Anthony Belcher, head of sustainable finance at ICE, said the exchange has been filling one of the big gaps in environmental, social and governance data which was fixed income and the link to securities issuance.

Belcher told Markets Media that market participants have been very focused on equities in sustainable finance and ESG, so Intercontinental Exchange saw fixed income as one of the big gaps.

“We can map a company’s ESG data to its fixed income issuance and cover 1.4 million debt securities,” he added. “Clients can now look at ESG from a multi-asset perspective as we also cover municipal bonds and mortgage-backed securities.”

Approximately only 1% of fixed income assets under management is focused on ESG in the US, compared to 22% in the European Union, according to Belcher, so fixed income data will become more important.

In addition, in February ICE announced it had expanded its ESG Company Data in the Asia-Pacific region and now offers global coverage of 16,000 companies across 105 countries. ICE said that with this expansion it provides granular data mapped to approximately 1.4 million corporate equity and fixed income securities.

Elizabeth King, president of sustainable finance and chief regulatory officer at ICE, said in a statement: “This expansion, combined with ICE’s unique security linkage capabilities, enables more ESG coverage of fixed income securities which has historically been a challenge for investors. With the growing demand for more disclosure from regulators and other stakeholders, there’s an increasing need for access to raw data to improve ESG reporting.”

In January, ICE also expanded its global corporate emissions and targets data, which now covers more than 600,000 fixed income securities. This expansion results from the integration of climate data provided by Urgentem, which ICE acquired in June 2022.

To assess physical risk ICE uses a broad range of data inputs, and geospatial mapping is very important.

“We can provide a two-step linkage from the geospatial entity through to a security, which allows us to provide that depth of physical risk management,” said Belcher. “A differentiator is that ICE can provide specific securities’ exposures to asset managers and banks.”

Emissions data and climate risk targets are currently the biggest focus from clients according to Belcher. Most demand for ESG data has come from Europe, but over the last 18 months ICE has seen a lot of demand from the US, and increasingly Asia Pacific, although the region is very varied.

Belcher added that the number of companies disclosing ESG information, the quality and the number who obtain third-party assurance has been improving year-on-year. ICE sees increased disclosure around targets for emission reductions and net zero goals, and also how companies are progressing towards those goals.

“Clients want to see how companies are progressing towards net zero, but also the exposure that companies have to industries with high emissions, so they can manage that risk,” said Belcher. “For market participants, disposing of holdings is very much the last resort and they want information for deciding who they need to engage with, and how they should engage.”

Modelling capabilities

Belcher continued that ICE reviews the data it collects to see if it is verified and assured, and also has a rigorous process to make sure it understands the boundaries and scope of the information, and what is published.

“Our inference model allows us to be able to expand that capability into companies that have either partially reported or not reported at all,” he added. “The benefit of the model is that we can go beyond the smaller number of companies who report their emissions data into the private and SME space.”

As a result the European Central Bank used ICE’s data and modelling capabilities to review the loan books of the banks the ECB regulates. Belcher said the central bank could review nearly 4 million companies using ICE’s model to assess the climate risk exposure of those banking groups.

Social is not as well-defined in the marketplace as green and environmental data said Belcher. For example, the EU taxonomy has delivered the green taxonomy, but social is still in development.

“From a corporate perspective, we are seeing more disclosure on gender balance and workforce diversity,” he added.

ICE’s roadmap over the next 12 months is to extend its capabilities into new geographies and asset classes. For example, Belcher explained a deepening of the capabilities around climate risk could help clients with reporting under the framework from the Task Force on Climate-related Financial Disclosures (TCFD).

Belcher said: “From our perspective ESG is being used in four ‘R’s’ – risk management, regulatory reporting, revenue generation, and doing the right thing. There has been an increase in demand for regulatory reporting and revenue generation.”

For example, ICE works closely with Bank of America, who have used the exchange’s data to develop a metric to help clients understand where there are financial opportunities as a result of using ESG.

