Adena Friedman, president and chief executive of Nasdaq, says the firm sees a huge opportunity from spinning out Nasdaq Private Market into a joint venture with a group of banks to accelerate investment and development of new capabilities.

On June 20 it was announced that Nasdaq Private Market will be contributed to a standalone, independent company, which will receive strategic investments from SVB Financial Group, Citi, Goldman Sachs, and Morgan Stanley.

Friedman said on Nasdaq’s results call on 21 July that they may examine the idea of bringing in additional banks over time.

It was a pleasure having CNBC and Joe Kernen on the top of the Nasdaq tower today to discuss Nasdaq’s strong performance in the first half of 2021. https://t.co/tnKrj0c45h

— Adena Friedman (@adenatfriedman) July 21, 2021

Friedman added that the partnership is designed to enhance Nasdaq Private Market’s position as the “go-to” marketplace for private company liquidity.

She said: “Private Market will continue to expand from its foundation of facilitating private company tender programmes to enhance and refine its buy-side bookbuilding auctions, investor block trades and pre-direct listing continuous trading programmes.”

She continued that the partnership highlights the success of the private market platform and the growing interest in developing a robust ecosystem for private company liquidity.

Nasdaq contributed the platform to the partnership and will be the largest minority shareholder in the new company, while the banks have contributed investment dollars to build out the platform.

“We are seeing a lot interest from institutional investors and other shareholders to really use the Nasdaq Private Market for price discovery and continuous trading programmes,” said Friedman. “We have relationships in Silicon Valley and the banks have theirs with the venture capital community and early stage private companies.”

The new company will also provide end-to-end settlement and a distribution network with Nasdaq Market Technology supporting the platform.

Nasdaq launched the private market business seven years ago and has built relationships with more than 250 private companies worldwide according to Friedman.

Adena Friedman, Nasdaq

She said: “We have executed more than $30bn in transaction volume for many of the world’s largest private companies and this new entity will expand upon that success going forward.”

In the last 12 months to the end of June revenues for Nasdaq Private Market increased $13m, or approximately 200% over the prior year period said Friedman,

“Going forward with our partners we expect to unlock significantly more value for our clients and shareholders by advancing the market for private company shares, with a high integrity, advanced platform that facilitates liquidity in new ways and build on the momentum that we’ve developed over the past several years,” she added.

Companies are staying private longer and liquidity programmes are important to attract talent. In addition early stage investors may want to capture returns and bringing in later stage investors who can take companies public.

“We see this a huge opportunity in terms of the total market opportunity,” said Friedman. “The total addressable market estimate for the broader market for private company secondary transactions could be between $500m to $1.5bn, so it’s a big opportunity that we’re going after over the next five to 10 years.”

Indexes

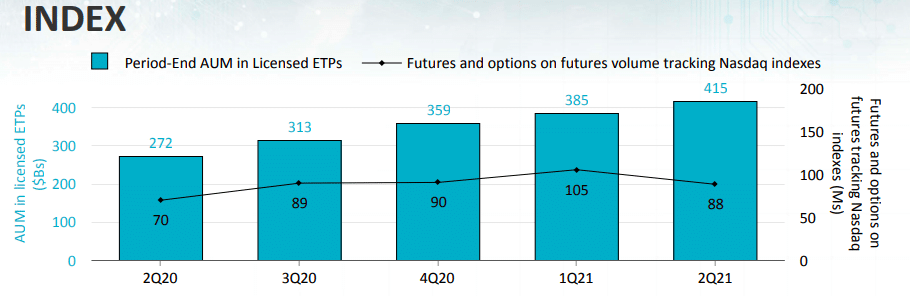

Friedman also highlighted the growth of the index business during the results call. Overall assets under management and exchange-traded products benchmarked to Nasdaq indexes reached $415bn at the end of the quarter, an increase of 53% from the prior year period.

Source: Nasdaq

“We continue to see strong global interest in our index franchise, with 12 of 15 new launches in the second quarter occurring outside of the US,” she said.

