Stéphane Boujnah, chief executive and chairman of Euronext, said large clients are co-locating ahead of the migration of its core data centre from the UK to Italy and the exchange and infrastructure group has bold ambitions for its index business.

On 29 April 2021 Euronext announced the closure of the acquisition of Borsa Italiana from the London Stock Exchange Group for a final consideration of €4.4bn, and added new capabilities in fixed income trading, clearing and the consolidation of a central securities depository.

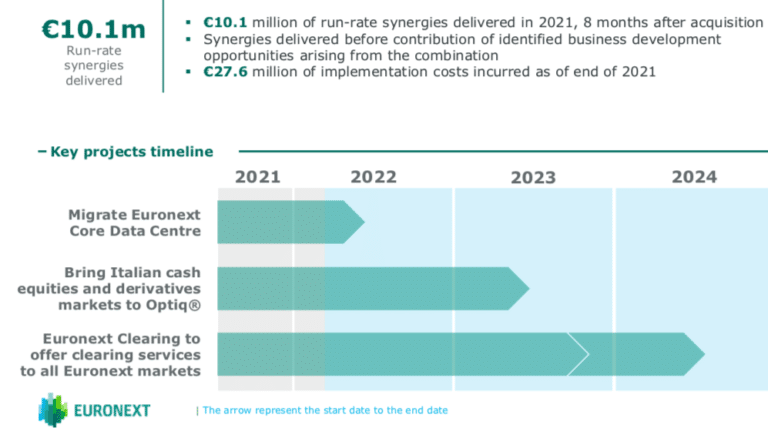

Boujnah told Markets Media: “The integration of Borsa Italiana is proceeding very well and we have three major group ongoing projects. The first is the migration of the core data centre to Bergamo in Italy, which is the physical centre of the exchange where trading and the matching of orders happens.”

The second project is the migration of the Italian cash and derivatives markets from the London Stock Exchange Group technology to Euronext’s proprietary Optiq trading platform during the first semester of 2023. The third migration is the transition of clearing operations from LCH SA in France to Euronext Clearing at the end of 2023 or the beginning of 2024.

He continued that Euronext was founded to be the backbone of the Capital Markets Union, to connect local economies in Europe with global markets and to finance the real economy. The group’s vision is to deploy a single liquidity pool, enabled by a single book and powered by a single technology platform, Optiq.

“This is a scalable model implemented within our framework of federal governance and our European college of supervisors,” Boujnah added. “We welcomed the Irish stock exchange in 2018, Oslo Bors in 2019, Nord Pool and VP Securities in 2020. We are now integrating Borsa Italiana which has changed the size of the group.”

The migration of the data centre was driven by Brexit, by Euronext wanting to be close to a market where it has large operations, and also by environmental, social and governance (ESG) drivers as the new data centre is mainly powered by hydroelectric plants and photovoltaic panels.

“Large clients are co-locating and in the process of migrating their servers ahead of the migration date, 6 June 2022,” said Boujnah. “This will take place just 14 months after closing the acquisition of Borsa Italiana, and this will be an important step for cost and revenue synergies.”

He added that after the migrations, operations for the full value chain will be in Euronext’s hands which is a fundamental facilitator for developing new products.

Euronext has been the only market infrastructure that did not directly manage its clearing activities for its listed derivatives markets. Since 2003 Euronext has used LCH SA, the Paris-based clearing house owned by LSEG, to clear most of its cash and derivatives trading flows and had a revenue sharing agreement.

As part of its new three-year strategic plan, Growth for Impact 2024, Euronext announced in November 2021 that it will grow Borsa Italiana’s CC&G into Euronext Clearing, which will be positioned as a European clearing house.

LCH SA’s agreement with Euronext to clear financial and commodity derivatives ran until 2027 but Euronext had limited early termination rights, one of which is exercisable with an earliest effective date of January 2024.

