cash to support moving money for clients and also trying to solve for inefficiencies in market structure when issuing loans or bonds.

For example, Citi Treasury and Trade Solutions recently announced it is piloting Citi Token Services for cash management and trade finance as institutional clients need ‘always-on’, programmable financial services and tokens will provide cross-border payments, liquidity, and automated trade finance solutions on a 24/7 basis. ABN Amro, in collaboration with Tokeny, also recently became the first Dutch bank to tokenize a green bond on a public blockchain. JP Morgan has said it has processed almost $700bn of tokenized short-term loans, and Boradrridge, the fintech infrastructure company, said it has facilitated more than $1 trillion worth of tokenized repos every month on its Distributed Ledger Repo platform.

Asset managers are also investigating tokenizing private equity funds and alternatives to provide access easier for investors and enable liquidity as a revenue play.

“We have seen some fund managers looking at tokenizing money market funds to make internal savings and pass them onto the end-investor,” added Kher.

For example Archax, the FCA-regulated digital asset exchange, broker and custodian in the UK, was approved to distribute certain abrdn funds based out of Luxembourg in August. Archax can now directly provide both tokenized and traditional access to abrdn’s sterling, US dollar and euro yield-generating money market funds to third parties.

Johnson also highlighted that structured products are expensive to issue and service so would also benefit from tokenization.

Texture Capital’s survey also found that the growth in adoption of tokenized real-world assets will be driven by traditional financial institutions, either in combination with crypto native companies or on their own. Only 18% of respondents felt that crypto companies alone would be able to drive adoption.

Barriers

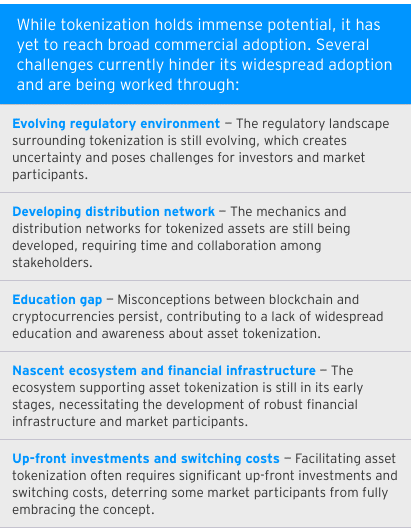

Despite the growing interest in asset tokenization, there are hurdles to widespread adoption. Nearly half, 49%, of institutional investors said regulatory uncertainty was the primary perceived obstacle, followed by a lack of trusted players in the market according to EY-Parthenon.

Texture Capital’s survey found that a lack of regulated digital asset market infrastructure was the biggest challenge for tokenizing real world securities, as well as a lack of liquidity.

“For example, public equities can turnover 200% of their total market capitalization per year, whereas some private markets have virtually no secondary market liquidity, or in the low single digital percent,” said Texture Capital. “In this context, if tokenization can enable a turnover increase to 15%, it is still a win.”

Jay Biancamano, head of commercialization at State Street Digital, said on the webinar that putting assets on a blockchain validates ownership and transfer value, reducing friction in the market.

“Our clients understand, and see, the efficiency that blockchain could bring to the market but there is no infrastructure to support that,” he added. “Our clients are looking to us to create the infrastructure so they can sell and service securities tokens.”

For example, State Street cannot presently custody digital assets but is developing an offering.

Biancamano agreed that lack of liquidity was a challenge and an ecosystem of issuers, investors and centralized venues need to develop so clients can trade, borrow and lend assets as they do in the traditional world.

“That’s just not going to happen quickly,” he said. “I think we’re still talking trickle and I just don’t see the flood happening in the next 18 to 24 months.”