There has been a backlash against ESG but Belcher argued this is very much a US phenomenon, and partially driven by misunderstanding about how the data can be used for good risk management purposes.

Impact Bond Report

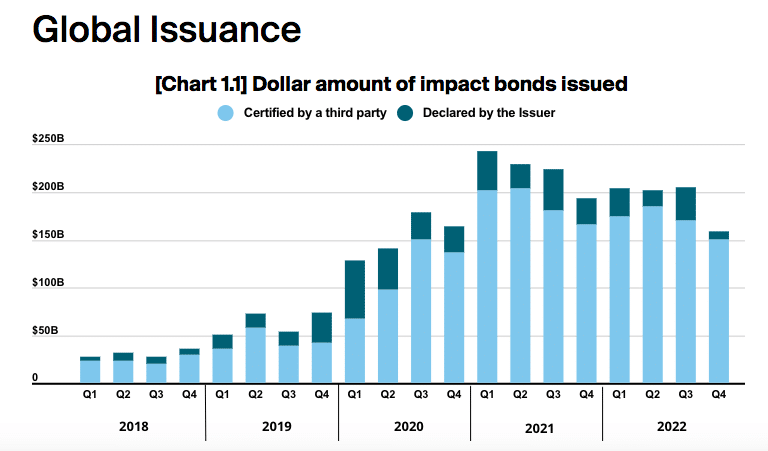

In January ICE published its second annual full-year Impact Bond Report, which showed that impact bond issuance fell 13% to $773bn in 2022 after reaching a record in 2021. Impact bonds include green bonds, social bonds and sustainability bonds according to ICE. However ICE noted that there was a 61% decline in overall bond issuance in 2022.

The report said: “Issuance showed robust growth versus five years earlier, up more than 6 times from $122bn in 2018.”

The percentage of impact bonds as a portion of the total bond market also doubled from 2% in 2021 to 4% in 2022.

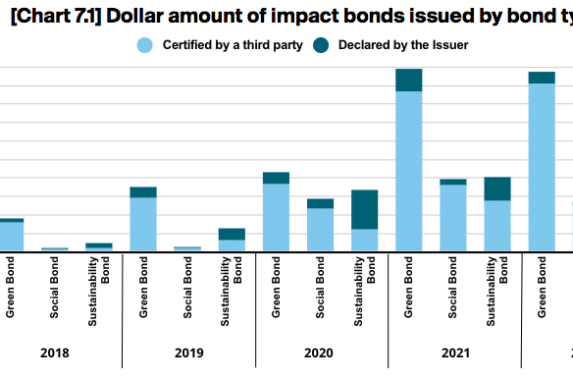

The absolute amount of green bonds issued was 2% lower in 2022, but they remained the most popular bond type among impact bonds, representing the majority, 63%, of all impact bonds issued.

ICE’s data showed that third-party certification, which provides an independent assurance that funds are being used for green, sustainability or social purposes, rose to 88% of all impact bonds issued during 2022, from 84% in the previous year. Growth in certification was most pronounced in the U.S., which increased from 59% in to 83% year-on-year which ICE said was due to regulators cracking down on greenwashing, unsubstantiated claims about the sustainability attributes of a product.

EMEA remained the largest issuing region according to the report, despite a 15% drop in issuance from 2021 to $405bn, more than half of global impact bond issuance. Asia Pacific was the only region that saw year-over-year growth in issuance to a record $241bn, making it the second largest issuing region as China which become the largest country issuer globally in 2022.

The total return index value of the ICE Green, Social & Sustainable Bond Index and the ICE BofA Euro Broad Market Index both fell 17% over the year, showing comparable performance between impact bonds and the broader bond market.

“All impact bond indices also improved their relative performance to the broad market in Q4, as all of them had a higher allocation to the credit sectors,” added ICE. “The credit sectors, in particular corporates, outperformed duration-matched government bonds during the quarter.”