Intercontinental Exchange reported record net revenues of $1.1bn in the exchange business driven by growth in agricultural commodities, the global natural gas business and the interest rate complex.

The group reported net revenues of $1.9bn, with the exchange segment contributing $1.1bn.

Ben Jackson, president and chair of ICE Mortgage Technology, said on the results call on 4 May that ICE had record volume for a single day of 14.5 million contracts on 13 March 2023.

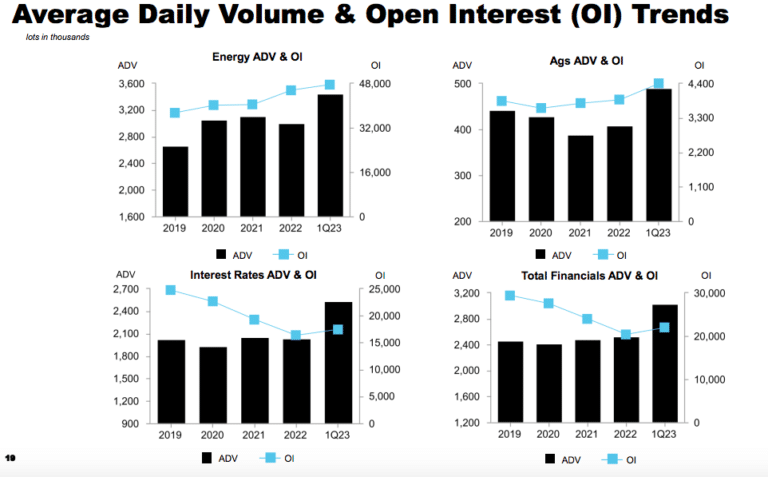

Warren Gardiner, chief financial officer of ICE, said on the call: “Transaction revenues of $739m in the exchange segment were driven in part by 15% growth in agricultural commodities, and a 16% increase in our global natural gas business. Importantly, open interest remains strong across futures and options as at the end of April.”

The Fixed Income and Data Services business reported record revenue of $563m in the first quarter of this year, a 12% year-on-year increase. Fixed income transaction revenues increased 54% from the same period last year, and there was a 42% growth in clearing credit default swaps.

“Similar to last quarter this strong growth was driven by market volatility, higher interest rates, and our continued efforts to build institutional connectivity to our bond platforms,”added Gardiner.

In the interest rate markets, central bank activity and concerns over bank failures led to increased hedging activity driving 18% volume growth in the first quarter including a 25% volume increase in the Euribor contract. ICE also had record volumes in its contracts for Sonia, the risk-free rate that replaced Libor.

ICE has continued to build institutional connectivity to its bond platforms according to Jackson, and volumes on ICE Bonds were up 100% year-on-year in the first quarter.

“There is a significant opportunity to continue to expand and evolve products and services within our fixed income and data services business,” said Jackson. “From the digitization of fixed income workflow to the innovations we bring to connectivity and market data, ICE is well positioned for long-term success and growth.”

Jackson continued that ICE has built a global energy platform that positions it well to provide critical price transparency across the energy spectrum and that will enable participants to navigate the clean energy transition. For example, ICE has invested in biofuels, renewable oil products and low carbon fuel standard contracts

“While volumes are small today, we see positive signs that they will become meaningful contributors in the future,” added Jackson. “As we look out over the longer term, corporates and market participants remain committed to reducing carbon emissions as illustrated by a record number of market participants in our environmental contracts in the quarter.”

On 1 May ICE implemented select price increases within the energy business.

“Through both continuous product innovation and technology enhancements, depending on the mix of volumes, we would expect a benefit in the energy rate per contract at the beginning of the second quarter,” Gardiner added.

Gardiner continued that ICE will continue to invest in technology and selective hires in certain areas including data products and datasets, ESG indices and the connectivity business.

Digital assets

Jeffrey Sprecher, chair and chief executive of ICE, said on the call that when the group created Bakkt and then spun the digital asset marketplace off, its philosophy was that the business would be highly regulated and comply with existing rules.

“We own and operate the world’s largest exchange, the New York Stock Exchange, with 38 million transactions a day so we have the infrastructure to list digital assets,” he added.

The Securities and Exchange Commission requires NYSE members to be licensed broker-dealers who provide know-your-customer and anti-money laundering oversight.

“So far, that model has not been one that the market has been interested in,” Sprecher added. “It is actually relatively simple for us to list a token and register it on a public blockchain compared to the complexity of the infrastructure that we are used to operating in, so we will see how this unfolds.”

Sprecher believes the SEC and other US regulators would prefer to use traditional infrastructure for listing tokens as their compliance activities seem to be focused on moving tokens to existing market infrastructure.

Mortgage Technology

During the first quarter ICE completed its first signing of a top five global bank to replace their legacy in-house loan origination technology with Encompass.

“While not expected to impact 2023 recurring revenues that helped to drive the best quarter for new sales of Encompass in the product’s history and is a clear testament to the increasing need for workflow efficiencies,” added Gardiner.

Sprecher spoke on the call about ICE’s pending acquisition of Black Knight which was announced in May 2022. In March this year ICE announced revised terms of the merger agreement to acquire the mortgage software, data and analytics company at $75 per share, giving a market value of $11.7bn, from the previous $85 per share. Black Knight’s shareholders approved the revised deal last week.

“Although I strongly believe that the acquisition is entirely pro-competitive, we also announced an agreement to sell Black Knight’s Empower loan origination system and certain related businesses to Constellation Software,” said Sprecher. “We did this in order to remove a perceived horizontal competition concern.”

ICE and Black Knight intend to defend the revised merger in a hearing scheduled in a federal district court on May 12 to establish the timetable for this process.

“We remain fully confident in our position and we look forward to presenting it in court,” added Sprecher.