There has been “unprecedented” growth trading volumes of options that expire on the same day according to Cboe Global Markets as Eurex, the derivatives arm of Deutsche Börse, has also started listing daily options

Cboe said in a paper, The Rise of SPX & 0DTE Options, that US options have seen significant growth in trading over the last few years, with volume in 2023 set to reach a record for the fourth year in a row. Total U.S. listed options volume increased at an annualized rate of 11% between 2000 to 2019, which increased to 24% between 2019 and 2023.

Growth has been boosted by index options, particularly in contracts that expire on the same day they are traded, i.e zero days to expiry or 0DTE. Jonathan Zaionz, senior derivatives analyst at Cboe Global Markets and author of the report, wrote that since late 2021, several types of investors have shifted their preference away from single stock options to broad based index options such as SPX, the S&P 500 index.

Zaionz said: “Growth in SPX options is more than double that of the rest of the options market since 2020, with a substantial portion of that growth coming from 0DTE trading.”

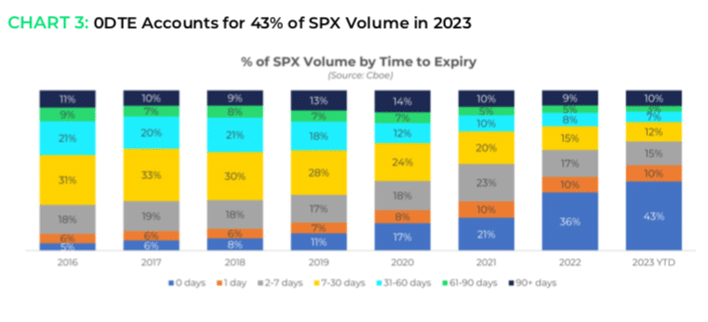

Options volume across the entire SPX term structure has been increasing, but 0DTE has far outpaced the growth seen in all other expiry terms. In the first half of this year 0DTE represented nearly half, 43%, of total SPX options volume according to the report.

“The hypergrowth seen in 0DTE the last couple of years has been unprecedented,” Zaionz added.

The growth trend in shorter dated options is due to the broadening of the user base across large institutions, mid-size hedge funds and small retail traders. In addition, they offer a better return on capital; the ability to reposition more frequently and the ability to hedge event risk more accurately due to more frequent expiries.

For example, investors who want to trade around a Federal Reserve meeting can sell these short-dated options to harvest the premium as the day goes on. The paper highlighted that on Federal Reserve interest rate announcement days, from 9:30am – 1:59pm eastern (right before the interest rate announcement) there has been almost no premium decay in the at-the-money strike, and after 2pm it rapidly declines into the end of the day. Therefore, there are typically muted 0DTE volumes pre-2pm and explosive volumes post-2pm.

Concerns have been raised about the impact of SPX 0DTE options on the underlying equity market.

“Specifically, the fear is if most customer trades are in one direction, dealers on the other side could have large amounts of delta they need to buy/sell to hedge their option positions – and those hedging activities could have disproportionate impact on the SPX Index (particularly if dealers are net short, hedging activity could exacerbate underlying index moves), said the report.

However, CBOE said that although this is a valid concern in theory, in practice customer flows tend to be fairly balanced in terms of buys and sells. For example on 15 June 15, the second highest volume day ever when the SPX index moved 170 basis points intraday, more than 1.33 million 0DTE contracts were traded that day, with the most popular strikes being the 4420 call (75k contracts traded) and the 4400 put (49k contracts traded).

“The growth seen in SPX options trading over the last year has received a lot of attention as the democratization of trading continues in full force across the United States and internationally,” said the report. “Cboe will continue to monitor this growth and provide innovative ways to meet investors needs as the market evolves.”

Eurex launches daily options

As the volumes of short-dated options have grown in the US, Eurex, the derivatives arm of Deutsche Börse, began to list daily options. The first daily options on the Euro STOXX 50 Index began trading on 28 August 2023. The new options were offered with expirations on the next five trading days and are settled “end-of-day”. Settlement is based on the index closing price calculated at 17:30 CET.

The demand for daily expiring options has increased during recent years as they allow institutional investors to target exposures or hedge risk around specific events such as economic data releases or central bank meetings according to Eurex.

Randolf Roth, member of the Eurex executive board, said in a statement: “Particularly against the backdrop of increasingly volatile markets, daily options are another innovative solution for the professional market to efficiently manage exposures in a regulated and transparent market environment.”