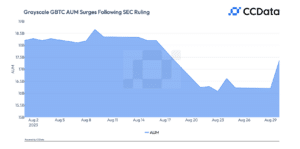

Digital currency asset manager Grayscale Investments has experienced an inflow of $1.17bn since a court ruled in its favor on 29 August against the US Securities and Exchange Commission according to data provider CCData.

“The wider digital asset market also experienced a rebound, with market participants speculating if this outcome could push the United States closer to the introduction of its first spot Bitcoin ETF,” added CCData in a report.

Grayscale’s total assets under management increased by 7.2% to $17.4bn according to the report.

Grayscale Investments said on 29 August that the D.C. Circuit Court of Appeals ruled in favor of its lawsuit challenging the decision by the SEC to deny conversion of Grayscale Bitcoin Trust to an exchange-traded fund, despite the regulator approving bitcoin futures ETFs.

The ruling said that in order to avoid arbitrariness and caprice, administrative adjudication must be consistent and predictable and follow the basic principle that similar cases should be treated similarly and that NYSE Arca presented substantial evidence that Grayscale is similar, across the relevant regulatory factors, to bitcoin futures ETPs.

THIS JUST IN: The D.C. Circuit ruled 3-0 in favor of Grayscale and $GBTC. This is a monumental step forward for all who have been advocating for Bitcoin exposure through the added protections of the ETF wrapper. Read the decision: https://t.co/ulAtcsad2G pic.twitter.com/BNZABvM7tw

— Grayscale (@Grayscale) August 29, 2023

“The Commission failed to adequately explain why it approved the listing of two bitcoin futures ETPs but not Grayscale’s proposed bitcoin ET,” said the ruling. “In the absence of a coherent explanation, this unlike regulatory treatment of like products is unlawful.”

Michael Sonnenshein, chief executive of Grayscale, said in a statement that the asset manager has adhered to U.S. financial rules and regulations in building products since its founding in 2013. He said: “It’s incredibly exciting that we are one step closer to making a U.S. spot Bitcoin ETF a reality.”

Brian Armstrong, co-founder & chief executive at crypto exchange Coinbase, said:

Congrats!

Strange world we live in where winning against this SEC in court is seen as a rite of passage in our industry.

— Brian Armstrong ?️ (@brian_armstrong) August 29, 2023

Blockworks Research said in a report that the ruling means that the SEC has to review the Grayscale application again, but it does not necessarily mean that Grayscale can convert the fund into an ETF just yet. Blockworks added: “However, taken at face value, this is a very promising development for Grayscale, and the numerous spot Bitcoin ETF applications that are pending.”

Ji Kim, general counsel and head of global policy for the Crypto Council for Innovation, said in an email that the door is now open for a range of investors, including those who have historically been apprehensive due to a lack of regulatory clarity.

“This ruling is not just about Grayscale or Bitcoin, it sets a precedent for the broader crypto industry. This is big, positive, and precedent setting news,” added Kim. “As spot bitcoins ETFs are now closer to a potential launch, we’re witnessing real-time investor confidence in the crypto space amidst this court’s ruling.”

Jake Chervinsky, chief policy officer at the Blockchain Association, said:

2/ The DC Circuit soundly rejected the SEC's view that Grayscale's ETF proposal was not "designed to prevent fraudulent and manipulative acts and practices."

The SEC has spent a full decade denying spot bitcoin ETF proposals under this reasoning. That era has now come to an end.

— Jake Chervinsky (@jchervinsky) August 29, 2023

4/ One theory is that the SEC will just pick a different reason to deny Grayscale's proposal and force more long and costly litigation.

That's possible. It's hard to understate the extreme hostility of SEC leadership toward crypto.

Will Chair Gensler really accept this loss?

— Jake Chervinsky (@jchervinsky) August 29, 2023

6/ There will also be political pressure on the SEC to approve spot bitcoin ETFs.

This isn't just about Grayscale. All of TradFi is ready for a bitcoin ETF.

Many other issuers have proposed ETFs this year, including Blackrock, and Larry Fink throws heavy punches in DC.

— Jake Chervinsky (@jchervinsky) August 29, 2023

8/ I have no doubt that we'll get a spot bitcoin ETF sooner or later.

The only question is if the SEC wants to make this more painful for itself. Trust me, if there's another denial, there will be another lawsuit.

I strongly recommend the SEC picks "sooner."

Let's see.

[end]

— Jake Chervinsky (@jchervinsky) August 29, 2023

Townsend Lansing, head of product at CoinShares, the European digital asset manager, said in a blog that the SEC can appeal, rescind its previous rejection and then re-review Grayscale’s application or concede defeat. He believes there will likely be additional political impetus to approve spot bitcoin ETFs, given applications from firms like BlackRock.

“The SEC has faced criticism for its perceived “regulation-by-enforcement” approach to crypto; approval of a spot bitcoin ETF would serve as a counter-narrative, showcasing their willingness to endorse suitable products,” Lansing added. “No matter what happens, the Court’s decision has definitely put the SEC on the back foot and dramatically improved chances for the approval of a spot bitcoin ETF.”

Brett Harrison, founder & chief executive of digital asset infrastructure provider Architect, said:

2/ A common commodities trading activity for speculators, arbitrageurs, and hedgers is to take position in the basis (long spot / short futures, or the reverse).

— Brett Harrison (@BrettHarrison88) August 30, 2023

4/ In the US basis volumes are much lower, due to (1) regulatory and technological hurdles to managing custody of spot, and (2) the lack of a single venue to efficiently trade spot and futures.

— Brett Harrison (@BrettHarrison88) August 30, 2023

6/ In addition, many FCMs that offer institutional clients access to these derivatives exchanges also have FINRA broker-dealers that can provide execution and clearing in securities such as ETFs.

— Brett Harrison (@BrettHarrison88) August 30, 2023

8/ Having a spot commodity, futures on that commodity, ETFs on the spot commodity, and ETFs that hold its futures all available to trade simultaneously will provide rare and valuable opportunities for US institutions if they are technologically and operationally prepared.

— Brett Harrison (@BrettHarrison88) August 30, 2023

K33 Research said:

?Grayscale won against SEC ?

We now expect spot bitcoin ETFs to eventually get approved. You can find the most important upcoming dates in our weekly report ?? https://t.co/mgpGmGeBgm

— K33 Research (@K33Research) August 29, 2023