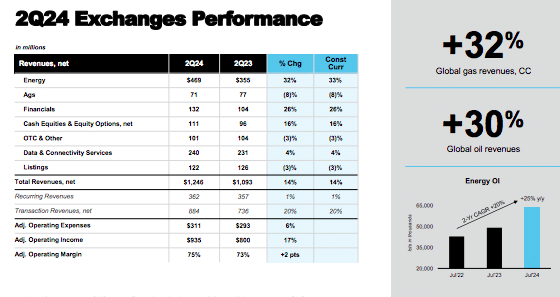

ICE, the exchange group and mortgage technology provider, reported record transaction revenues of $884m in the second quarter of their year thanks to increases in the interest rate business and record energy derivatives revenues.

Warren Gardiner, chief financial officer of ICE, said on the second quarter results call on 1 August that transaction revenues increased 20% from a year ago, driven by a 40% increase in the interest rate business over that period and record energy revenues.

“This strong energy performance included a 30% increase in our oil complex, 32% growth in global natural gas revenues and 64% growth in our environmental business,” said Gardiner. “In addition, at the end of July open interest was up 20% year-over-year, including 21% growth in global interest rates and 25% growth in our energy markets.”

Ben Jackson, president and chair, ICE Mortgage Technology, said on the call that ICE has been building its global energy platform for more than 20 years. As a result, the firm is strategically positioned for the globalization of natural gas and societal demand for a transition to clean energies, leading to revenue growing, on average, of double digits over the past five years.

“Our long-term strategic direction and the value of our diverse deep and liquid markets contributed to record trading volumes across our energy complex in the second quarter,” said Jackson.

Open interest continued to set records into July according to Jackson, and grew 25% year-over-year. He explained that price formation has become increasingly complex as market participants have to constantly weigh the impact of an array of macroeconomic, geopolitical and regulatory forces, as well as climate risk and the emergence of new renewable fuel sources. Therefore, demand is increasing for more precise risk management tools and customers want to come to a single place to manage risk across oil, gas, power and environmental contracts.

Jackson highlighted that a global natural gas market is evolving and the three key benchmarks across North America, Europe and Asia are becoming increasingly interconnected. In Europe, ICE’s TTF (title transfer facility) contracts are increasingly being used by global commercial participants, traders and investors with a record number of market participants in the second quarter, which has doubled since 2019.

“This has been accompanied by volumes and open interest increasing with both setting new highs in the second quarter,” Jackson added.

The number of market participants in ICE’s global environmental markets has nearly doubled since 2019 and volumes increased 61% in the second quarter. This has contributed to a 43% increase in environmental revenues in the first half of this year.

The volume of power contracts grew 51% in the second quarter of this year, and Jackson said the demand for artificial intelligence and data centers is expected to drive meaningful demand into the next decade.

He continued that open interest is a barometer for future volume potential. Open interest is up 20% from last year across the whole futures complex, but up 25% in energy.

“This creates a flywheel effect because anybody that is trading in energy markets wants to put a price on oil, power, gas and in one place,” Jackson said. “Our innovation and open interest growth has also fed into the growth of our benchmark contracts.”

Us Treasury clearing

Jeffrey Sprecher, chair and chief executive of ICE, confirmed on the call that the group will launch a clearing service for US treasury securities and repos, following the expansion of the clearing mandate by the U.S. Securities and Exchange Commission. He said that no existing clearing offering is compliant with the new rule, which opens an opportunity for ICE.

“We look forward to working with our clients and the entire treasury ecosystem to deliver on this innovation following the proven playbook that we have applied across futures and fixed income markets, and by leveraging our expertise and building new technology,” said Sprecher.

The new service will be based on the existing clearinghouse, ICE Clear Credit, which ICE said is the leading global clearing house for credit default swaps (CDS). However, treasury clearing will have a separate rulebook, membership, risk management framework, financial and liquidity resources and risk committee.

ICE Clear Credit was founded during the financial crisis in 2009 to bring confidence and stability to the CDS market.

Stan Ivanov, president of ICE Clear Credit said in a statement in June: “The rich experience we’ve developed creating and operating ICE Clear Credit and the work we’ve done to ensure its compliance with all U.S. and foreign regulatory regimes has created a fertile environment for adding treasury clearing to our suite of credit clearing services.”

Financials

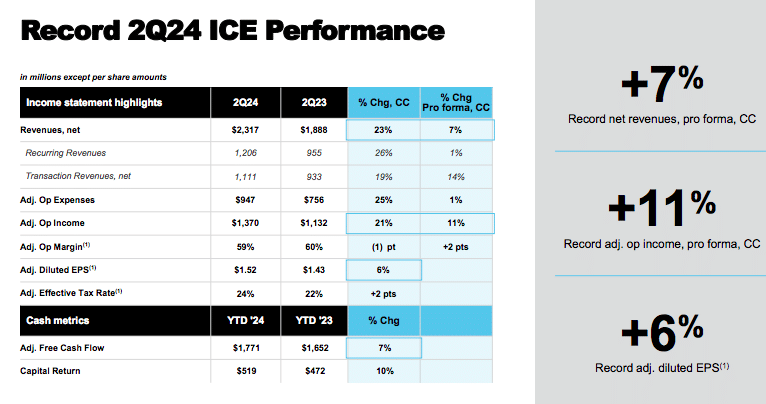

Gardiner said: “Through the first half of 2024, we have generated record revenues and record operating income, while also continuing to make progress towards achieving the leverage and synergy targets related to our 2023 acquisition of Black Knight.”

ICE reported record second quarter net revenues of $2.3bn, a year-on-year increase of 23%. The results included exchange net revenues of $1.2bn, up 14% year-on-year, and fixed income and data services revenues of $565m.

“Mid single-digit growth in our broader exchange data services was underpinned by high single-digit growth in futures data, in part driven by the continued expansion of our global energy and environmental network,” Gardiner added.

In the fixed income and data services segment, transaction revenues were $108m in the second quarter which Gardiner said was driven by strong growth across both corporates and municipal bonds, particularly in the institutional channel.

Jackson said ICE is one of the largest providers of fixed income indices globally with benchmarked passive ETF assets under management growing to a record $616bn through the end of the second quarter, from less than $100bn in 2017 and doubling since 2020.

Investment in consolidated feeds has directly contributed to double-digit revenue growth in the year to date according to Jackson, with content from over 600 data sources.

“While our consolidated feeds and index businesses are smaller components of our comprehensive data platform today, both are well positioned to continue to grow and capture market share,” said Jackson.