Eurex Clearing is planning to use distributed ledger technology to improve collateral mobilization in the second quarter of this year as the financial data and markets infrastructure (FDMI) industry is facing an inflection point, according to consultancy McKinsey.

In January 2025 Eurex Clearing said in a statement it had received non-objection from German regulator BaFin for DLT-supported collateral mobilization for its clients in all the markets that the CCP services – repo clearing; the cash market; and over-the-counter and exchange-traded derivatives.

Efthimia Kefalea, director, collateral & repo clearing design at Eurex Clearing, told Markets Media: “This is only the initial step we are taking in this area as innovation is in our DNA. We continuously explore the advantages that new technologies can offer.”

The CCP, owned by Deutsche Börse Group, said the flexibility, speed and efficiency of collateral transfers will be enhanced by mobilizing collateral with the support of the HQLAx’s digital ledger. HQLAx was formed by a consortium of financial institutions to improve collateral mobility.

There is no change in Eurex Clearing’s margining or default management process, and the risk-related methodologies remain the same. There is also no change in eligible collateral as CCPs in the European Union have strict requirements on what they can accept under Emir, the trading bloc’s central clearing regulation.

The new service is optional and clearing members can make an optimized decision depending on their business requirements. To join the new service, they need to become a client of HQLAx to use their digital ledger.

Kefalea said: “Clients can hold eligible collateral in custodians or central securities depositories (CSDs) where Eurex Clearing lacks a direct connection. Our solution ensures efficient, secure, and instantaneous mobilization, as the assets do not need to be physically transferred to be utilized as margin collateral.”

As a result, the new offering enables clients to effectively manage collateral during intra-day margin calls as the process of transferring eligible securities collateral is now more streamlined, which boosts efficiency for both clearing members and CCPs.

J.P. Morgan is planning to participate as the pilot clearing member. Helen Gordon, global head of derivatives clearing, at J.P. Morgan, said in a statement that the bank was early to identify the benefits of using traditional assets in digital form to move cleared derivatives collateral and is pleased to see this regulatory milestone achieved. She said: “We look forward to the next phase of implementation and realizing the risk and optimization benefits associated with improved collateral mobility for us and our clients.”

Kefalea continued she has been pleasantly surprised by the amount of interest expressed by multiple clients. Eurex Clearing has received numerous inquiries and many requests for meetings to gain further information and understand the technical details.

“We expect to have several clients onboard and actively using the service,’ added Kefalea.

She argued that the new offering enhances the attractiveness of Eurex Clearing’s offering, particularly within the context of EMIR 3.0. The regulation requires EU counterparties to establish an active account at an authorized CCP in the region and to clear a representative number of interest rate derivatives through this account.

“As we approach the implementation of active accounts, we view this as a unique selling point, enabling our clients to leverage previously underutilized collateral pools,” said Kefalea.

Matthias Graulich, member of the executive board at Eurex Clearing, said in a statement that Eurex Clearing continues to invest in such advanced services, reflecting its commitment to providing cutting-edge solutions and services to its clients.

Kefalea highlighted that Eurex Clearing is also taking part in market-wide initiatives such as the European Central Bank’s trials for the wholesale digital euro, and that it is the only CCP participating in BIS’ Project Agorá.

“During the ECB trials, we successfully integrated flows from the new technology with existing flows on traditional infrastructure,” she said. “CCPs can achieve this integration seamlessly while maintaining market integrity and safety by employing consistent risk management practices and serving as the single source of truth for both ecosystems.”

Inflection point

McKinsey said in a report that the financial data and markets infrastructure (FDMI) industry is thriving but potential disruption requires providers to make strategic changes to sustain their success.

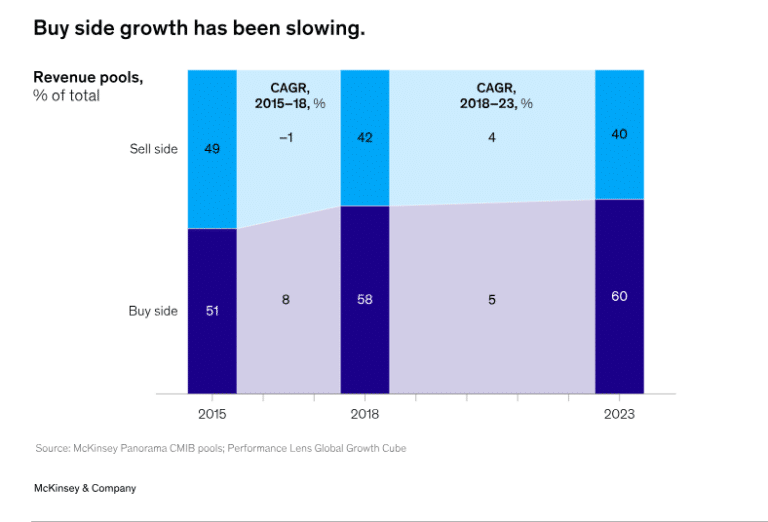

The consultancy highlighted that global FDMI revenues have risen at an 8% compound annual growth rate since 2018 and exceeded $278bn in 2023. The FDMI segment’s total shareholder return was 17% between January 2019 and December 2023, 70% higher than that of the broader financial services sector.

However, disruption is coming from Big Tech, the slowdown in capital market revenues, the rise of non-bank market makers, the growth of private markets and generative AI.

“Combined, these factors are creating an inflection point for the sector,” said McKinsey. “They will need to find new sources of value and change their playbooks to address two things at once: strengthening the core to improve the performance of existing businesses and innovating beyond the core to unlock new adjacencies and value pools.”

Over the last few years, the focus of FDMI providers has moved from crypto to the underlying technology of tokenization, said McKinsey. The consultancy has estimated that tokenized market capitalization could reach $2 trillion in 2030, excluding cryptocurrencies.

“With this focus, several FDMI providers are building solutions to enable the tokenization of specific assets,” added McKinsey. “Given the nascency of the technology and the lack of institutional-grade infrastructure, providers need to partner and collaborate to drive progress and encourage adoption.”

As a result, McKinsey recommended that FDMI providers should follow a two-pronged approach to sustain their growth of both strengthening the core and investing beyond the core, such as in new asset classes and private markets.

McKinsey said: “To build these new ecosystems, FDMI players will need to invest in technology that can deliver a wide range of services, seamlessly integrate with client systems, and make their operating model client-centric.”