ICE has partnered with Dun & Bradstreet, who has built up one of the largest private company databases, to add to the climate and environmental, social and governance data that the group already provides across global public companies, U.S. municipalities and fixed income securities.

Chris Edmonds, president of ICE’s fixed income & data services, said in a statement in October: “By combining Dun & Bradstreet’s business intelligence, supply chain and asset location data with ICE’s geospatial and climate capabilities, and leveraging ICE’s distribution channels, this new service will offer the broader investment community a single source of climate data for virtually all business entities globally.”

In 2022 ICE acquired Urgentem, which provides global corporate emissions and climate transition data. As a result, ICE’s geospatial intelligence platform ,which incorporates satellite imagery, and its climate data models already cover multi-asset class transition emissions and physical climate data on over 110 million US properties, global public companies, US municipalities and more than 4.2 million fixed income securities, including corporates, municipals, sovereigns and mortgage-backed securities.

Larry Lawrence, head of ICE Climate told Markets Media that all the Dun & Bradstreet data will be integrated by the end of this year. ICE Climate provides data and analytics that help quantify investment impacts posed by transition and physical climate risks, such as extreme weather events.

Lawrence highlighted that ICE Climate has experience of integrating huge amounts of data. Following the 2023 acquisition of Black Knight, the software, data and analytics company for housing finance company, ICE Climate integrated data on more than 100 million properties in the US to include in its climate models of transition and physical risk.

“We have a data operations team that has done a tonne of work in collecting company data for 13,000 public companies,” he added. “Dun & Bradstreet have tens of millions of private companies in their database so that is a big reason why we felt this partnership would be a really big step forward in providing transparency.”

Dun & Bradstreet can provide data such as all of a company’s locations, buildings and employees around the globe and its supply chain, which could involve hundreds of suppliers.

“Imagine dropping a bunch of pins across the world and then overlaying extreme weather events, or extreme heat or extreme cold,” added Lawrence.

By taking all these inputs and using ICE Climate’s geospatial platform and modelling capabilities, ICE can infer scope 1, 2 and 3 emissions.

“You are never going to get every company to report all the information without waiting for decades,” said Lawrence. “However, our cutting edge modelling capabilities and scientific climate capabilities really help clients understand their exposure to companies today and where that might be going based on their assets.”

Hazard watch

Lawrence continued that demand for ICE Climate’s data increases after extreme weather events such as hurricanes or floods.

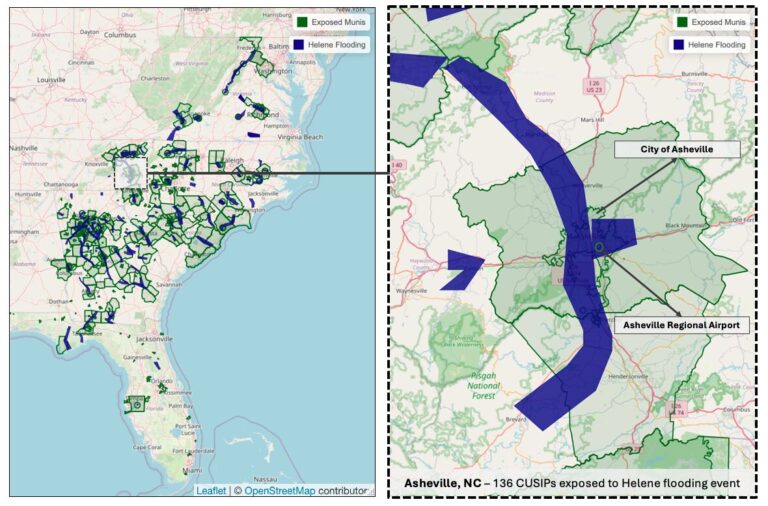

As a result, ICE Climate has recently introduced Hazard Watch. An investor can, for example, search for data on hurricanes such as all the hurricanes that are active right now in the US, or that have happened since a specific data and see the data displayed on map.

ICE Climate can then show how many securities are impacted based on the path of the hurricane and the assets on the ground according to Lawrence.

“We can model how exposed, or how much reliance, a particular area has to an extreme weather event and link that back to securities that are meaningful for an investor,” he added. “That is where we add a ton of value.”

Hazard Watch currently covers the US but ICE Climate plans to roll it out to cover the global corporate universe next year.

Lawrence said: “The fixed income market has been largely under-served, and that is where we are focused. We are the predominant player in fixed income climate data.”