Green bond indices have, in general, performed better than traditional indices over the past four years according to NN Investment Partners, the Dutch fund manager.

Bram Bos, lead portfolio manager green bonds at NN IP, said in a statement that investing in green bonds is an easy way to invest in fixed income more sustainably without having to compromise on performance.

“Green bonds are typically issued by innovative, forward-looking issuers, whose activities are adapting to the urgency of climate change. As a result, these companies are less exposed to climate and environmental, social and governance risks and are more transparent in their activities,” added Bos. “The consistent outperformance of green bond indices versus regular bond indices underscores this and also makes a compelling argument for green bonds in a broader context.”

NN IP analysed the performance of euro green bond indices to regular indices since 2016.

Market performance and volatility data reveal increasingly low barriers to replace regular bonds with green corporate bonds in portfolios: https://t.co/rclrX1pHj5 #greenbonds pic.twitter.com/AFr57NQsDQ

— NNInvestmentPartners (@NNIP) February 20, 2020

The research found that last year the Bloomberg Barclays MSCI Euro Green Bond Index returned 7.4%, higher than the 6% for the Bloomberg Barclays MSCI Euro Aggregate Index of regular euro-denominated corporate and sovereign bonds. Euro green bonds outperformed for three of the last four years, by an average of 0.7% per year.

“The annual volatility of the green bond index was higher for three of these years,” said the study. “This means that the higher returns were largely the result of higher risk.”

NNIP continued that the duration of the Bloomberg Barclays MSCI Euro Green Bond Index increased in early 2017 when the Republic of France’s issued its first green government bond for €7bn ($7.6bn) and with a 22-year maturity. The higher duration means green bonds are more sensitive to interest rate changes.

As interest rates fell last year, the Bloomberg Barclays MSCI Euro Green Bond Index outperformed the Bloomberg Barclays Euro Aggregate Index.

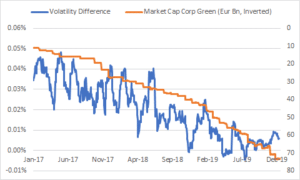

NN IP also found that the volatility of the corporate green bond index has been moving closer to the traditional bond index.

“This shrinking volatility differential means that the barriers to replacing a portfolio of traditional corporate bonds with a portfolio of corporate green bonds have also diminished,” added the study.

Amundi research

The performance of green bonds was also analysed by Amundi Asset Management who found that ESG investing is a source of outperformance for investment grade bonds from European issuers, but the opposite for American issuers.

? [Instit Invest]

"We have crossed the Rubicon: the positive relationship between #ESG and performance in the 2014-19 period shows that ESG is materializing to the point that it has become a factor"

Read ESG's evolution analysis on our #ResearchCenter ⤵https://t.co/EJDnYmTUzK pic.twitter.com/jZtDov9DEw— Amundi (@Amundi_ENG) February 11, 2020

Alban de Faÿ, head of socially responsible investment fixed income processes at Amundi , said in a statement: “Contrary to common ideas, ESG investing may generate performance in euro investment grade bonds. In the case of US dollar investment grade bonds, ESG investing is penalized. But we are beginning to see the light, as the cost of ESG investing has been dramatically reduced these recent years.”

Amundi also found that issuers with higher ESG scores have lower cost of capital than issuers with lower ESG scores for the same credit rating.

“After controlling for the credit quality, we estimate that the theoretical cost of capital difference is equal to 31 basis points between a worst-in-class corporate and a best-in-class corporate in the case of euro investment grade corporate bonds,” added the fund manager.

ESG futures

Qontigo, the data analytics and index company owned by Deutsche Börse, also found that ESG exclusions do not harm performance in the futures market.

In their latest study, #Qontigo's product management experts Anand Venkataraman and Ladi Williams take a look at our #STOXX USA 500 ESG-X #Index and the effect of #ESG exclusions on portfolio performance. Have a read! https://t.co/TAVlOerzVo pic.twitter.com/GHlsouJxq7

— STOXX Ltd. (@stoxx) February 20, 2020

“Overall, the exclusions have enhanced total returns. Between March 16 2012 and January 31 2020, the Stoxx USA 500 ESG-X Index outperformed the benchmark by 3.45% in cumulative returns,” said the study.

The German exchange launched ESG futures a year ago. This month it introduced the Stoxx USA 500 ESG-X Index futures, which are the first listed derivatives covering the US market that implement a screening for thermal-coal mining and coal-fired power plants. The index also excludes companies involved in controversial weapons and tobacco, as well as those deemed in breach of United Nations Global Compact principles.

The analysis showed that the removal of securities involved in controversial weapons resulted in a drag on the index, while the other three exclusions resulted in a positive contribution.

“The biggest boost came from applying the UN Global Compact principles screen, which added over 4% to returns over the entire period,” added the report.