The Canton Network has partnered with iBTC to allow bitcoin to be used as collateral while maintaining transactional privacy, while Ripple has become the first crypto company to own and operate a global, multi-asset prime broker.

On 24 March 2025 Canton said in a statement it will deploy iBTC, a bridgeless wrapped Bitcoin solution designed to bring institutional-grade security and liquidity to decentralized finance (DeFi). Canton has described itself as the financial industry’s first and only public chain that can achieve on-chain privacy, control, and interoperability which makes it the most suitable network for institutional assets. The network was initially built on technology from enterprise blockchain provider Digital Asset and its controls, governance, and app development have been open-sourced and decentralized.

Eric Saraniecki, head of network strategy at Digital Asset, told Markets Media: “There would be a big hole in the Canton Network if we didn’t have bitcoin in the ecosystem and it has been a super-high priority for a long time. I’m really excited that iBTC was so excited, and that they’ve been working so hard with us as an excellent partner.”

He continued that it is a bit of a misnomer to say that there’s a crypto derivatives market as it is overwhelmingly a Bitcoin derivatives market.

In January this year Canton initiated a project with Digital Asset, QCP, one of the first digital asset trading firms in Singapore and a global market maker in digital asset derivatives, and a select group of their counterparties to create onchain collateral and margin management solutions for bilateral derivatives. Around 90% of trades are in bitcoin in this project and use bitcoin as collateral according to Saraniecki.

Canton’s partnership with iBTC allows wrapped bitcoin to be posted as initial or variation margin on the network with more efficiency, higher velocity and privacy, according to the firm. Wrapped crypto tokens are designed to increase interoperability between different blockchains by mirroring their value from a different blockchain.

Bitcoin on a public blockchain can be “wrapped” and used on a financial institution’s blockchain on Canton, which has privacy controls, so there is a bridge between traditional finance (TradFi) and DeFi, and vice versa. The privacy features in Canton’s public network can be configured to ensure that bitcoin flows are visible only to the desired market makers, enhancing confidentiality and security.

Aki Balogh, chief executive and co-founder of iBTC, said in a statement: “With top-tier privacy, liquidity from partners like DRW, and optimized workflows, we’re excited to meet the growing demand for streamlined margin needs.”

Initial and variation margin cycles will occur every two to four hours, allowing for seamless bitcoin movements to meet margin requirements. The rollout initially involves a select group of institutional counterparties, with plans to scale participation to between 10 and 20 firms processing $20m to $50m in daily trading volume. As part of the partnership , iBTC will operate a Canton Network Validator, which offers additional incentives and mining rewards.

Canton aims to provide maximum utility for crypto collateral by connecting it to the maximum number of use cases, venues, triparty agents and settlement facilities. Saraniecki said Canton also hopes to connect into the big crypto derivatives exchanges and custodians to offer privacy in the same way.

He added there is a large pipeline of people looking to use bitcoin on Canton, and they are overwhelmingly interested in the privacy opportunity.

“People are already talking to us about very interesting bitcoin structured products because it can really transform capital formation for bitcoin-denominated businesses,” said Saraniecki.

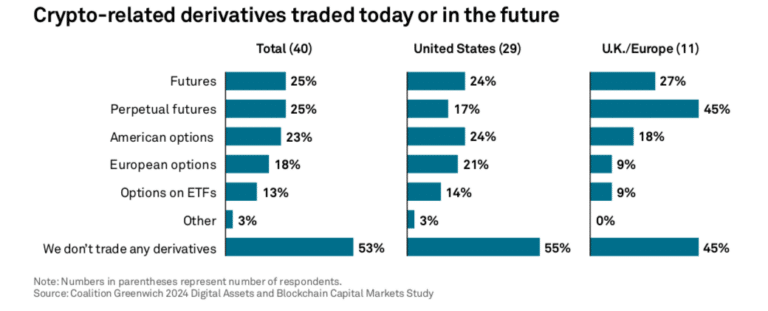

Consultancy Crisil Coalition Greenwich said in a report, Digital asset trading 2025: A market in transition, that crypto derivatives are set to explode, especially options. The report said two thirds, 65%, of the crypto buy side currently trade some type of crypto derivative i.e. futures, options and perpetual futures.

“With the proliferation of ETFs, we expect the options market on listed ETFs to explode, with volumes and open interest accelerating throughout 2025,” added the study. “It’s a good time to be a regulated derivatives market for digital assets.”

Saraniecki described the world of crypto-native versus TradFi as “a bit of a false dichotomy.” He said : “When Canton is super-successful, we will have been the ledger that knocked down this artificial barrier between the two.”

Ripple buys prime broker Hidden Road

In another example of the convergence between crypto and TradFi, Ripple, a provider of digital asset infrastructure for financial institutions, said in a statement on 8 April 2025 that it is acquiring Hidden Road for $1.25bn. Ripple said it will become the first crypto company to own and operate a global, multi-asset prime broker.

Hidden Road offers clearing, prime brokerage, and financing to institutions across foreign exchange, digital assets, derivatives, swaps, and fixed income. The prime broker clears $3 trillion annually across markets with more than 300 institutions according to the statement. Ripple said that Hidden Road will expand its capacity to service its pipeline and become the largest non-bank prime broker globally with the backing of its significant balance sheet.

