Stéphane Boujnah, chief executive and chairman of Euronext, said the pan-European market infrastructure is at the “end of the beginning” of its transformation due to its change of scale and having full control of the entire capital markets value chain for the first time since it went public.

Euronext management presented the new three-year strategic plan, Growth for Impact 2024, at an Investor Day on 9 November. The group achieved its 2022 financial targets two years in advance in 2020.

Over the past three years Euronext has acquired the Irish Stock Exchange, Nord Pool to enter the European power market, VP Securities, the Danish central securities depository and Borsa Italiana Group, which added fixed income trading, a central securities depository and a multi-asset clearing house.

Stephane Boujnah sets our ambitions:

“We want to build the leading market infrastructure in Europe, to shape capital markets for future generations. Our mission will be to connect European economies to global capital markets, to accelerate innovation and sustainable growth.” pic.twitter.com/cjt6qtKXPd

— Euronext (@euronext) November 9, 2021

Clearing

Boujnah said the 2024 strategic plan’s priorities include the European expansion of CC&G clearing activities with Italian CC&G becoming Euronext Clearing.

He explained that Euronext is the only market infrastructure that does not directly manage clearing for its derivatives market. Since 2003 Euronext has relied on LCH SA, part of the London Stock Exchange Group, for clearing most of its cash and derivatives trading through a revenue sharing agreement.

Boujanh said: “Today, for the first time, thanks to the acquisition of CC&G in April 2021, Euronext is the owner of a multi-asset clearing house and is thus in a position to directly manage its clearing activities to complete its value chain. Euronext is determined to directly manage the clearing of its cash and derivatives flows.”

He added that Euronext will operate an open access model and significantly enhance technology investment in the clearing house and transform an Italian CCP into a European multi-asset CCP with new teams in France and Italy, in particular for commodities futures.

“A single default fund will be set up for all cash equity and listed derivatives markets,” he added. “This will provide significant benefits to our clients compared to the current fragmented clearing landscape.”

Simon Gallagher, head of cash and derivatives at Euronext, said at the Investor Day that having a co-ordinated approach between a clearing house and trading venue is critical and will allow the business to expand through a single pool of open interest.

“You can imagine the margin inefficiencies between the underlying on cash business where we have 25% of trading in Europe and the growing derivatives asset class,” Gallagher added. “We firmly believe that in 2014 this will be a real space to watch.”

Crypto

Gallagher said the crypto market is becoming institutionalised and the asset class is here to stay. In addition, there will be increased regulation and crypto assets will have their own regulatory framework in Europe by 2024, the equivalent of MiFID II in the cash and derivatives business.

Euronext’s approach for the the next strategic cycle really is threefold.

“First, we will continue working with the issuers of exchange-traded products and funds to provide access to crypto assets,” Gallagher added.

For example, France’s Melanion Capital launched a bitcoin-linked ETF in Paris in October which tracks the Melanion Bitcoin Exposure Index. Gallagher said the ETF important because it is fully cleared and provides exposure to companies who are involved crypto assets.

Head of Cash and Derivatives at @euronext, Simon Gallagher:

"We want to provide our clients with exposure to #crypto-assets with the same level of regulatory security and operational efficiency as on our core markets, through a diversified product set." pic.twitter.com/YorEOsZRLX— Euronext (@euronext) November 9, 2021

“We’ll be developing a suite of crypto indices and launching derivatives around crypto assets,” said Gallagher. “We will provide a stable regulated home for our customers to trade these assets in a regulated manner.”

ESG

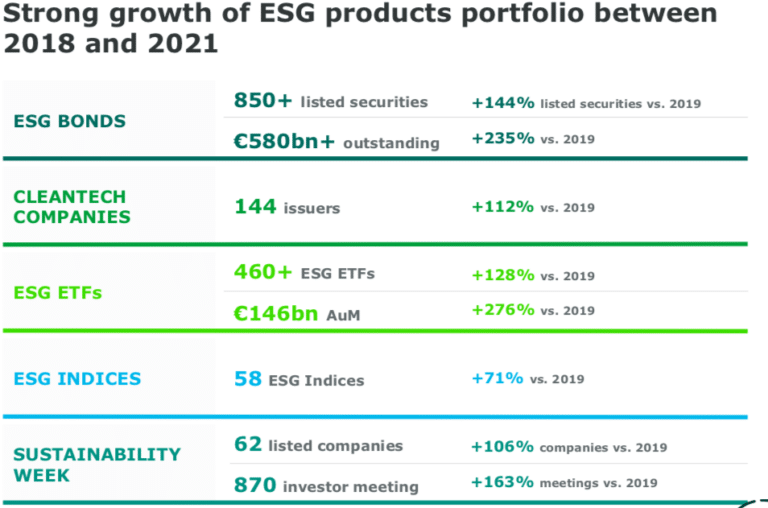

Euronext aims to become the leading global environmental, social and governance financing venue.

