Figure Technology Solutions, a blockchain–based technology platform for financial services, accounts for almost 80% of tokenized private credit, and firms like Goldman Sachs, Jefferies and Deutsche Bank are using the company’s DART electronic lien registry as part of their broader adoption of Figure Connect, its loan marketplace.

Tokenized assets have exceeded $18bn in value according to Blockworks Research, with Figure accounting for almost 80% of tokenized private credit.

2/ Tokenized assets have surpassed $18B in value, with private credit and US Treasuries representing 90% of this figure. pic.twitter.com/JjlbfEeHV1

— Blockworks Research (@blockworksres) March 19, 2025

4/ Private credit refers to non-bank lending where the debt is not issued or traded on public markets.

Private credit tokenization via platforms like Figure and Tradable improves liquidity and enhances transparency.@Figure accounts for almost 80% of tokenized private credit. pic.twitter.com/Uf7yoNDU8E

— Blockworks Research (@blockworksres) March 19, 2025

Todd Stevens, chief capital officer of Figure, told Markets Media: “We want to bring efficiency to the financial markets by leveraging technology and the biggest impact is in private markets.”

Figure Connect was launched in June 2024 and uses the Provenance blockchain to automate loan origination and make it easier for lenders to scale their businesses. In addition, Figure Connect provides marketplace infrastructure for price discovery so users can put out pools of loans for bidding.

The firm’s software has been used to originate more than $13bn of home equity across a broad network of more than 140 loan originators and it is also used by capital markets buyers and homeowners. With Figure, homeowners can receive approval for a home equity line of credit (HELOC) in just five minutes and receive funding in as few as five days.

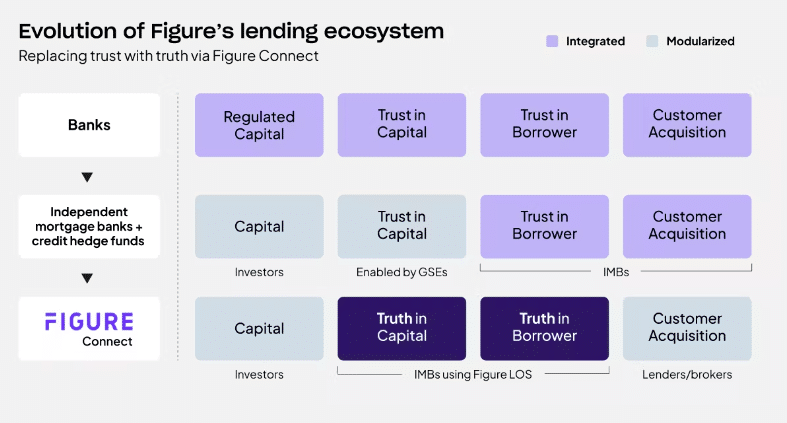

Stevens said: “We do not have underwriters in our process and that is a feature, not a bug. We remove humans and use blockchain technology to replace trust with truth, i.e. we can cryptographically prove that processes have happened.”

Figure Connect also provides lifecycle management services to the mortgage marketplace, which includes its DART electronic lien registry. DART uses the Provenance Blockchain to actively “listen” for loan transactions and automatically update loan ownership and registration information in real time, which reduces the time taken to assign mortgages from weeks to minutes, saving hundreds of dollars for the average loan.

In March this year Figure said Goldman Sachs, Jefferies, Deutsche Bank, Texas Capital, and more than half of the top 20 independent mortgage banks are using its DART electronic lien registry as part of their broader adoption of Figure Connect.

Michael Wade, co-head of securitized markets group, capital markets at Jefferies, said in a statement: “Figure’s use of blockchain technology to streamline loan transactions and increase market liquidity represents a significant step forward for the industry, and we’re thrilled to be part of it.”

Stevens described the “core win” on Dart as banks embracing the technology, not because they want to be blockchain cheerleaders, but because it provides solid risk management.

For example, in traditional capital markets an investor can buy a loan and then pledge it to a warehouse or into a securitization. When the mortgage changes hands, it needs to be assigned and Stevens said DART provides next generation Web3 technology. Loans can move easily between wallets using blockchain, data can be automatically uploaded, and there is an onchain audit trial and transparency which removes the risk of a mortgage being double pledged.

“Banks see real value as they have better risk management and originators like it because assigning mortgages costs money,” he added. “Blockchain is removing friction in a process.”

Partnership with Sixth Street

Figure also originates loans through a subsidiary, Figure Lending, which is the largest non-bank provider of HELOCs, according to the firm, although banks still provide between 85% and 90% of HELOC loans.

Last year Figure issued seven mortgage-backed securities deals and will issue more than 10 this year, working with traditional banks according to Stevens.

“We are a big player in the mortgage-backed market, and we leverage all the participants in that market,” he added.

In February Figure said in a statement it had formed a joint venture with Sixth Street in which the asset manager committed to invest $200m of equity. The joint venture is expected to securitize Figure loans, forward-sell its bonds to investors and buy loans from originators, opening up a liquid marketplace.

Michael Dryden, partner and head of asset based finance at Sixth Street, said in a statement: “We’re thrilled to bring our deep experience in residential mortgage investing to form this joint venture with Figure and its Figure Connect marketplace platform, which we believe is a stand-out leader that can support the evolution of home equity as well as the broader private credit market.”

Michael Tannenbaum, chief executive of Figure, said in a blog that the joint venture is “much more than a forward flow agreement” as the equity can be recycled to stabilize the Figure loan ecosystem and securitization program, which will increase liquidity in the private credit market.

Tannenbaum wrote: “Having just launched Figure Connect in spring 2024, the Sixth Street joint venture is our most significant milestone to date.”

The joint venture will be a consistent forward loan buyer and then sell these loans to securities investors.

“This will be a transformation similar to the advent of “TBA” (to be announced) securities in the agency mortgage space,“ he added. “ With more standardization and more liquidity, Figure Connect is the future of mortgage capital markets.”

Stevens argued that Figure is the “first inning” of changing the rails of the financial system. For example, blockchain technology can enable real-time servicing of mortgages.

“The initial application is in the mortgage market which is right for disruption, because there are so many analog processes,” he added. “The technology can be used for any private credit asset.”

He continued that one of Figure’s ultimate aims is to use digital assets to disrupt prime brokerage, where the main constraint is counterparty exposure.