In addition, Hidden Road will use Ripple’s US dollar stablecoin, RLUSD, as collateral across its prime brokerage products. Ripple said: “This will make RLUSD the first stablecoin to enable efficient cross-margining between the digital asset space and traditional markets.”

Marc Asch, founder and chief executive of Hidden Road, said in a statement: “Together with Ripple, we’re bringing the same level of trust and reliability that institutional clients are accustomed to in traditional markets — designed and optimized for a digital world.”

David Easthope, senior analyst who heads up fintech research on the market structure and technology team at Crisil Coalition Greenwich, said in the report that the crypto market is undergoing a significant transition, evolving from its adolescent phase to a more regulated, mature and sophisticated stage so institutional traders are driving the demand for more advanced infrastructure and products.

“The market is shifting toward a more robust and institutional-grade landscape, with firms like Bullish, LMAX Digital, Zodia, EDX Markets, Crossover, Coinbase, and Kraken providing upgraded venues, and BitGo, Galaxy Digital, Hidden Road, FalconX, and Coinbase building out prime brokerage operations,” said Easthope. “Custodians like Etana, Anchorage, BitGo, and Copper also have aspirations to further build out institutional offerings to support the full trading life cycle, including in settlement and collateral movement.”

The consultancy predicted that the emergence of full-stack prime brokerage operations will provide institutional traders with a more comprehensive and coordinated approach to trading, custody, settlement, and staking.

Brad Garlinghouse, chief executive of Ripple, posted that the deal “marks a once-in-a-lifetime opportunity for crypto to access the largest and most trusted traditional markets, and vice versa.”

Today, @Ripple announced the acquisition of Hidden Road for $1.25B, one of the largest deals ever in the crypto space. But the price tag isn’t what’s most important – it’s that this deal marks a once-in-a-lifetime opportunity for crypto to access the largest and most trusted…

— Brad Garlinghouse (@bgarlinghouse) April 8, 2025

For example, Garlinghouse said that instead of waiting for to settle trades through fiat rails, Hidden Road will be using XRPL for clearing a portion of trades, and most consequentially, using RLUSD as collateral across its prime brokerage services, including cross-asset (crypto and traditional instrument) trades. The XRP Ledger (XRPL) is a cryptocurrency platform that was originally launched in 2012 by Ripple Labs but is now a decentralized open source public blockchain that allows for the fast, low-cost, real-time transfer of both fiat currencies and digital assets.

Garlinghouse said: ‘Ripple and Hidden Road combined are a generational leap forward, ready to truly bring the worlds of traditional and decentralized finance together.”

Chris Perkins, president of Coinfund, posted that he is a former TradFi prime brokerage and derivatives veteran and believes this acquisition is a “big deal” :

3/This beautifully complements Ripple’s recent lead investment in Bitnomial, an onshore licensed exchange (DCM) and clearinghouse (DCO). For a scalable, regulated derivatives ecosystem in the U.S., all three licenses (FCM→DCM→DCO) are needed. https://t.co/5G1x5UktYq

— Christopher Perkins 🦅🌎⚓️NYC (@perkinscr97) April 8, 2025

Monica Long, president of Ripple, posted: “Through Hidden Road, for the first time, an institutional investor is able to post multiple forms of collateral (including crypto and tokenized assets – and soon RLUSD!) to one counterparty, and trade across 100+ venues and liquidity providers that support 1000+ assets across FX, crypto, fixed income etc. This is no small feat to achieve today, especially with risk management. That, in combination with using the XRP Ledger for post-trade settlement in the future, means the possibilities are staggering.”

Rob Hadick, general partner at cross-border crypto venture fund Dragonfly, said:

@WKahneman posted Ripple now has a direct path to put real institutional volume on the ledger, potentially for the first time at scale.

“This could be the beginning of XRPL becoming a true settlement layer in global finance,” he added. “For Ripple, this opens the door to get its RLUSD stablecoin and XRP into actual institutional flows across multiple trading venues.”

@WKahneman continued:

“If Ripple can prove that #XRPL works as a high volume, low cost settlement system for real trades and real institutions, it sets a new benchmark for blockchain utility. This has the potential to dramatically increase the transactional volume on the ledger and make XRP part of institutional trading and clearing flows.

Note that the use of credit is key. Institutional finance runs on leverage and netting, not fully-funded accounts. Hidden Road gives Ripple the ability to provide capital efficient trading backed by its own balance sheet, especially RLUSD. It can now be used as collateral across Hidden Road’s platform, immediately increasing its utility and circulation. Instead of just being used for payments, RLUSD can now function as a funding asset, a margin asset, and potentially a settlement layer across crypto and traditional markets. Put simply, this deal gives Ripple a potential place in the traditional finance world. They have a robust stack or plumbing: A regulated trading network. A stablecoin with real utility. A ledger with institutional-grade settlement speed. A way to scale volume onto XRPL. And a new kind of customer, FI’s & funds that need clearing and credit. If Ripple can connect all of that together, the #XRPL becomes its end goal of infrastructure.”