CME Group’s first quarter average daily volume (ADV) reached a high of 29.8 million contracts, which led to the group reporting record revenue, operating income and earnings per share for the first three months of this year.

Terry Duffy, CME Group chairman and chief executive, said on the first quarter results call on 23 April 2035 that heightened economic uncertainty and clients’ ever-growing need for risk management drove a 13% year-on-year increase in the group’s first quarter ADV. He said: “This reinforces our past comments about the importance of deep liquidity, especially in times of market stress.”

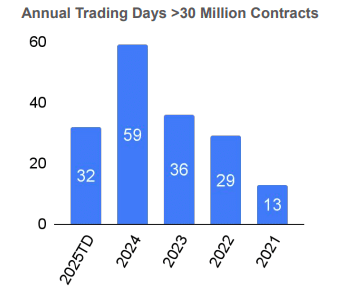

Nearly half, 43%, of trading days in the year to date (just under four months) have had a volume of more than 30 million contracts, compared with 23% of equivalent trading days in 2024. CME Group said four of its top five trading days have occurred in 2025, overtaking the volume seen during the Covid pandemic and the regional bank crisis in the US.

Duffy continued that volumes are still “very strong” at the start of the second quarter, as market participants are looking to hedge exposures to tariff policies and geopolitical dynamics.

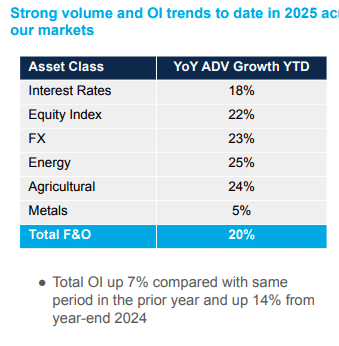

“Our open interest is 7% higher than at the same point last year, with strong open interest growth across our interest rate, energy and agricultural complexes,” Duffy added. “This strong open interest indicates that, despite the high level of volatility, participants are not leaving the market, but rather continuing to use our products to manage their risk exposures.”

He explained that it is very difficult for clients to take risk off or deleverage their hedges when operating in the most uncertain times ever seen in CME’s history. Duffy added: “No one’s ever traded through these tariffs in the market to any extent. I don’t think you have the luxury of not participating in this volatile time, because if you do not participate you could be out of business the next day.”

Suzanne Sprague, chief operating officer and global head of clearing and post-trade services at CME Group, said on the call that CME proactively increased margin requirements in April in response to the heightened levels of volatility. She said CME set a new single day record for moving cash associated with mark to market on 9 April 2025, collecting and paying out $32bn in margin, exceeding CME’s previous record of $22bn.

“Given the increased volatility and liquidity, risk management is of utmost importance to our business, and we are monitoring risk on a real-time basis every day,” she added. “In periods of increased volatility, people are looking for central counterparties to manage their risk in a safe manner, and relying upon the collateralization that happens in our ecosystem.”

Sunil Cutinho, chief information officer at CME Group, said on the call that systems functioned as designed despite the high volatility and record activity, including seven straight days over 40 million contracts.

“During the week of 7 April, we saw record order entry volumes and exceeded 13 billion messages over the course of the week,” he added. “The system’s ability to handle record volumes underscores our resilience.”

CME reported that revenue increased 10% from a year ago to $1.6bn, and revenue for five of six futures and options asset classes grew double-digits. There were quarterly ADV records across four out of six asset classes – interest rates, equity index, agricultural, and foreign exchange. The group also had its highest quarterly clearing and transaction fees, market data revenue and retail volumes, especially in micro contracts across asset classes.

“Record revenue was aided by the effectiveness of our volume tiers which help our customers cost effectively manage their risk exposure in high volume times,” added CME.

Financial contracts

Financials ADV in the first quarter increased 12% year-on-year to 24.2 million contracts. All-time high Treasury ADV was 9.2 million contracts, up 18% year-on-year, and CME said there was significant growth across all parts of the curve. Treasury options had a record ADV of 1.7 million in the first quarter, up 28% year-on-year. CME also had the strongest Treasury futures quarterly roll in history, reaching a daily record volume day of nearly 51 million interest rate contracts on 25 February 2025.

During the first quarter, CME Group and The Depository Trust & Clearing Corporation (DTCC) confirmed plans to expand their existing cross-margining arrangement to end users by December 2025, which provides capital efficiencies for clients trading U.S. Treasury securities and CME Group interest rate futures. Duffy said CME’s broad-based products across the six major derivatives asset classes provide clients with daily margin savings of approximately $60bn.

Sprague said CME continues to onboard participants in the cross-margin program. She said: “We are up to 15 house accounts, and we also continue working together to be able to expand that to end-user customers. Our plan is to be operationally ready to support that by the end of this year, subject to regulatory approval.”

There has been an increase in clearing membership to take advantage of the current house program, according to Sprague.

In order to create stronger links between cash and futures markets, CME aims to launch a second BrokerTec central limit order book (CLOB) for cash U.S. Treasuries. This will be co-located in Chicago next to the group’s U.S. Treasury futures and options markets to support trading between cash and derivatives markets. Launch is scheduled for the third quarter of 2025 and client testing will be available shortly, probably at the end of April.

Mike Dennis, global head of fixed income at CME, said on the call that the second CLOB in Chicago will be in the Aurora data center, where clients already have a lot of connectivity.

Dennis said: “As the futurization trend has grown over the past several years, clients have come to us looking for solutions to help better manage trading between cash and futures.”

CME has received “overwhelmingly” positive feedback from the dealer community, as well as from clients that are very active, and relative value strategies trading both Treasury futures and cash treasuries, according to Dennis. He believes the new CLOB will help drive new client acquisition, as well as allowing CME to be more creative in thinking about new trading strategies in its interest rate complex. The New York CLOB will continue to be the main venue for risk transfer and price discovery, but Dennis said different traders need different execution tools and different execution types.

“Offering both access models will allow us to capture a broader set of clients,” Dennis added.

Last week, CME launched FX Spot+ which enables spot FX participants to tap into CME Group FX futures liquidity and gives FX futures users broader access to OTC liquidity.

International

The first quarter was also a record for CME’s international business. ADV outside the U.S. reached a new high of 8.8 million contracts, up 19% year over year.

There was a record ADV for Europe, Middle East and Africa (EMEA) of 6.5 million contracts, up 20% from a year ago, and a record ADV for Asia Pacific (APAC) of 2 million contracts, up 20%.

Derek Sammann, global head of commodities markets at CME Group. highlighted on the call that it was a record quarter for non-US options growth.

He said: “This has been another strategic initiative that we’ve talked – increasing that penetration in options.”

OSTTRA

On 14 April 2025, CME and S&P Global announced a definitive agreement to sell OSTTRA, the post-trade infrastructure, to KKR, the alternatives manager, for a total enterprise value of $3.1bn, subject to customary purchase price adjustments.

Closing is expected in the second half of 2025. Proceeds will be divided evenly between CME Group and S&P Global for the 50/50 joint venture.