In May, for example, XP Inc, a technology-driven platform and provider of low-fee financial products and services in Brazil, announced the launch of the first Nasdaq-100 ETF in Latin America.

In April Hashdex, a Brazilian crypto-focused asset management firm, debuted the country’s first crypto index ETF which tracks the Nasdaq Crypto Index. The index was co-developed by Hashdex and Nasdaq to represent the institutionally investable crypto asset market with inclusion criteria such as market representation, liquidity thresholds, presence on regulated exchanges and institutional custody support.

ESG

An increased area of focus is environmental, social and governance investing.,

“We’ve seen growing interest from a range of clients in both the US and Europe,” said Friedman. “We’re actively engaging with clients to help them successfully navigate the complex and fast maturing ESG landscape.”

.@Nasdaq corporate highlights include:

➡️Launch of the 2020 Nasdaq Sustainability Report

➡️Recognition in @Seramount’s 2021 Best Companies for Multicultural Women list

➡️Acquired a majority stake in @PuroCO2RemovalLearn more: https://t.co/BXxKYk2lYx

(4/4)

— Nasdaq (@Nasdaq) July 21, 2021

In June this year Nasdaq announced its acquisition of a majority stake in Puro.earth, the first marketplace to offer industrial carbon removal instruments that are verifiable and tradable through an open, online platform. Carbon removal is a process in which carbon dioxide is physically captured from the atmosphere and stabilized into a durable storage and is expected to play a critical role in keeping global warming below 1.5C degrees.

The Nasdaq ESG Data Hub was also launched in June this year to provide unique, high-quality datasets that fill an interesting niche for customers. The hub launched with seven providers – Equileap (gender equality); Ecogain (biodiversity), RepRisk (reputational risk), Munich Re (climate risk), Inrate (carbon emissions), Upright Project (Net impact) and Clean Tech (Renewable technology).

Results

Second quarter net revenue were $846m, an increase of 21% over the same period last year.

Nasdaq Q2 earnings are out:

Organic revenue +15% YoY

Op Income +22%

EPS +23%Recurring revenue strength + cyclically high trading volumes = another ? quarter pic.twitter.com/6yAYBKC87d

— Hide Not Slide (@HideNotSlide) July 21, 2021

“Our performance in new listings and trading as well as our focus growing areas like anti-financial crime and buy-side workflow solutions sustained year over year revenue growth across all of our businesses,” said Friedman. “Each of our businesses has expanded both the diversity and depth of their client-base in recent years and that is what underpins the strength and resiliency of the Nasdaq platform as we move through each quarter.”

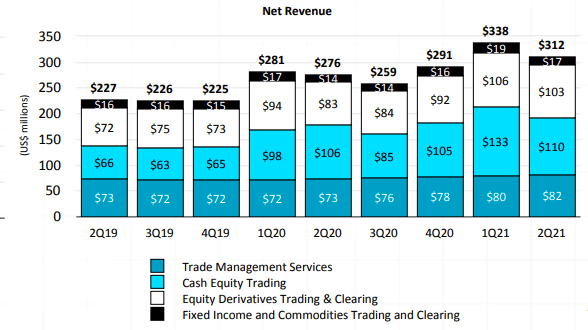

In Market Services, net revenues were $312m in the second quarter of 2021, a 13% increase of $36m.

Equity derivative trading and clearing net revenues increased $20m, or 24%, in the second quarter primarily due to higher U.S. industry trading volumes.

Cash equity trading net revenues increased $4m, or 4%, in the second quarter. Nasdaq said the increase primarily reflects higher U.S. net capture rates, higher European value traded and the impact of changes in FX rates, partially offset by lower U.S. industry trading volumes and U.S. market share.

Source: Nasdaq

Ann Dennison, chief financial officer of Nasdaq, said on the call: “Our strong net revenue, operating profit and EPS results in the second quarter of 2021 demonstrate both the strength of our diverse offerings and scalability of our increasingly SaaS-oriented business model. We completed the sale of our U.S. Fixed Income business during the second quarter and we expect to initiate an accelerated stock repurchase, or ASR, imminently as part of our effort to offset the related share issuance.”