Volume at ICE Bonds tripled and contributed to the best third quarter in the history of Intercontinental Exchange, alongside record fixed income and data services performance.

Warren Gardiner, chief financial officer of ICE, said on the third quarter results call on 3 November that total transaction revenues increased by 84%, including 122% growth in ICE Bonds and 75% growth in credit default swap clearing.

Gardiner said: “Similar to last quarter, this strong growth was driven by market volatility and rising interest rates as customers allocated additional capital to CDS trading and our continued efforts to build institutional connectivity to our bond platform.”

Lynn Martin, president of NYSE and chair of fixed income & data services, said on the call that volatility has been a tailwind for fixed income execution with record levels of CDS clearing so far in 2022.

“We continue to be really excited about the pick up of activity on our ICE Bonds platform, where the continued Fed rate hikes have caused tremendous volatility in fixed income markets globally,” she added.

Volume on ICE Bonds was almost 200% higher in the third quarter than in the same quarter of 2021 according to Martin. She continued that it was very important to continue to broaden out participation, especially of institutional customers.

“In the third quarter alone in our municipal bond markets, the levels of institutional participation grew by 192%,” she added.

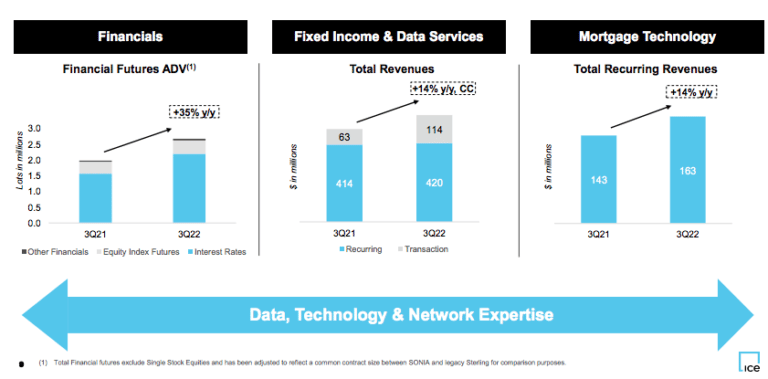

Martin explained that although volatility had been a significant tailwind for fixed income execution, it was a headwind for fixed income data and analytics. The fixed income and data services division had record revenues of $534m, 14% from a year ago.

“This really illustrates how we build all-weather businesses,” she said.

For example, assets under management benchmarked to ICE indices reached an all-time high, but the mix changed significantly which impacted revenue. Assets moved out of higher revenue indices, such as equities, corporate bonds, and munis, into lower revenue indices such as treasuries.

In another example, data services has been affected by a decline in bond issuance. In contrast, Martin said other parts of data services have experienced outsized growth such as consolidated feeds, data analytics which provides transparency to opaque asset classes and the chat platforms as the ways that customers interact with markets continue to modernize.

Exchange net revenues were $1bn, an increase of 8% year over year, boosted by higher levels of collateral at ICE’s clearing houses and higher member interest revenues.

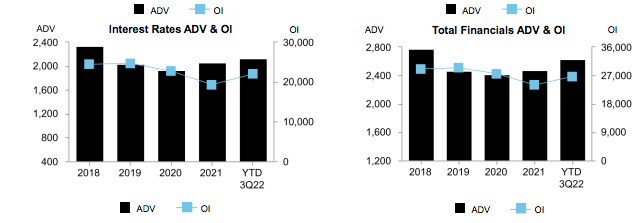

Gardiner said the strong performance of the exchange business was driven by a 54% increase in interest rate futures revenues, a 23% increase in equity derivatives and a 30% increase in cash equities and options revenues.

“Importantly, total open interest which we believe to be the best indicator of longer-term growth ended October up 11% versus the end of last year, including 7% growth in energy and 18% growth across our financial futures and options complex,” he added.

Ben Jackson, president and chair of ICE Mortgage Technology, said on the call that the fixed income and data platform continues to deliver compounding revenue growth.

“Our recurring and transaction revenues are a testament to the strategic diversification of our business model and our ability to deliver growth through an array of macroeconomic environments,“ he added.

He continued that rising inflation and central bank activity across Europe and the UK continue to drive increased hedging activity.

Average daily volume in interest rate contracts increased 40% year over year in the third quarter, including record ADV in Euribor futures and equity derivatives.

“Although our European carbon markets are seeing headwinds, we continue to see growth in active participants in this market with participation of 7% year over year,” added Jackson. “At the same time, the secular trend toward cleaner energy is also driving growth in our North American environmental markets with volumes up 6% year over year.”

Equities market structure

Jeff Sprecher, chair & chief executive of ICE, commented on the call on recent remarks from the Securities and Exchange Commission on the structure of the US equities market.

In a speech on June 8 Gary Gensler, chair of the SEC, said key elements of the national market system rules have not been updated since 2005 and US equity markets have become increasingly opaque.

Gensler highlighted that most US retail order flow is executed through off-exchange bilateral trading relationships with a small number of wholesalers, who can trade against customers without exposing those orders to competition. In some cases wholesalers pay retail brokers for first look at their clients’ order flow, in a practice known as price improvement, and trades can be executed at prices better than the national best bid and offer (NBBO) ticker displayed by the public exchanges in trades that often contain fractions of less than one whole penny per share.

Sprecher argued that what is often left out of this price improvement narrative is the fact that public exchanges, like the NYSE, are prohibited from displaying orders at price increments of less than one full penny under current SEC rules As a result, public investors are prevented from narrowing the NBBO to sub-penny price increments.

“Ask yourself if the NBBO ticker is really the best market price that we should all be relying upon if investors can routinely buy shares cheaper than the price being displayed,” said Sprecher. “We measure the opportunity for investor price improvement savings to the tune of $1.8bn a year if there were a simple harmonization of the quote and trade increments across the entire market.”

He hopes that this opportunity will be considered by the SEC.

“We embrace opportunities to transform businesses to create efficiencies and lower customer costs, not only in home mortgage, but even in a 230-year old business like the New York Stock Exchange,” he added.

Financials

Gardiner said third quarter net revenues were $1.8bn, up 3% year over year, and marked the best third quarter in the company’s history. Operating income was $1.1bn, an increase of 6% from a year ago.

“While transaction revenues were flat on a year by year basis, our recurring revenues, which accounted for over half of our business, increased by 6% with all three of our business segments contributing to this strong year-over-year growth,” Gardiner added.

However, the consolidated net loss attributable to ICE in the third quarter was $191m due to net losses from Bakkt, a crypto platform. ICE reported a $1.4bn loss on writing down goodwill of Bakkt.

ICE had launched Bakkt in 2018 and the crypto platform went public through a merger with a particular purpose acquisition company in October 2021, with ICE still owning a stake.