Exchange-traded funds in the US had record trading volumes as volatility increased following the Trump administration’s tariff announcements.

$SPY saw close to HALF A TRILLION in volume this week, easily a record. Many stud ETFs had record weeks incl $QQQ, $HYG, $VOO. So much trading and so much big fish trading (you not getting these $ numbers without institutional investors) pic.twitter.com/8WRRustZ2j

— Eric Balchunas (@EricBalchunas) April 11, 2025

Jeff Sardinha, Americas head of ETF solutions at State Street told Markets Media on 10 April 2025 that the firm saw record notional gross orders in the US of $16bn on 7 April, triple the volume on the same day in 2024.

Sardinha said: “I looked at the previous six days compared to the same six days in 2024 and we saw 50% more orders. Overall, notional trading volumes have been 87% higher.”

In equities, active equity products retained their share of 44% of flows since the start of 2025 according to Sardinha. In contrast, active fixed income was relatively muted, but passive fixed income ETFs had “massive activity.”

“It was less of a fixed income story and more of a Treasuries story,” he added.

At State Street, trading volumes of Treasury ETFs were almost 300% higher than in the same week in 2024. The spike in volumes did not create any operational issues at State Street, added Sardinha, as the firm has one global digital portal for authorized participants, who have the right to create and redeem shares of an ETFs. State Street has FIX API connectivity with these firms, which enables standardization of workflows across the industry. Sardinha added that close to 70% of State Street’s ETF trading flow is API-driven and the other 30% is somebody inputting into the digital portal.

“ETFs have proven time and time again that the liquidity doesn’t go away,” said Sardinha. “They have gone through financial crises, Covid and this volatility, and things are still being executed efficiently.”

ETF usage tends to increase during periods of market volatility, as investors look to express short-term tactical positions. March was no exception, and activity on our European and U.S. ETF marketplaces amounted to an all-time record of EUR 82 billion and USD 89 billion,… pic.twitter.com/R5nTeWMiME

— Tradeweb (@Tradeweb) April 11, 2025

Data provider Morningstar said in a report that its global markets index, a broad gauge of worldwide equities, fell 11% between 3 April and 8 April as markets digested the tariff announcements in early April. In contrast, ETF investors put $18bn into US ETFs.

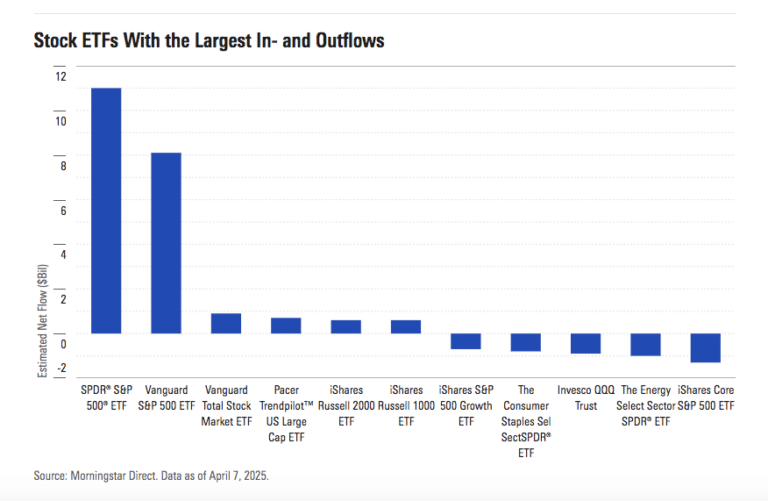

Bryan Armour, director of ETF and passive strategies research for North America, and Ryan Jackson, senior analyst, passive strategies at Morningstar, said in the report that although headline figure seems encouraging, investors were choosier than normal as 59 Morningstar categories had outflows over that span while just 40 gathered inflows.

“Investors piled into S&P 500 ETFs, specifically Silver-rated SPDR S&P 500 ETF SPY and Gold-rated Vanguard S&P 500 ETF VOO, and not much else when markets soured from April 3 through April 7,” said Morningstar. “These two ETFs accounted for over $19bn of inflows, while $5bn departed from the remaining equity ETFs in total.”

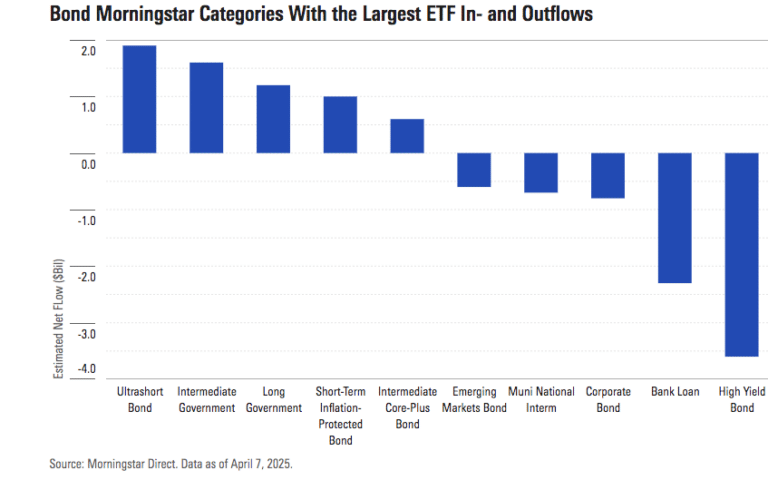

Morningstar continued that the flight to safety was more pronounced in fixed income than stocks. ETF investors preferred low credit-risk categories such as ultrashort bond, government, and Treasury inflation-protected securities but fled high-yield bonds and bank loans. The report added: “ETF investors flocked to nearly all flavors of Treasury bond and TIPS ETFs during the market turmoil. Five government-bond and TIPS categories brought in a combined $4.2 bn.”

Nick Kalivas, head of factor & equity ETF strategy at Invesco, told Markets Media that the asset manager is having increased conversations around low volatility and quality factors, and also international ETFs. He said: Investors are looking for exposures that can shine in a difficult environment.”

However, he warned that as factor-based ETFs provide an avenue for investors to express a view on certain segments of the market, so there has been dispersion in their performance during the volatile environment. Kalivas believes this provides an opportunity for investors.

‘The other thing that is important in this environment is that the cap-weighted S&P 500 is so concentrated with the big names,” he added. “When you you see a correction in those big names and their concentration falls, that has to be good for factor strategies which are tend to be underweight in those stocks.

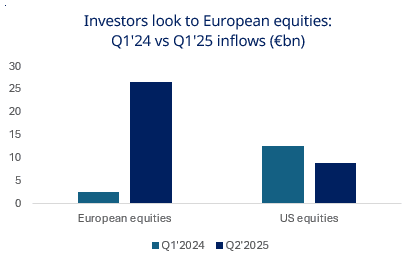

European asset manager Amundi said in a report that ETF investors scaled back their US equity exposures as the rotation to Europe continued.

“In a reversal of recent trends, investors allocated almost €10bn to European equity UCITS ETFs in February and withdrew €400m from US strategies,” added Anumdi.

This represents a shift from 2024, when equities accounted for more than half of the total net new assets.