Eurex, the derivatives arm of Deutsche Börse, aims to launch €STR options in the first quarter of next year as competition for market share in €STR short-term interest rate futures is increasing.

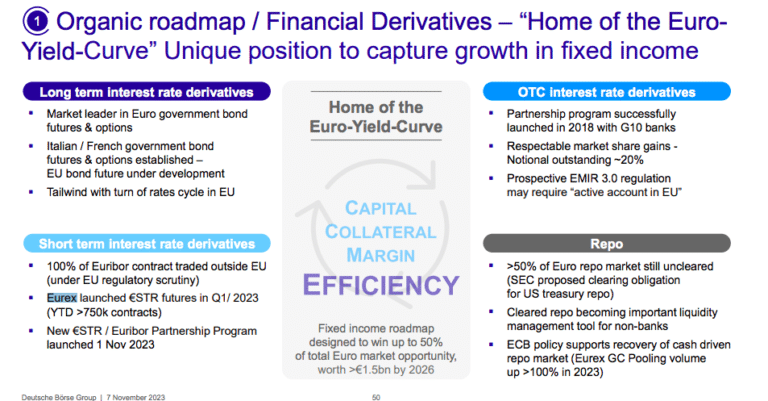

Matthias Graulich, global head of fixed income, funding & financing strategy and development of Deutsche Börse and member of the executive board of Eurex Clearing, said at a media roundtable on 21 November: “We are working towards a launch of €STR options in the first quarter of next year and also plan to introduce a spread functionality which reduces margin by around 70% between Euribor or €STR and Schatz futures.”

He continued that more than 1.4 million contracts have been traded in three-month Euro €STR futures since Eurex launched the product in January 2023 and activity has been significantly increasing in the last four weeks.

Eurex’s three-month Euro STR futures are based on the compounded €STR over a three-month period and provide a listed, centrally cleared, and cash-settled solution for trading or hedging the new risk-free rate that operates in parallel to the reference rate Euribor. They complement Eurex Clearing’s €STR overnight index swap offering with the aim of delivering maximum margin and capital efficiencies.

Eurex said at the time that the launch marked an important milestone in establishing €STR as the new benchmark risk-free rate and expanded Eurex’s EUR-denominated fixed income product offering.

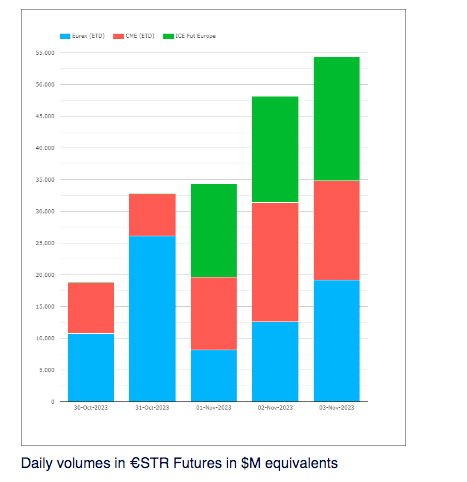

Chris Barnes at derivatives analytics provider Clarus Financial said in a blog on 8 November that there is now a three-way battle for market share in €STR STIRs between CME, Eurex and ICE.

Barnes wrote that volumes of €STR futures have been increasing from a small start in April.

“The competition between CME and Eurex has seen volumes increase to over $550bn-equivalent each month,” Barnes added. “For those futures market participants reading this, that is a volume of over 500,000 contracts a month.”

In September and October market share was evenly split between CME and Eurex, although 88% of open interest in €STR futures was at CME according to Barnes. However in November volumes of ICE’s €STR contract suddenly increased and Barnes noted that ICE introduced a three month ESTR indexed future liquidity provider programme at the start of that month.

“The three way battle for market share in €STR futures is an interesting one to follow,” Barnes wrote. “We cannot help but be reminded of SONIA futures. Will we end up with a single dominant exchange this time round?”

Graulich said that Eurex’s aim in fixed income is to build out its vision of the home of the euro yield curve by providing a single legal, operational and risk management framework across Euro denominated fixed income derivatives and repos. He highlighted that repo is becoming more attractive as excess liquidity shrinks and cleared repo is a source of funding the next morning’s variation margin.”

“We are the market leader in Euro government bond futures and options, we are in the advanced stages of developing EU bond futures and also growing share in euro swaps clearing,” Graulich added.

October volumes

Eurex reported that total volume increased by 16% year-over-year in October to 161.2 million contracts.

Turnover in equity derivatives increased by 43% over the same timeframe, and turnover in Interest rate derivatives rose by 22%. In index derivatives turnover grew by 4% year-on-year in October.

In OTC Clearing, notional outstanding volumes increased 15% over the same period. Notional outstanding volumes in interest rate swaps increased 7% to €13,955bn and notional outstanding in overnight index swaps increased 25% to €2,974bn.

“Eurex Repo, Eurex’s leading electronic market for secured funding and financing, again recorded a major increase in daily GC Pooling volumes in October, up 191% to €212.6 billion, whereby total average daily term-adjusted repo volume increased 78% y-o-y in October to €460.5bn,” added Eurex.