Stéphane Boujnah, chief executive and chairman of Euronext, said 2020 will be a transformative year for the pan-European exchange group after it successfully diversified its revenues last year through acquisitions.

Boujnah said on a results call this morning that last year Euronext entered into new strategic cycle and aims to build the leading pan-European market infrastructure with innovation and sustainable finance at its heart.

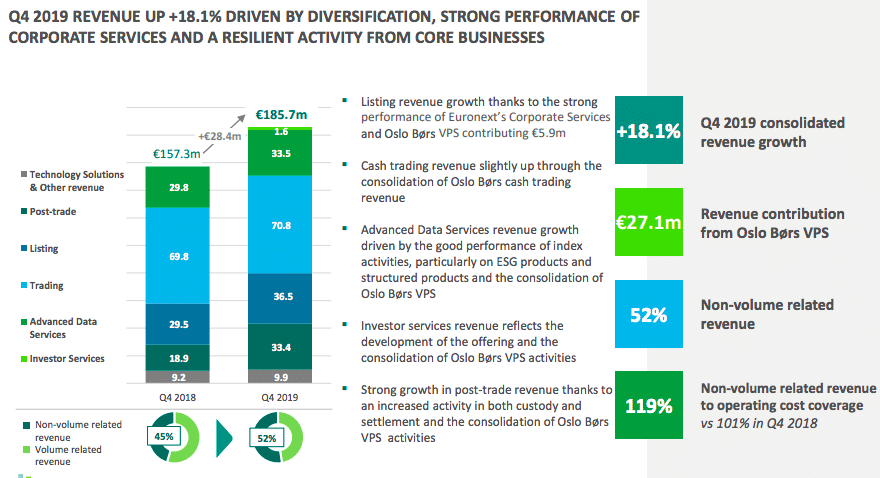

Full year 2019 results: Euronext delivered a strong performance in 2019, which results from successful diversification and solid core businesses dynamics, with a cash trading market share at 68.7%.

Read the full press release: https://t.co/aMZgxhUB2A pic.twitter.com/5VxbsqC31E— Euronext (@euronext) February 12, 2020

He added: “We will be pursuing a growth strategy through high value-added acquisitions aimed at diversifying and strengthening the business profile.”

In November last year Euronext confirmed that it was in talks with the board of Spanish exchange operator, Bolsas y Mercados Españoles about a potential offer. The confirmation followed the announcement of an all-cash offer for BME by SIX Group, the Swiss financial markets infrastructure operator.

Boujnah said: “We are monitoring all the developments around BME. We are analysing the relevant parameters around the asset before a decision will be made on whether or not to make an offer.”

In 2019 Euronext bought Oslo Børs VPS, which expanded the federal model into the Nordics and grew the post-trade franchise, in its largest acquisition since the pan-European group went public. The purchase of Nord Pool last year also grew the footprint in the Nordics and took Euronext into a new asset class of energy trading.

The exchange also invested in Tokeny, a tokenisation platform to digitise traditional financial assets, and OPCVM360, a French fund data provider last year.

“We continued our diversification strategy with non-volume related revenue representing 50% of total revenue,” added Boujnah. “2020 will be a year of transformation.”

This year Oslo Børs markets are due to migrate to Optiq, Euronext’s proprietary trading platform. Euronext Dublin markets moved to Optiq in February last year and the Euronext derivatives markets migrated in November last year.

Last year, we migrated ISEQ trading onto @euronext's #Optiq trading system.

Since then we have increased market share, and #Dublin has once again become the home of liquidity for two of #Ireland's largest companies: #CRH & #Smurfit Kappa. https://t.co/es8FV1NNLi $CRH $SKG

— Euronext Dublin (@euronext_ie) February 13, 2020

MiFID II

The European Securities and Markets Authority is reviewing MiFID II, the regulations that went live at the start of 2018. Boujnah was asked how Euronext would be affected by possible changes in the double volume caps. MiFID II introduced caps on trading in dark pools with the aim of shifting volumes onto lit markets.

The chief executive said Euronext has a close dialogue and constructive discussions with all regulators.

Boujnah added: “The collective objective of MiFID II was to deliver more transparent capital markets and move volumes from dark to lit markets but this was not achieved. Tools conceived and designed as buffers have become alternative price setters and involved in quasi-price formation. The market architecture will be brought back to the framework mandated under MiFID II.”

Foreign exchange

The group acquired foreign exchange trading platform FastMatch in 2017 and last year it was renamed Euronext FX. An analyst on the results call said some banks were decreasing their use of multi-dealer foreign exchange platforms and asked how this would impact the business.

Boujnah said some banks are redirecting their electronic FX flows but this presents an opportunity for growth as there is demand for high performance electronic platforms.

“We are confident in our FX initiatives which included the launch of a matching engine in Singapore last year,” he added. “The FX world is changing but we are a cutting-edge technology operator and that is a key differentiator.”