Ratings agency S&P Global said difficulties in making on-chain payments and the lack of a functioning on-chain secondary market have limited issuers’ and investors’ interest in digital bonds but recent innovations could boost demand.

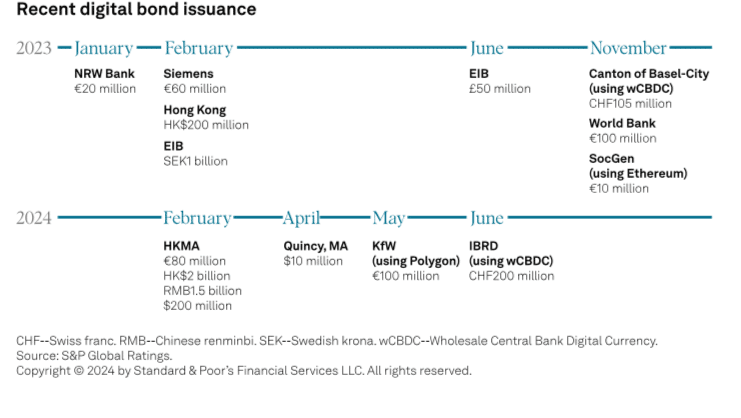

Mohamed Damak, primary credit analyst at S&P, said in a report that the agency has rated 14 digital bonds that totaled about $1.6bn over the 18 months from a variety of issuers.

Damak continued that they were mostly issued on private blockchains, with bond payments made off-chain through traditional payment mechanisms, which reduces the efficiency of issuing digital bonds.

“However, recent innovations related to public blockchains and wholesale central bank digital currencies (wCBDCs) could overcome these challenges and boost adoption,” he added.

For example, some digital bonds have been issued on public blockchains or were part of the Swiss National Bank’s pilot scheme to enable settlement using a wholesale central bank digital currency, which enables near-instant delivery versus payment.

In March this year two Swiss digital bonds settled on blockchain-based SIX Digital Exchange (SDX), the digital asset arm of SIX Swiss Exchange using a wholesale central bank digital currency from the Swiss National Bank.

In May this year the World Bank priced the first Swiss Franc digital bond by an international issuer settled using Swiss Franc wholesale central bank digital currency, which also listed on the traditional SIX Swiss Exchange and SDX.

David Newns, head SIX Digital Exchange, said in a statement: “Being able to settle wholesale transactions in tokenized central bank money is a critical, foundational requirement for the adoption of a blockchain based capital markets infrastructure.”

Damak highlighted that innovations which would make digital bonds particularly attractive to investors have not yet materialized such as enhanced collateralization and trading capabilities.

Digitization can make it quicker for investors to use bonds as collateral, for example by improving efficiencies in intraday liquidity management and enabling investors to trade bonds 24/7, rather than only during market hours,” he added. “However, this requires an active and liquid on-chain secondary market, which does not exist yet.”

In addition, most digital bonds have been issued on private blockchains from traditional financial intermediaries, including HSBC Orion and Onyx by J.P Morgan, which Damak described as “walled gardens”. This decreases liquidity as the secondary market is limited to investors who are members of the platform or who go through intermediaries that are members.

Automating trading

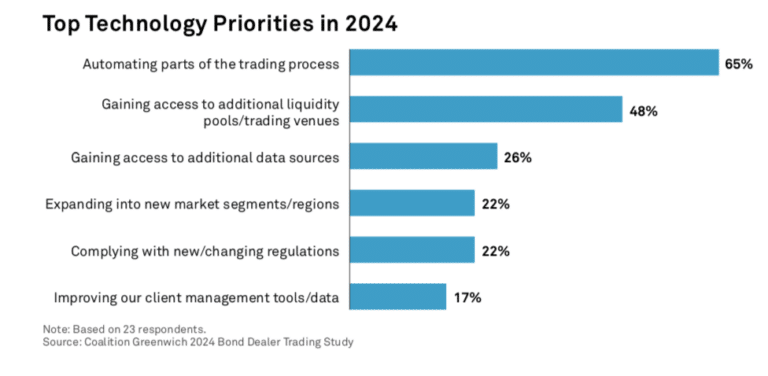

In addition to the issuance of digital bonds in the primary markets, another trend is the automation of trading of standard bonds in secondary markets. Kevin McPartland, head of research for market structure & technology at consultancy Coalition Greenwich, said in a report that an increasing number of client orders are now executed with little or no human intervention.

“Institutional investors are increasingly expecting near-instant liquidity when trading corporate bonds, with over 40% of the total notional volume of investment-grade bonds now traded electronically,” said McPartland. “The only way for dealers to meet this need is to price and quote bonds faster than a human could via point-and-click.”

In addition, as volumes have increased traders cannot maintain the same level of service without automation. U.S. corporate bond trading volume is up one third, 34% year over year; the average daily trade count is up 20%; and the average ticket size is down 16% according to McPartland. His study is based on interviews with 26 U.S. corporate bond dealers in the second quarter of this year.

Top-tier U.S. corporate bond desks see roughly 30,000 inquiries per day on average (about 80% of which are in IG bonds), making it virtually impossible for humans to manually respond to all (or in some cases even some) of those client-generated requests- for-quote (RFQs),” he added. “In fact, one large global dealer told us that no RFQs are responded to via a trader entering a price and hitting send—the process is fully automated.”

However, although investment grades can be auto-quoted, only 44% of firms can auto-quote for high yield and were, 38%, due to their relative lack of liquidity.

McPartland concluded that the heavy use of proprietary technology to manage the auto-ex process suggests this market segment remains in the early innings.

“A big question to ponder is where the line should be drawn between technical differentiation (aka secret sauce) and must-have utility,” he said. “One could also argue that the logic used to determine how to respond and with what price are differentiators but, given the quality and customizability of third- party solutions available today, it’s not the solution that is the differentiator but, instead, the way you use it.”