Female founders in the US venture capital ecosystem received $38.8bn in funding in 2024, a 27% rise from the previous year, but still took home a smaller share of both deal count and value according to a report from data provider PitchBook.

Last year outpaced 2023 for the third-highest annual level of capital raised by female founders according to PitchBook’s report, All In: Female Founders in the VC Ecosystem.

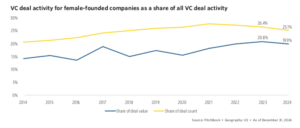

Their share of deal value, which PitchBook said is typically more volatile and driven by market effects, declined by less than 1% to just below 20%. PitchBook continued that given the number of variables involved in a company closing a deal, female founders’ share of total funding activity is unlikely to follow a perfectly linear progression each year, but the longer-term trend lines indicate progress toward parity.

The report said: “Sociopolitical tides are shifting with renewed action against diversity, equity & inclusion (DEI) and ESG initiatives, which may impact the trajectory of founder demographics in the US.”

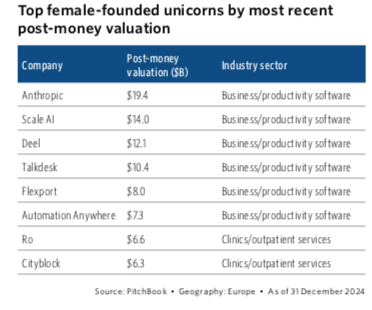

Female founders made uneven gains in 2024 with later- stage companies and select software and healthcare subsectors gaining substantial funding momentum.

“The number of newly minted unicorns rose materially as 13 female-founded companies crossed the coveted $1bn valuation threshold,” added the report. “Female founders also secured a record 24.3% of total US VC exit count in a positive signal particularly for investors who work with these founders.”

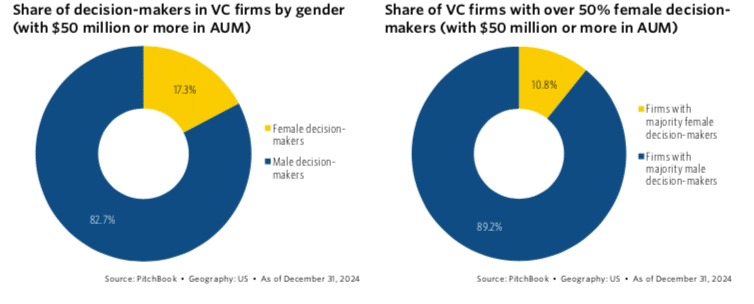

Increasing the representation of women in check-writing roles can create more opportunities for female founders but the report highlighted that the majority of decision- makers in venture capital firms—including partners, principals, and managing directors—are still male.

“Progression through the VC career ladder takes time, with several years between promotions in most cases, so we expect these figures to grow more slowly than deal activity,” said PitchBook.

Kristen Craft, vice president at Fidelity Private Shares, highlighted in the report that the venture capital landscape for female founders in the US has shown persistent disparities despite incremental progress. She said that over the past decade, women-founded startups have secured only around 2% of all VC funding despite research finding that female-led companies often outpace their male-led counterparts in revenue generated per dollar raised .

“This continues a pattern of female entrepreneurs facing disproportionate challenges in accessing early-stage capital, even as the overall venture market has grown to record levels,” added Craft.

She argued that three big needs arise time and again – women need increased access to capital, they need to be able to tap into the talent pool and connections and top hires and advisors who can help them see around corners. Lastly, female founders need access to information as first-time founders can risk wasting time when navigating new processes they’ve never encountered.