Euronext, the European capital market infrastructure, has set out its new strategic plan which aims to accelerate growth in non-trading related businesses through decreasing post-trade fragmentation in the region and reducing friction for investors.

Stéphane Boujnah, chief executive and chairman of the managing board, gave an overview of the new three-year strategic plan, ‘Innovate for Growth 2027′, on Euronext’s investor day on 8 November. In addition to reducing post-trade fragmentation, other pillars of the new strategy include expanding the fixed income, currency and commodities (FICC) trading, launching fixed income derivatives, expanding clearing and growing trading.

Boujnah described how the group has changed since completing its previous plan, ‘Growth for Impact 2024.’ He said the group has become increasingly diversified both in terms of trading revenue and non-volume related revenues, such as the central securities depository (CSD) business. In trading, Boujnah said cash equities is still a large part of the business, but fixed income has become significant through the MTS business. In addition foreign exchange, commodities and power trading have all grown.

“In addition to these diversified trading businesses, we are starting to milk the complete integration of our clearing business within the group,” he added.

In September this year Euronext completed the migration of Euronext clearing business from London Stock Exchange group’s LCH SA in Paris to Euronext Clearing, and can now clear all the relevant asset classes traded across all its markets. This marked the completion of Euronext’s ‘Growth for Impact 2024’ strategic plan and the integration of the Borsa Italiana Group, three years after it was acquired by Euronext.

“We embarked on this plan in Milan in November 2021 and we did it,” he added. “We now have an integrated value chain with a single access point trading platform for all equity markets in all respective countries, and that has created the largest liquidity pool in Europe.”

Boujnah argued that Euronext is now present in the entire value chain, so the group is best positioned to address one of the most critical issues in Europe – the fragmentation of post-trade – by creating the third largest clearing house in Europe.

In addition to clearing, the CSD landscape in Europe is still complex. Euronext has created the third largest CSD in Europe according to Boujnah, with the domestic CSDs of four Euronext countries – Italy, Portugal, Denmark and Norway – connected to more than 20 international markets.

“We have transformed Euronext into a powerful, integrated capital market infrastructure which allows us to interact with a much more diversified group of partners,” said Boujnah.

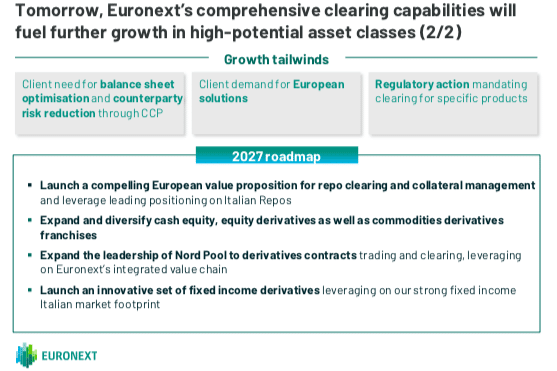

The transformation comes as the regulatory landscape is changing with more pressure for transparent and secure clearing and trading solutions, and as clients want integrated solutions that optimise their balance sheet. For example, the integrated clearinghouse can help expand Euronext’s power derivatives offering by combining a Nordic electricity trading platform with Rome-based clearing capabilities.

“Transforming a local Italian-only clearinghouse into a pan-European multi-asset clearinghouse is a game changer,” added Boujnah. “That has created integrated capabilities and a great catalyst for growth.”

In addition, Euronext aims to address the fragmentation in the exchange-traded fund market in Europe by offering a single ETF order book, to enhance liquidity, reduce costs and simplify post-trade processes.

Post-trade harmonization

Pierre Davoust, head of CSDs said at the investor day that many see the business as a boring obscure part of the group, but it is a key source of growth for Euronext as there is a push for deeper, larger capital markets in Europe. In particular, there are concerns that post-trade fragmentation is holding back investment, trading and capital raising opportunities in the region.

“We will position Euronext as the CSD of choice in Europe to meet demand for European solutions,” he added. “Plumbing can be turned into growth and that is a very exciting journey.”

Euronext intends to roll out its new integrated CSD platform by 2027.

Davoust compared the US to the European post-trade landscape. In the US there is one CSD supporting $50 trillion worth of equities. In contrast, in Europe there are 30 CSDs supporting €15 trillion worth of equities. He continued that Euronext already provides customers with access to more than 20 markets through its four CSDs, but they are each mostly used by domestic customers.

“What will change is that we will beef up this offering to allow customers across the whole of Europe to issue, trade, keep and settle shares in a true European CSD,” he said.

He argued that expanding the group’s European footprint, Euronext will integrate the European capital market from the bottom and trading opportunities unlock operational efficiencies for clients unlocking across the region. In addition, Euronext will accelerate the scale of its value-added services such as data services as a CSD is the golden source for data, such as settlements and corporate actions, and expand tax services.