Boujnah said: “ESG is the most massive change in capital markets in centuries.”

The group will create a climate transition market segment dedicated to issuers committed to science-based targets, expand ESG bonds and flag taxonomy-eligible issuers to increase their visibility to investors. Euronext wants to become the number one European ESG index provider and create climate and ESG versions of Euronext’s national benchmark indices.

Brexit

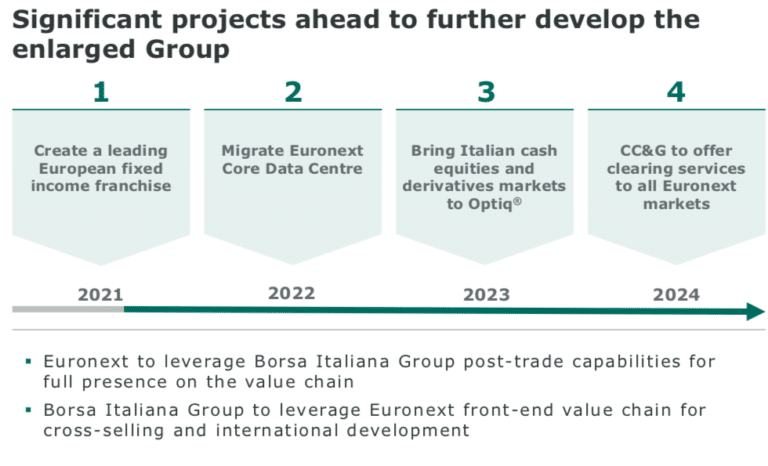

In April 2021 Euronext announced that it will migrate its core data centre from the UK to Bergamo, in Italy.

Boujnah said: “The migration is a response to multiple factors, including the dynamic created by Brexit and a strong rationale to locate the group’s core data centre in a European Union country where Euronext operates a large business.”

Similar to clearing, the migration will allow Euronext to fully control and directly manage its core IT infrastructure, which was previously outsourced. The initial migration is slated for June 2022 and due to finish for the move of Borsa Italiana equity and derivatives markets onto the Optiq, Euronext’s proprietary trading platform, by mid-2023.

Boujnah said: “London used to be the largest financial centre in the European Union. Now London is the largest financial centre of the United Kingdom.”

He continued that the UK is in the process of designing regulation to position the finance sector in London.

“But one thing is clear. When you want to address the needs of the blue-chip companies in the European continent, the needs of 450 million citizens and their savings, financing of sustainable development, you have to operate in the EU and be regulated in the EU,” he added. “It is a fundamental change that creates opportunities for Euronext.”

For example, overseas companies who want to list in Europe will not have to decide between London and Euronext

“Amsterdam has become a leading city for international listings like Universal Music Group,” he added. “Oslo is a very attractive location now that it is connected to to the single liquidity pool of Euronext so I believe that there are opportunities that are a combination of what Brexit is creating and increased divergence.”

Fixed income

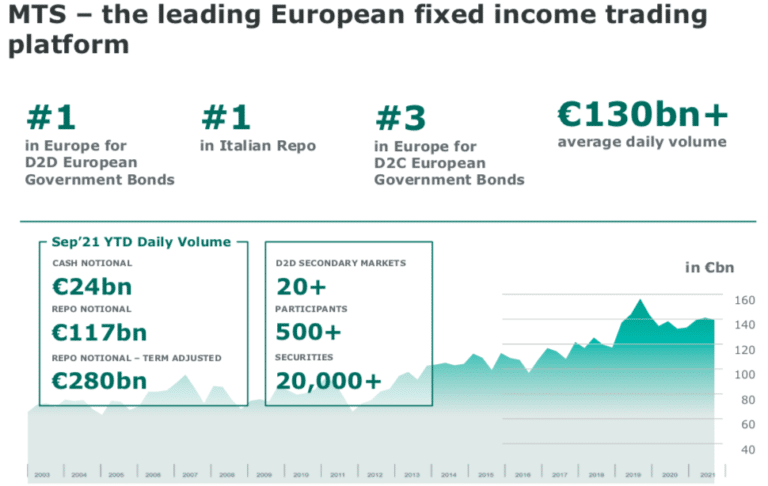

Euronext now owns MTS which it said is number one in Europe for dealer-to-dealer European government bonds trading, number one in Italian repo trading and number three in Europe for dealer-to-client European government bond trading.

“As part of its mission to finance the real economy, Euronext has proposed to the European Commission the use of the MTS platform for the secondary market, and transparent negotiation, of bonds issued within the Next Generation EU recovery programme,” said Boujnah.

Euronext will expand MTS geographically and offer new products, including data and analytics.

Combining CSDs

Euronext will combine its four CSDs brands into Euronext Securities, a new umbrella brand for its CSD business.