ESG

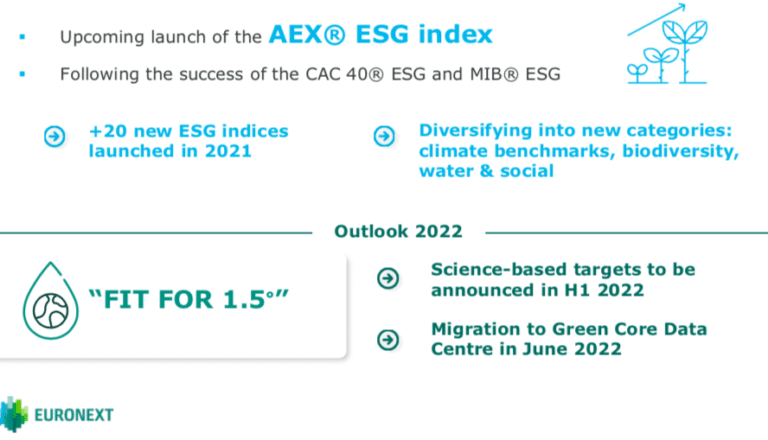

Boujnah said the group’s ESG strategy is notably related to financing the real economy as it has almost 1,500 listings of small and medium-sized enterprises. He added: “We are soon going to release a programme called Fit for 1.5 degree with targets for a massive reduction of carbon footprint by 2030.”

The Fit for 1.5 degree ESG strategy will include detailed science-based targets for carbon footprint reduction.

In addition, Boujnah sees opportunities for the index business to help accelerate the transition to a sustainable economy. “We have very wide and bold ambitions for our index business, because asset managers want more ESG indices,” he said.

The AEX ESG Index is due to launch on Euronext Amsterdam in the second quarter of this year. The new index will identify the 25 companies that demonstrate the best ESG practices from the 50 constituents of the AEX and AMX indices and combine measurement of economic performance with ESG impacts in line with the UN Global Compact principles.

As part of the strategy to offer ESG versions national flagship indices, Euronext also launched the CAC 40 ESG in France in March 2021 and the MIB ESG in Italy in October 2021.

“We have very successful activities in ESG bonds,” added Boujnah. “Euronext Dublin is the leading platform and will position their offering for international issuers.”

Euronext also has its own self-imposed targets of reducing emissions, such as encouraging employees to take the train instead of systematically taking the plane and powering the new data centre with renewable energy.

Digital assets

The group also believes in staying very close to the digital asset market, but does not have any ambition to enter the direct retail segment or to launch a crypto trading platform.

“We spend a lot of time and resources finding a way to make sure that digital assets are leveraged in the best way to become relevant,” added Boujnah.

He continued that regulation of digital assets is improving but that, in general, when it comes to accountability and systemic risks, European regulators prefer a centralized system they know rather than a distributed system they do not know.

Financial results

Euronext reported record quarterly revenue of €370.1m in the last three months of 2021 with Borsa Italiana contributing €127m. Non-volume related revenue accounted for the majority, 55%, of total revenue and income, slightly up compared to last year, while at the same time the trading business has been growing.

[Q4 and full year 2021 results] Euronext delivered a record performance during Q4 of 2021, marking a dynamic year for the group with more than 40% of growth in revenue, EBITDA and almost 20% increase of adjusted EPS in 2021.

Read the press release: https://t.co/zOqm7DIXg3 pic.twitter.com/fXARd6CANF

— Euronext (@euronext) February 10, 2022

For the full-year 2021, Euronext reported 46.9% revenue growth to approximately €1.3bn. The exchange delivered €10.1m of run-rate synergies at the end of 2021, eight months after the completion of the Borsa Italiana acquisition, and is committed to deliver €100m of run-rate synergies by 2024.

Boujnah said in the results call: “This is the combination of strong organic growth and combination of the Borsa Italiana Group. 2021 has been a strong year and 2022 is a year of transformational projects for Euronext.”