Woody Bradford, chief executive & general manager of Generali Investments Holding, part of Italian insurer Assicurazioni Generali, said the joint venture with Natixis Investment Managers, the asset management arm of French bank BPCE, offers tremendous growth opportunities in private assets though being able to offer products to clients of the insurance group.

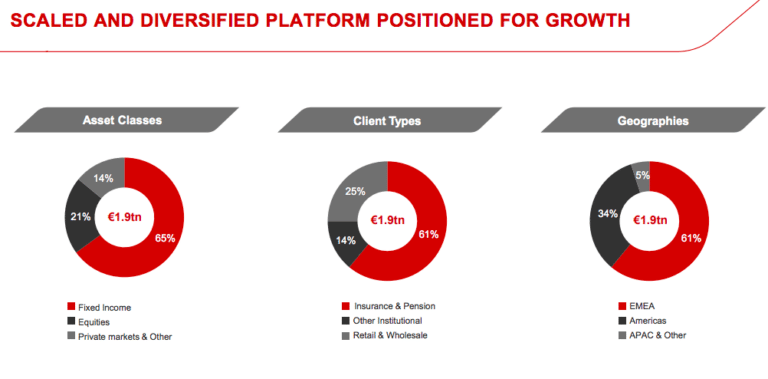

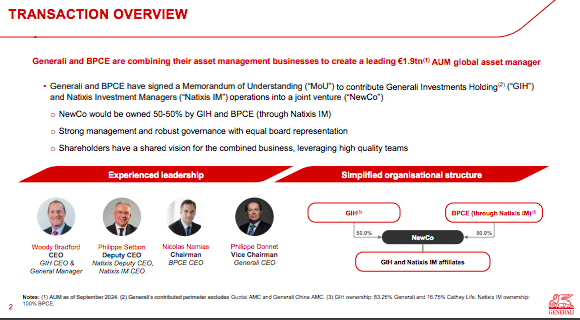

On 21 January 2025 Assicurazioni Generali and BPCE said in a statement that they intend to create a joint venture between Generali Investments Holding and Natixis Investment Managers, their respective asset management operations. They said the combination will create a fund manager with €1.9 trillion in assets under management and critical scale in Europe and North America. The combined business would rank first by revenues and second by assets under management in Europe, and ninth by assets globally.

Bradford said on a conference call on 21 January that the joint venture will be the largest insurance asset manager in the world on a proforma basis, so there is a “compelling” industrial logic to the transaction. He said: “There is real synergy in providing attractive private asset products to our owners and clients.”

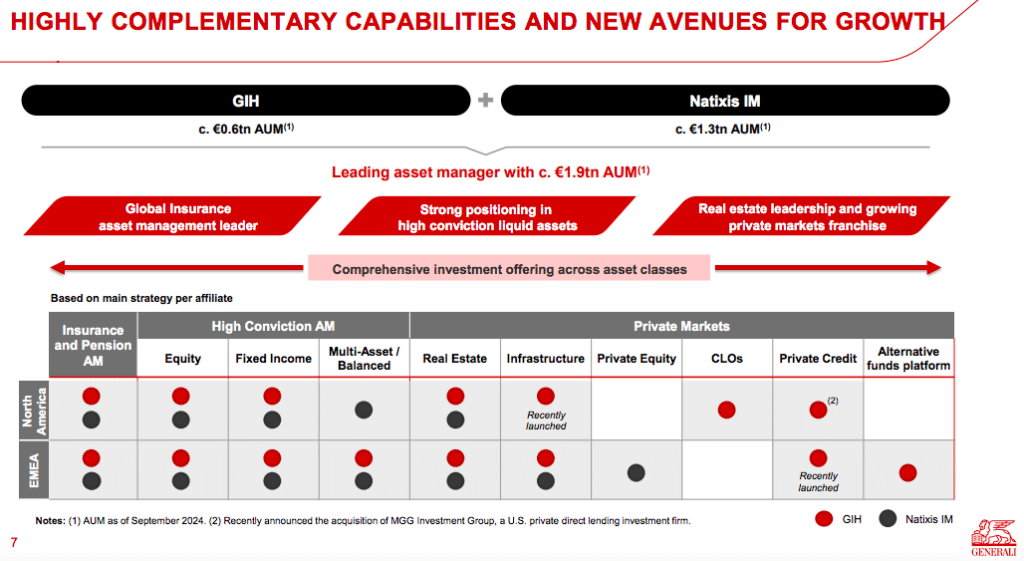

He argued that both asset managers have proven investment capabilities across insurance and pensions with high-conviction active strategies and a number of private market strategies that they expect to grow over time.

“Real and private assets have been a tremendous area of interest and focus for asset owners,” said Bradford. “It has been a tremendous area of growth for many alternative asset managers and partnering with life insurance companies to build these businesses can create tremendous value for clients.”

Private credit has “exploded” away from syndicated private credit loans to a number of other speciality asset classes according to Bradford. He highlighted that New York-based Aperture Investors, is part of Generali Investments’ multi-boutique platform, and offers private credit.

“I see private credit as a tremendous growth area,” added Brasford. “Many clients I talk to are also very interested in shifting private debt allocations over to infrastructure.”

