Northern Trust has seen an increase in fixed income in outsourced trading as portfolio managers shift their asset allocations, as well as larger asset managers using the service.

Stephanie Farrell, head of integrated trading solutions, Americas, at Northern Trust told Markets Media that the market understands the benefits of outsourcing equities trading, but fixed income has moulded the story in 2024. She added: “The amount of fixed income volume has easily doubled in recent years.”

Increased interest rates have led to more money being allocated to fixed income. Fund managers who wanted to deploy cash into fixed income may not have run strategies in the asset class for many years, and so had no in-house resources. In addition, managers have wanted to increase existing allocations to fixed income, deploy new strategies or enter new markets, which can be expensive to do in-house.

“Managers looked for a provider that can offer a multi-asset capability across equities, fixed income and options,” added Farrell. “There were really dynamic conversations around changing asset class allocations.”

She continued that fixed income is an area of focus for Northern Trust and the firm will continue to invest in technology and talent across the globe. On 12 September 2024 Northern Trust said in a statement that it has launched its integrated trading solutions fixed income outsourced trading capability in Asia-Pacific through Northern Trust Securities in Australia.

Rob Arnott, head of brokerage, Asia Pacific at Northern Trust, said in a statement: “Our advanced trading technology, local market knowledge and experienced traders help reduce inefficiencies in the inherently complex and time-intensive fixed income market, allowing our clients to benefit from more seamless fixed income trading.”

With this addition, Northern Trust can offer 24/6 fixed income trading coverage with desks in Chicago, London and Sydney. The firm said integrated trading solutions clients have access to a global, multi-source liquidity network of more than 160 fixed income counterparties, ranging from bulge bracket to local specialists.

Northern Trust can also offer fixed income services from idea generation through to trade execution according to Farrell. The firm has been focussed on developing what it calls a fixed income “tool belt” across its trading providers, and expanded its data and analytics.

“We have added new venues and tools across fixed income asset classes,” Farrell said. “That has put us in a place where we are able to offer a more expansive tool to our clients than a single manager could achieve.”

She also argued that a differentiator for Northern Trust is that its outsourced trading service is directly linked to its settlement service, and can add foreign exchange, which further increases efficiency for clients.

“Firms are looking across their service provider network and looking for partners that can take on more pieces of that puzzle,” Farrell added.

Equities

In addition to the growth in fixed income, Northern Trust has also seen an increase in equities outsourced trading, which is still the asset class leader.

The firm benefited from an increase in outsourcing after the US, and other markets, shortened their settlement cycle for securities. On Monday 27 May 2024 Canada, Mexico and Argentina cut their settlement cycles from two days after a trade, T+2, to T+1. On the following day, 28 May, the US market made that transition. The shorter settlement times were particularly difficult to meet for overseas investors in Europe and Asia transacting in US securities, who also needed to complete foreign exchange trades in time to meet the shorter deadlines.

“We had strong growth out of Europe and Asia as forms looked for efficiency and optimization from trading through the settlement process,” Farrell said.

T+1 highlights the fast-moving regulatory landscape, which can sometimes involve holistic shifts with firms having to redesign their workflows to meet a new mandate. Farrell added: “The focus on scale, efficiency, resiliency and regulation were themes five years ago, but have only got sharper.”

Tipping point

As a result of these pressures, Farrell said the number of conversations that Northern Trust is having from a pipeline perspective have quadrupled, and are with managers of all shapes and sizes.

“It has been an explosive year for conversations,” she added. “The first wave of resistance has certainly gone away, and outsourcing is more broadly accepted.”

Farrell noted that asset managers of size and scale are looking to increase outsourcing. They are asking for more customized strategies or access to different markets in order to be nimble when meeting the needs of their underlying clients.

“The scale curve of established managers is rising and we are in conversations with managers who have well over $50bn in assets,” she said. “That line of demarcation has been completely washed away over the past year.”

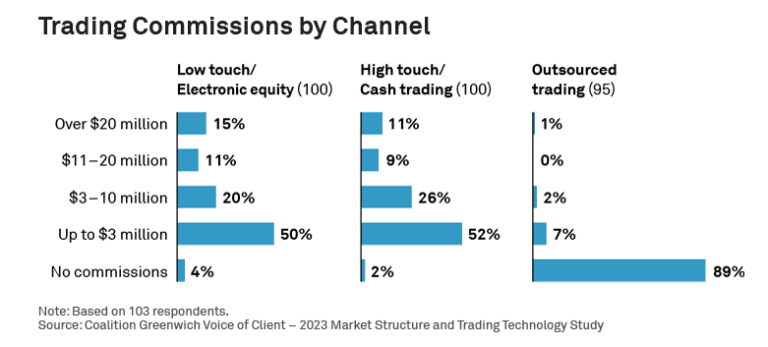

A Coalition Greenwich survey of asset managers published in August 2024 found that 10% have paid trading commissions to outsourced trading platforms over the past year.

Jesse Forster, who leads equity market structure research for the consultancy’s market structure and technology team, said in the report: “This finding may raise eyebrows, as the buy side has traditionally been hesitant to admit to using such providers due to concerns about cannibalization and compatibility with best execution requirements.”

The survey found that 7% of respondents paid commissions to outsourced trading providers ranging up to $3m, while 3% paid more.

Forster added: “This got us wondering: Has outsourced trading reached a tipping point where it’s no longer a niche service but, instead, a mainstream solution in the spirit of workflow automation? “

He noted that outsourced trading was initially aimed at emerging hedge funds, but Coalition Greenwich has spoken to several large and well-established managers who have also used the service to access liquidity, research and market intelligence that they might not have internally or through their traditional sell-side providers.

Coalition Greenwich also highlighted that as the demand for outsourced trading has grown, so has the number of providers, with more than 40 firms claiming to offer services.

“Many newer entrants may struggle to gain traction – building relationships with the sell side takes time and effort,” said Forster. “Several successful platforms pointed out that it’s not just about having the budget for technology; it’s about having the scale to hire top talent.”