Martin Small, chief financial officer of BlackRock, said creating a single managed account to provide access to private markets for financial advisors and their clients will be a “huge unlock.”

Retail wealth investors allocated $2.3 trillion to private markets in 2020 and are expected to increase their allocations to $5.1 trillion by 2025 according to a Morgan Stanley/Oliver Wyman Study. BlackRock expects managed model portfolios to roughly double in assets under management over the next five years, growing into a $10 trillion business.

Small spoke about the asset manager’s aims to help wealth managers build long-term portfolios that blend public and private markets on BlackRocks’ results call on 15 January. He highlighted that wealth manager and retail allocations to private markets are currently in the low single-digits according to recent data from Cerulli Associates.

“We are focused on innovating to provide better access to private markets for wealth managers and retail investors across taxable and non-taxable accounts, and retirement accounts,” Small added.

In September 2024 BlackRock established a strategic partnership with private assets manager Partners Group to launch a model portfolio solution which provides access to private equity, private credit and real assets in a single portfolio, which is currently not available to the US wealth market. BlackRock’s alternatives team and whole portfolio capabilities powered by its technology platform, Aladdin, will be combined with Partners Group’s investment platform and portfolio management capabilities.

Steffen Meister, executive chairman of Partners Group, said in a statement: “This separately managed account solution has the potential to revolutionize the wealth management industry, setting a new benchmark for institutional-quality programs that meet wealth investors’ private markets portfolio needs.”

Small continued that creating model portfolios with different risk tolerances that blend public and private assets and that manage the cashflows on a single subscription will be a “huge unlock.” One of the barriers to adoption of private markets with wealth managers is the operational burden of managing multiple subscription documents, cashflows and distributions.

“We think a managed account can do that better and increase access,” Small added.

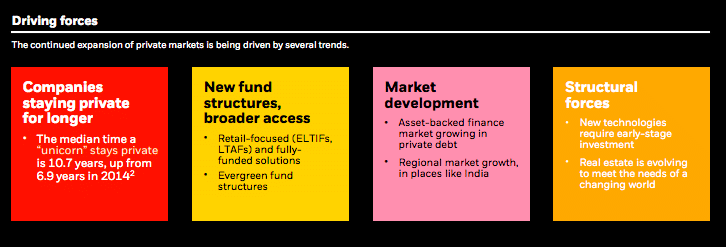

In contrast to the US, BlackRock launched an ‘evergreen’ private markets platform for wealth investors in Europe under the region’s Long-Term Investment Fund (ELTIF) 2.0 structure, with initial funds in private equity and multi-alternatives. BlackRock also wants to launch evergreen funds in infrastructure and private credit. Small said Blackrock is looking at bringing similar evergreen structures to the US.

Partners Group launched the first US private equity evergreen fund in 2009, which is currently the largest in the market at $15.5bn. As of 30 June 2024, evergreen funds accounted for almost one third, 30%, of Partners Group’s global assets.

“I think that the biggest opportunity ahead of us is to integrate semi-liquid products and private markets into our $300bn+ managed models and SMA (separately managed accounts) franchise,” Small added. “That would be the biggest unlock and I think it’s our competitive advantage.”

On 14 January 2025 Hamilton Lane, a private markets manager with more than $947bn in assets, and Republic, an investment platform for private market assets, announced that they intend to launch a digital blockchain-based solution for retail investors in the first half of this year. Hamilton Lane said data shows that the majority of private markets funds have outperformed their public market equivalents in 19 of the last 20 years.

“This partnership is believed to represent a major step forward in expanding access to this historically high-performing investment category and empowering retail investors with new wealth generation opportunities,” added Hamilton Lane.

ETFs

The exchange-traded fund structure is also expected to play a greater role in allowing access to a broader range of alternative investments according to a report from Cerulli Associates in December 2024. In 2019 commodities and real estate ETFs made up two thirds, 65%, of what Cerulli defines as alternative category ETFs. In the second quarter of 2024 that fell to 37%, as derivative income, defined outcome, and cryptocurrency categories increased.

“Rapidly, the alternative investment offerings in the ETF structure have shifted from simple passive holdings to more active strategies that provide advisors with specific outcomes such as greater income and predefined return profiles,” said Cerulli.

For example, State Street and alternatives manager Apollo Global Management filed with the US Securities and Exchange Commission in 2024 to launch an actively managed ETF that invests in public and private credit.

Morningstar, the asset manager research provider, said in a report: “Other ETFs have attempted to offer private credit exposure through public investments, but this one would be the first to hold private credit directly—a strategy that comes with challenges.”

