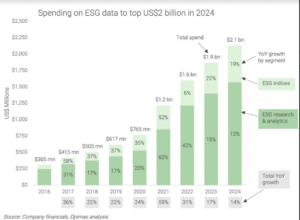

Following two years of unprecedented growth, the market for ESG data continued its winning streak in 2023, albeit with a more modest year-on-year growth rate of 17%. In a new report – The Market for ESG Data in 2024 – Opimas finds that the global market for ESG data should exceed the US$2 billion mark in 2024.

The blockbuster growth in 2021 and 2022 can largely be attributed to the EU’s Sustainable Finance Disclosure Regulation (SFDR) – what Opimas deems “the SFDR effect” – highlighting the importance of regulation as a key demand driver.

The US Securities and Exchange Commission’s recent approval of a climate disclosure rule for large corporates (The “Climate Disclosure Rule”) is likely to be followed by the passing of its own ESG fund reporting rule (“ESG Disclosures for Investment Advisers and Investment Companies”). The latter should re-accelerate spending on ESG data in the coming years. However, the former already faces legal challenges.

The SEC’s Climate Disclosure Rule as well as the latest European ESG disclosure regulation, the Corporate Sustainability Reporting Directive (CSRD), are boosting adjacent spending on corporate ESG reporting software and services, creating a major vertical expansion opportunity for ESG data vendors.

Looking beyond regulatory developments, we find that M&A activity among ESG data providers has continued. In addition to further horizontal consolidation among vendors, we are seeing increased vertical integration, whereby ESG data businesses are merging with index data entities, fund reporting vendors, and so on.

Regarding market share, the lineup has shifted since Opimas’ last report on ESG data, resulting in further consolidation. MSCI remains the market leader, followed by S&P, which recently overtook Deutsche Börse’s ISS.

Although ESG has become increasingly politicized, especially in the US, it is far from dead. Instead, 2024 marks yet another stage in its evolution, and we are seeing new terms such as “transition investing” replace the three-letter acronym.

Source: Opimas