Anthony Attia, global head of derivatives & post-trade, said at the investor day that Euronext Clearing offers a new value proposition by doubling the number of clearing members, and creating a new distribution network. In addition, Euronext implemented a value at risk model that brought 20% margin reductions to clients who migrated to the new clearing platform.

“We have developed our in-house technology and that has allowed us to be more agile and to improve the time to market and to launch future products,” Attia added.

There are also synergies between the clearing and CSD businesses by providing one settlement hub for all the transactions on Euronext markets, which creates economies of scale and significantly reduces costs for clients.

“This creates a fully integrated value chain from listing to trading to clearing to settlement into data,’ Attia said. “This creates the ability for Euronext to expand and I don’t think we have had these kinds of opportunities in the past 20 years.”

For example, he said Euronext can expand geographically, into new products, add new clients, and enter new asset classes. Cash equities have migrated to Euronext clearing and Attia said the business is gaining market share. He continued that the market expects clearing to expand to non-Euronext trading venues in order to provide a single solution to cash equity clearing in Europe.

“This demand for European solutions is one of the key drivers that are in all the initiatives that we are launching,” Attia added. The other diversification is into fixed income futures.”

Attia acknowledged that launching fixed income futures has been attempted many times in the past without success. He argued Euronext will develop new products and solutions that are not copycats, but respond precisely to market demands.

There are also opportunities in repo clearing as half of the repo trades in the EU are uncleared, and the buy side wants to move away from uncleared, non-transparent margins. Euronext is very strong in Italian repo clearing according to Attia, and wants to expand into other geographies. Clearing will expand into sponsored access, giving the buy side direct access to the CCP and to collateral optimization functions.

“This is an investment that will take place in the next month and will ramp up that business in the next three years,” he added.

Fixed income

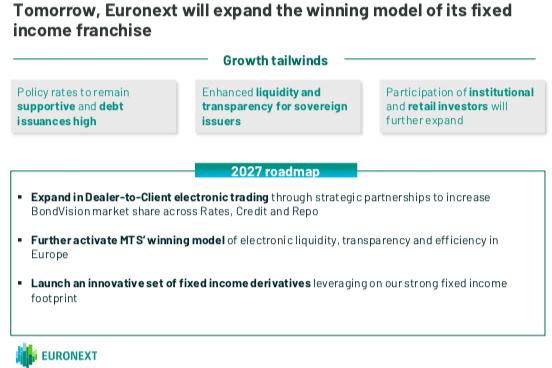

Boujnah described Euronext’s bond trading platform, MTS, as a hidden gem as trading volumes have multiplied by four since its acquisition as part of the Borsa Italiana deal.

“We are in an environment where fixed income is becoming more relevant and there are opportunities in the boom of sovereign debt in Europe,” he added.

Fabrizio Testa, chief executive of Borsa Italiana and Euronext head of fixed income trading, said at the investor day that fixed income trading revenue has grown to about 10% of the total. Testa said MTS benefitted from being in the same data center as Euronext’s other products and clients, and a co-location which provides opportunities for providing low latency, tick data.

He highlighted that the expansion of the fixed income franchise will include data, launching derivatives and expanding the fixed income index family. There is also an opportunity to grow algorithmic trading in fixed income.

“The fact that we now are in full control over our technology, we can capture all that business,” added Testa.

Financial targets

Boujnah said the group’s financial guidance reflects its ambition to accelerate growth and invest to seize future opportunities.

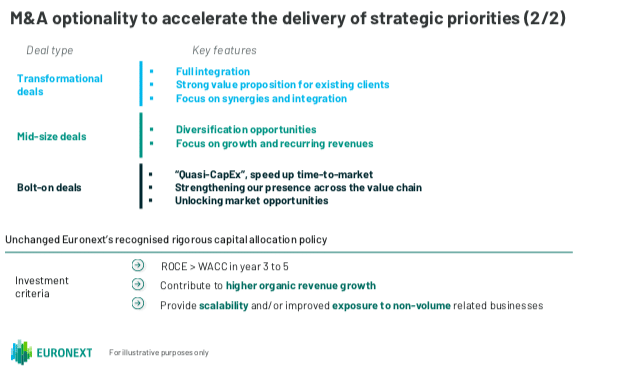

Euronext’s organic revenue growth is expected to be above 5% on average per year between 2023 and 2027 and adjusted EBITDA growth is expected to be above 5% on average per year over the same time period. Although Euronext is focussing on organic growth, Boujnah said the group will make more acquisitions if they are in line with its investment criteria.

“If and when we find opportunities that create, and not destroy, capital, and if we find opportunities with the right financial discipline, we will proceed,” he added.

Boujnah said that by 2027, Euronext will be larger, stronger and more diversified across new activities and asset classes in Europe.

“The group will be positioned as the unique and most efficient gateway to European capital markets for listing, trading, clearing, settlement and custody,” he added.