Challenges include private credit being illiquid and valuations, as instruments rarely trade.

“The State Street-Apollo venture is sure to be just the first of many private-market ETF proposals,” said Morningstar. “BlackRock has announced a private-investment model portfolio with private equity firm Partners Group. Invesco and Goldman Sachs have kicked the tires on private investments in ETFs.”

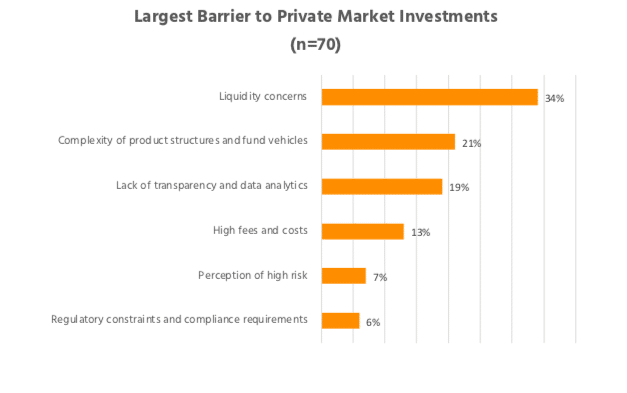

Cerulli’s research found that about half of advisors do not use alternative investments exposures due to a mix of concerns about liquidity, heightened fees, product complexity, and burdensome subscription/redemption processes on the illiquid side combined with a lack of liquid private capital product.

Daniil Shapiro, director of Cerulli, said in a statement: “While not a perfect replacement to illiquid private capital exposures, an ETF could be exactly the thing for a cohort of financial advisors looking to initiate use of true alternative investments exposures with greater operational ease.

Private markets outlook

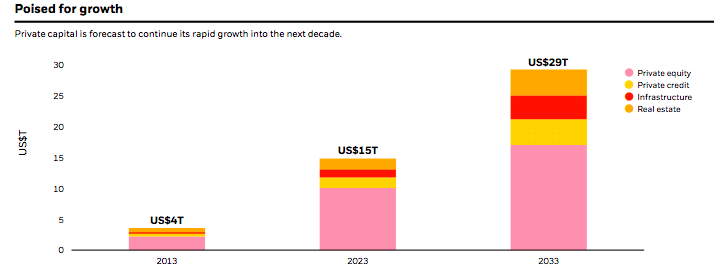

Blackrock’s 2025 Private Markets Outlook said private markets allocations will continue growing across all client segments, especially wealth.

“Allocations to private markets in wealth management remain in their infancy—just 1%-2% for individual investors and nearly zero for defined contribution systems globally,” added BlackRock. “Even modest increases will drive growth.”

Private credit and infrastructure currently make up about 20% of private markets, but by 2030 BlackRock expects this to grow to 30%. Private credit is being driven by firms diversifying their funding beyond banks to longer-dated liability investors such insurance, pensions, and wealth. Infrastructure is driven by the fiscal constraints of states with aging populations, the artificial intelligence and data center revolution and the energy transition.

BlackRock noted that democratization of private markets comes with challenges such as portfolio construction expertise to build diversification while providing a degree of liquidity; and the necessary modelling to predict cashflows, manage liquidity and optimize holdings.

“We are still in the early stages of this new phase in the private markets, with rapid developments in product design, regulatory frameworks, as well as the tools and solutions for clients,” said BlackRock.

Percent, the private credit technology provider, said in its 2025 Private Credit Forecast that asset-based financing, such as merchant cash advances, trade receivables and equipment loans, is poised for significant growth; and that direct lending, including senior debt, mezzanine financing and unitranche loans, will remain a key driver for institutional investors.

Investors will also seek broader segmentation across deal types, company sizes and geographies to optimize risk-adjusted returns in both developed and emerging markets according to the report.

Nelson Chu, founder and chief executive of Percent, said in a statement: “As we enter 2025, banks’ entry into private credit signals the asset class’s resilience and appeal. Yet, the lower middle market remains a largely untapped frontier, where financing gaps left by traditional lenders are most pronounced.”

Myles Milston, co-founder and chief executive of an automated capital markets platform Globacap, said in an email that private markets are growing at double the rate of public markets and advancements in technology are simplifying access.

“It’s not just asset managers driving this growth; we’ve seen significant increases in allocations from private wealth, pension funds, and more,” said Milston. “Private markets have evolved beyond merely being an inflationary hedge – they’re rapidly becoming the crown jewel of modern investment portfolios.”