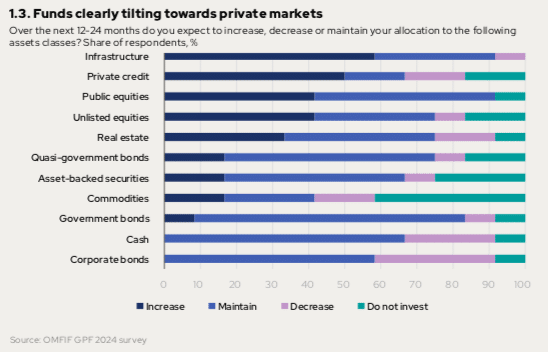

Four of the top five asset classes with the highest demand from global public pension and sovereign funds are in private markets.

The Official Monetary and Financial Institutions Forum, an independent forum for central banking, economic policy and public investment policies spoke to 28 global public pension and sovereign funds with more than $6.5 trillion in assets under management between September and October this year, before the US election.

OMFIF’s Global Public Funds 2024 report said the funds have a more risk-on approach which implies a shift from fixed income into public equities. The survey added: “But there is a more fundamental shift – away from liquid, public markets and instead into illiquid, private markets.”

Infrastructure, private credit, unlisted equities and real estate are four of the top five sectors where funds are increasing allocations over the next 12 to 24 months.

Infrastructure is most in demand for the third successive year, with close to 60% looking to increase their allocation, according to OMFIF. In addition, more than 40% are looking to move towards private credit or private equity over the next 12 to 24 months.

The report highlighted that Calpers, the California Public Employees’ Retirement System agreed in March this year to increase its total private market allocations from 33% of plan assets to 40%.

In another example, in September this year BlackRock, GIP, Microsoft, and MGX, the technology investing company affiliated with the United Arab Emirates’ Mubadala, announced the Global AI Infrastructure Investment Partnership to invest $100bn in new and expanded data centers, as well as energy infrastructure to create new sources of power for these facilities, chiefly in the United States. The partnership will seek to unlock $30bn of private equity capital from investors, asset owners, and corporates, in order to mobilize up to $100bn in total investment potential, including debt financing.

Winston Ma, adjunct professor at the NYU School of Law and former managing director and head of the North America office at China Investment Corporation, said in the report: “Digital infrastructure has become a frontier asset class as a proxy for investing in technology, and digital infrastructure investments also provide an avenue to foster development goals in countries themselves.”

Mark Wiedman, head of BlackRock’s global client business, said in its 2025 Private Markets Outlook that the sector accounts for $13 trillion. The asset manager expects private markets to grow to more than $20 trillion by the end of the decade, driven by rising allocations across pensions, insurance, wealth, and sovereign investors.

Wiedman said: “Credit and infrastructure will lead the way with the fastest growth. And everywhere investors will demand transparent, holistic information about their private exposures in the context of their whole portfolio.”

Retail access to private markets

Christopher Davis, head of US fund research at ISS Market Intelligence, said in a report that managers will try to escape the zero-sum dynamics of traditional active management by carving out new market niches, such as bringing private market access to retail investors.

For example State Street and private equity giant Apollo have applied to the SEC to combine public and private debt in an exchange-traded fund.

“The race to private markets will expose traditional asset managers to new competitive dynamics—not just from conventional rivals but also alternative specialists, which benefit from their expertise and the perception of exclusivity,” Davis added.

He continued there will be more than one way to compete including alternatives managers, using in-house capabilities, or making acquisitions.

For example, BlackRock this month announced the $12bn acquisition of private credit manager HPS Investment Partners.

This follows the purchase of Global Infrastructure Partners (GIP), an independent infrastructure manager with more than $170bn in assets, which completed in October this year. In 2019, BlackRock bought eFront, an end-to-end alternative investment management software and solutions provider to allow investors to seamlessly manage portfolios across public and private asset classes on a single platform by integrating with Aladdin, BlackRock’s technology platform.

In June this year when BlackRock announced its £2.55bn acquisition of Preqin, an independent provider of private markets data, which has yet to close.

Larry Fink, chairman and chief executive of BlackRock, has said the asset manager can lead the indexing of private markets in the same way that indexing has become the language of public markets.