Displayed share at IEX Group has risen from 10% to 30% of total trading volume since it introduced a new order type last year, which the exchange said has demonstrated improved execution quality.

IEX Exchange fully launched its D-Limit, discretionary limit order type, on October 1 last year after receiving approval from the US Securities and Exchange Commission.

Ronan Ryan, IEX

Ronan Ryan, co-founder and president of IEX Group, told Markets Media that the venue’s machine learning signal seeks to predict how the market is going to move in the next fraction of a second. D-Limit then uses the power of the IEX Signal to move an order out of the way if the price is about to become imminently stale i.e. the order avoids being “run over” when the price is unstable.

Ronan added that approximately 30 brokers are using D-Limit and more are in the pipeline. “Since the order was launched last October our displayed volume has risen from 10% to 30% of our total,” he said.

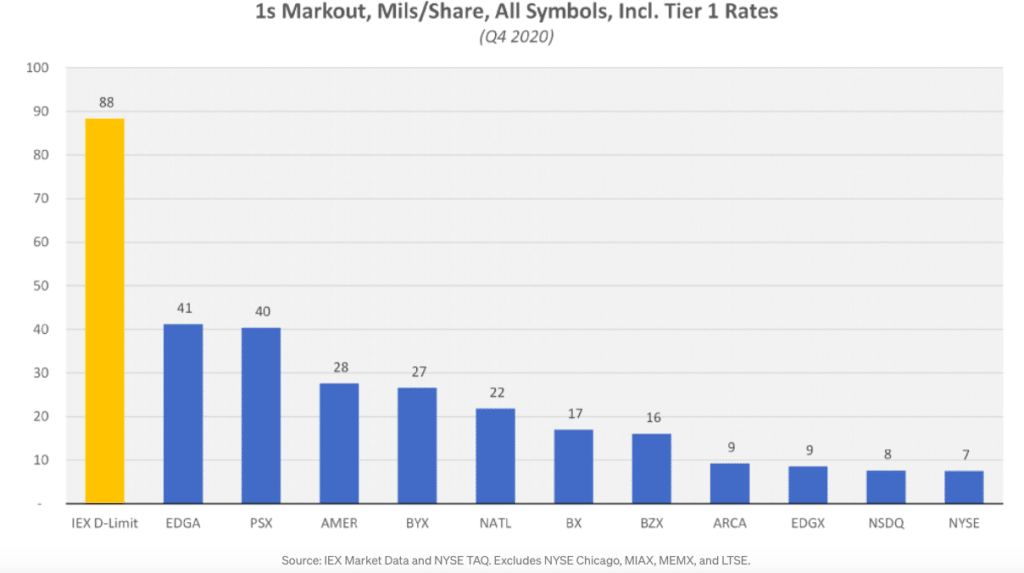

He analysed the performance of the D-limit order against other exchanges using public NYSE TAQ data in a blog this month.

“We measured markouts, or the impact of the trade, one second after execution and found that the D-limit order had better performance, even when rebates from the other venues were included,” said Ronan.

He explained that the analysis showed that the outperformance occurred across various time horizons, both short- and long-term.

Ronan said: “We have opened the door to innovation in displayed markets and shown it can be done without paying rebates.”

Source: IEX.

Joe Wald, co-head of electronic trading at BMO Capital Markets, told Markets Media that the firm had been supportive of the D-Limit order in comments to the SEC because it wanted better execution quality for displayed liquidity and protection from predatory pricing.

Wald said: “We have been using the D-limit order and found it delivers superior execution quality. We rigorously measure execution quality and will incorporate the D-Limit order into more of our strategies as long as it continues to perform.”

He added that there is a gap for order types that focus on execution quality. ”We expect to see more innovation in this space,” Wald said.

Joe Wald, BMO Capital Markets

For example, he said that in principle he supports the possible introduction of periodic auctions in the US by Cboe Global Markets to attract more block trading, which is waiting for regulatory approval.

Wald added: “It is great to see the exchanges innovating to attract more institutional flow.”

Execution quality in displayed markets is important because if a large volume of trading is executed off-exchange, there could be consequences for price discovery.

Ronan said that for the first time, off-exchange equity trading volumes in the US have surpassed 50% of total daily volume for at least four days since late December.

“We’ve reached a critical point in what has been a decade-long decline in displayed trading and this may be a focus for the new SEC commissioners,” he added. “Innovation in lit markets has been a long time coming and D-Limit should only be the beginning.”

Rule 606

Best execution was a focus last year when the SEC’s Rule 606(b)(3) came into full effect with the aim of giving the buy side more data and information about their trades. Broker-dealers are required to disclose routing and execution data for not held orders over the previous six months if a customer asks for the information.

*New* Equities TCA in 2021 – A Transitional Year https://t.co/bWY6AdrKoj via @GreenwichAssoc by @deasthope

— Greenwich Associates (@GreenwichAssoc) February 2, 2021

Consultancy Greenwich Associates said in a report that Rule 606 has started to have an effect on transaction cost analysis. However, as it came into effect late last year, the impact should be felt much more strongly in 2021 and beyond.

Wald said the introduction of Rule 606 has democratized market data and led to conversations with a wider group of participants. “There is much more meaningful dialogue,” he added.

David Easthope, Greenwich Associates

David Easthope, senior analyst for Greenwich Associates market structure & technology, said in a statement: “With more data and increasing access to cloud-based analytics platforms, TCA is moving from a post-trade report card to an interactive trading assistant.”

The consultancy expects the industry to eventually arrive at a state where real-time data is used to inform algorithm switching based on how well the execution is performing against the forecast.