The number of women working in alternative assets improved marginally in the last 12 months but they still occupy less than a fifth of senior roles in every asset class.

Female employment in the alternatives industry rose to 21.3% in 2022, up from 20.9% in the previous year, according to Preqin’s latest annual Women in Alternatives report. Data provider Preqin said recent efforts toward gender balance have had little effect in the alternatives industry with progress being incremental at best.

Our latest ????? ?? ???????????? ?????? highlights which asset classes and regions are showing the most improvement in terms of representation and which organizations are using data and policy changes to improve diversity: https://t.co/5zp2hILwz7 pic.twitter.com/m91f4xGEo2

— Preqin (@Preqin) March 15, 2023

“While the percentage is higher among institutional investors, at 24.4%, that proportion exhibited no increase from last year,” added the report. “Given the current trend, and assuming no change, gender equality in the alternatives industry will take until 2065.”

In addition women make up one third, 32.5%, of the alternatives workforce at junior level but only 13.6% at senior level.

By geography, North America had the best female representation at 22.3% in 2022 and maintains this lead in every asset class. Europe and Asia had female representation of 20.9% and 20%, respectively. Africa, Latin America, and the other regions collectively have fallen further behind, with 18.8% according to the report. North America also leads with 14.4% of senior positions occupied by women, compared to the global average of 13.6%.

In the seven asset classes tracked by Preqin, the proportion of women in the workforce ranges from 26.5% in hedge funds to 22.3% in private equity. There has been improvement amongst hedge funds which had one of the lowest proportions of women employees, 19.3%, in 2019. Hedge funds also led other alternative asset classes in having the highest proportion of women in senior roles, at 19.5%.

2023 witnessed the launch of the largest woman-led hedge fund, SurgoCap Partners, in New York with $1.8bn in assets under management. However, the proportion of female employees in portfolio management is the lowest among hedge funds.

“The lack of gender diversity in investment roles is an issue across all asset classes in the alternative investments industry, not just hedge funds,” added Preqin. “The three divisions with the highest representation of female employees are typically investor relations, accounting, and operations.”

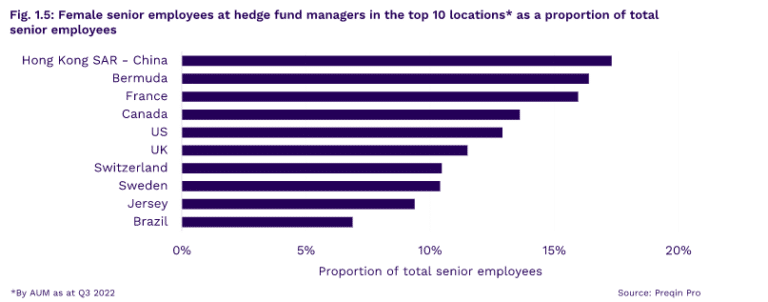

At GP level, Hong Kong has the highest proportion of women in senior roles, at 17.3%. Asia also has the highest percentage of women in the role of chief operating officer, at 30.3%.

“While this may indicate that women in Asia hedge funds are gradually breaking the glass ceiling in the C-suite, it also highlights the persistent gender division of labour, where women are predominantly found in operations and accounting roles,” added Preqin. “Globally, women are still more likely to be appointed as CFOs and COOs in the hedge fund industry.”

Webinar

Claudia Bertolino, head of private equity & private credit at The Citco group of companies, spoke on a webinar on the report hosted by Preqin on 15 March. Bertolino said the attention to gender diversity had completely changed since she entered the alternative investment industry over 25 years ago.

“Even my attire was addressed differently in those orientation classes and I was strongly encouraged, almost mandated, to wear skirts and dress suits as pant suits were not appropriate,” she added. “My authenticity, and dare I say femininity, is far more acceptable and even celebrated today.”

Heidi Melsheimer, managing director, global private equity and M&A Services at Marsh agreed that the industry has change since her early days and that a lot of progress has been made. For example, March’s team has recently increased parental leave for both men and women as a way to normalize women leaving the workforce temporarily following birth or adoption, as well as elder care.

Imogen Richards, partner at Pantheon, said on the webinar that there is much more focus on the diversity and inclusion aspects of ESG when firms are making investments – and this will really drive change.

“It makes a really big difference if people who are writing the checks say that diversity is an important factor for them, and it feels like there has been a sea change in recent years,” she added. “It’s much more of a focus for us as investors and it really is making a difference to where we are committing capital.”

Richards continued that it is encouraging to see a lot of the top global alternative asset managers with early internship programmes targeting diverse candidates.

Huda Al-Lawati, founder and chef executive at Aliph Capital, spoke on the webinar about launching her own firm and said the biggest challenge is making your own decisions and living with the consequences. She knew that starting her own firm would require a sacrifice of many hours, which could be leisure or family time, for a few years.

“You have to tell yourself that if you build the right teams, empower the right people, create the right culture, then it will be very rewarding and people will share that responsibility with me,” she said.

Richards added that the lack of work life balance in their early careers is a significant barrier for women to reach leadership positions, especially if they have a family. However, if they can get through that barrier, women gain more control and flexibility, and they can reach leadership positions.

She also highlighted that the workforce will become more gender neutral if men support women in their childbearing responsibilities. For example, if men leave work early to go to their child’s sports day, then it becomes normalized for women to do the same.