01.17.2024

PitchBook published its 2023 Annual European Private Equity Breakdown, which provides an overview of dealmaking, exits, and fundraising during the year.

Key takeaways include:

- Dealmaking resilience: Deal value in 2023 was down 26.5% YoY, but deal count increased 4.4% YoY. In fact, deal value was still 10% to 20% higher than pre-2021 levels, which shows the overall resilience of PE as an asset class through its continued growth regardless of the macroeconomic headwinds.

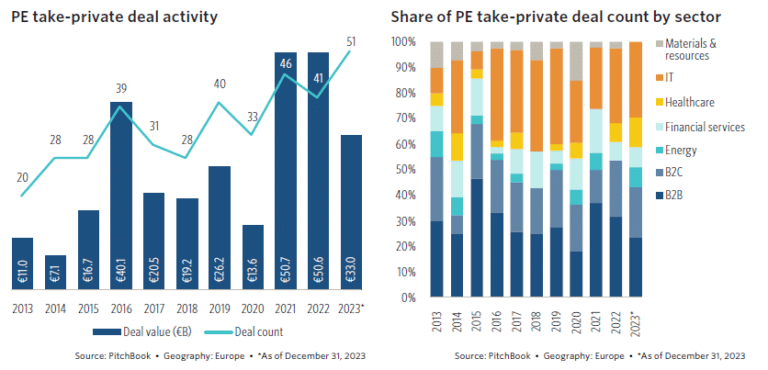

- Opportunistic take-privates: 2023 was a record year in terms of the number of take-privates in Europe, totalling 51, up from 41 in 2022. IT was the sector with the most take-privates, counting 15, up from 12 in 2022. The largest take-private in Europe came in Q2 when Swedish PE giant, EQT, took Dechra Pharmaceuticals private for €5.1 billion in the fourth largest deal of the year.

- Consolidation in financial services: Financial services is the only sector in Europe that grew in 2023 in terms of deal value, with a 22.7% YoY growth. Within asset management, we saw a number of buyouts in 2023 with Degroof Petercam, CRUX Asset Management, Gresham House, and IO Asset Management all getting acquired. We expect this trend to continue into 2024 as asset managers and banks strive to increase their assets under management through M&A whilst having to decrease fees every year. Similarly, PE houses are deploying dry powder in financial services in order to diversify and expand into new categories and geographies.

- Regional breakdown: All regions in Europe saw deal value decrease YoY, but we note the Nordics and France & Benelux showed somewhat higher resilience than the rest of the regions with declines just in the teens. The UK continues to be the heart of dealmaking in Europe by a substantial margin.

- Mega-exits: 2023 saw a price dislocation in the market, creating a drought in exits as conditions moved from a seller’s market to a buyer’s market while valuations continued to correct. When exits did materialise, they were often mega-exits, which highly skewed the data picture. 2023 saw €263.6 billion in exit value, roughly flat YoY. However, excluding mega-exits, exit value was 24.5% lower YoY.

- Fundraising: 2023 was nearly a record year for PE fundraising in Europe in terms of capital raised. This is perhaps the most resilient and surprising data point of the year as macroeconomic headwinds made it mostly tougher for sponsors to raise capital this year. We saw almost €120 billion in new capital raised across 117 funds, which is the lowest number of new funds in over a decade.

Source: PitchBook