He argued that private markets businesses also have the ability to enhance overall fee margins, as passive strategies have put pressure on fees in equities and fixed income.

Seed capital

Building private asset offerings takes time in order to raise fund vehicles, manage and deploy these funds and then to deploy capital back to investors over a number of years. Therefore, Assicurazioni Generali has committed to providing at least €15bn in seed money over the first five years of the joint venture across the affiliates forming the joint platform, which it said enhances the capability to develop new investment strategies and expand.

“I want to reiterate the critical importance of the size of the $15bn in seed capital, and what that allows us to do as a management team with our affiliates and for our clients,” added Bradford.

The significant large pool of long-term insurance capital is a strong competitive advantage and offers the joint venture attractive opportunities to deploy capital and seed new strategies to unlock new avenues of growth, especially in private markets. The scale of the joint venture will allow the new business to compete in data and technology in a way that smaller firms cannot, according to Bradford.

“I think the joint venture is a very attractive value proposition as a partner to sophisticated asset owners who are more discriminating in their choices,” he added. “They want more capabilities, better service, to be data-enabled and they want all of that for a fair price.”

Increased distribution

The two groups said they share a similar approach to operating multi-affiliate models and the combined platform would offer a range of competitive strategic solutions to all categories of clients, ranging from Banque Populaire and Caisse d’Epargne’s retail customers, wholesale intermediaries to institutional investors worldwide.

The distribution systems of the two asset managers are complementary, according to Braford, as Generali Investments is stronger in southern Europe, while Natixis Investment Managers covers northern Europe “extremely well.”

The joint venture will have a worldwide presence with Europe comprising nearly two thirds, 61% of assets, North America making up one third, 34% of AUM, and a small footprint in Asia. Bradford said the new platform will benefit from a very strong distribution network around the world – with 23 offices operating outside the United States and eight to 10 offices in Asia Pacific. He expects “tremendous” opportunities in Japan, Australia, Korea, Singapore and Taiwan.

“That is hard to replicate and would have been extremely difficult for us to contemplate building in our standalone business plan,” Bradford added.

He added the new business will also have a substantial presence in the US retail marketplace with nearly 400 professionals in the country and a distribution network covering bank, broker dealers, financial planners and retirement plans.

“Natixis IM has an extraordinary distribution network in the US,” he added. “It has successfully supported the growth of some iconic brands in their system such as Loomis Sayles and Harris Associates.”

The majority of the joint venture’s assets, 65%, will remain in fixed income, with 21% in equities, supplemented by private markets and other franchises. Insurers and pension funds would represent more the majority of assets, 61%, with the balance split between other institutional and retail and wholesale clients.

Bradford said the joint venture will remain principally a fixed income business, which is important in order to match the balance sheets of insurance companies.

Governance

Natixis IM and Generali Investments would each own 50% of the combined business with balanced governance and control rights. As a result Nicolas Namias, chief executive of BPCE will be chairman of the board of the joint venture, with Assicurazioni Generali’s group chief executive Philippe Donnet, as vice chairman. Bradford will be chief executive of the new entity and Philippe Setbon, the chief executive of Natixis IM, will be deputy chief executive.

Donnet said on the conference call: “The joint venture marks a key milestone since the launch of Generali’s asset management business seven years ago and is testament to the significant achievements over the most recent strategic cycles.”

He highlighted that creating a broad global fund manager has been a key priority for Generali since the insurer launched its first asset management strategy in 2017 and expanded its affiliate strategy and distribution. Assicurazioni Generali’s ‘Lifetime Partner 24: Driving Growth’ strategic plan focused on driving further diversification and integration, expanding private asset capabilities and distribution to build scale and additional third-party revenues.

As a result Generali completed the acquisition of Conning Holdings and its affiliates in April 2024. Conning focused on insurance and institutional fixed income, and its affiliates Octagon Credit Investors on bank loans, CLOs and specialty credit, Global Evolution on emerging markets debt and Pearlmark on debt and equity real estate.

On 17 January 2025 Conning & Company, Generali Investments’ wholly-owned subsidiary, said in a statement that it will acquire a 77% stake in MGG Investment Group (MGG), a U.S. private direct lending investment firm with over $6bn in assets under management, for $320m. This further expands Generali’s private credit capabilities, especially for affiliated insurance companies who will become investors in MGG offerings.

“We moved from not having an asset management strategy in 2016 to building something that allows us to look to create the largest asset management business in Europe,” added Donnet. ”The partnership will take us to the next level in creating a truly global asset management platform with leading positions and scale in both Europe and North America.”

The firms said the joint venture is expected to create value via synergies as well as growth opportunities and to be accretive to BPCE’s earnings and Generali’s adjusted earnings and cash already from year one. The closing of the potential combination is subject to customary regulatory approvals and expected by early 2026, and the two firms have put together a three-year integration plan.

Nicolas Namias, chief executive of BPCE, said in a statement: “With our Vision 2030 plan launched last June, we expressed our ambition to expand in France, Europe, and beyond. It’s very exciting to kick off a project that aligns perfectly with these goals.”