The Depository Trust & Clearing Corporation (DTCC), the US post-trade market infrastructure, is contributing its own technology into an industry sandbox to help market participants move more efficiently from digital asset proofs of concept into production, and accelerate tokenization of real world assets.

Nadine Chakar, global head of DTCC Digital Assets, told Markets Media there has been incremental progress but there has not been a significant shift in traditional finance adopting digital assets, which could potentially transform the industry through further automation, increased efficiency and lower costs. One issue has been that many firms have launched their own digital asset initiatives and this siloed approach has led to a proliferation of infrastructures with a lack of interoperability.

Chakar said: “Interoperability is more than just technology, it is also about leadership, data, compliance, controls, standards and regulatory requirements.”

DTCC is naturally suited to take on the role of sponsoring a sandbox to help ensure interoperability because it is an industry utility owned and governed by its participants according to Chakar. She added: “In the US we are governed by multiple regulators, so sponsoring a sandbox has been a significant undertaking.”

She highlighted the importance of DTCC’s experience in helping the industry to move to a shorter settlement cycle in the US of one day after a trade, T+1, in May this year.

“T+1 proved that if we work together, nothing is impossible,” said Chakar. “While DTCC led the charge and execution of the shift, we did not get there on our own. We are taking that same spirit of innovation and leadership with Launchpad.”

In October this year DTCC announced an industry sandbox, DTCC Digital Launchpad, which is intended to clear the path to scalable adoption of digital assets.

Frank La Salla, president, chief executive and director at DTCC, said in a statement: “DTCC Digital Launchpad will unify stakeholders from nearly every corner of the financial markets to solve the challenges facing adoption of digital asset technology.”

DTCC will contribute its own technology into the sandbox which will allow market participants more efficiently move proof of concepts into production according to Chakar. She believes this will also increase the velocity of advancing digital infrastructure into the underlying structure of the marketplace.

Fintechs and other technology providers can use Launchpad for developing their own solutions, subject to meeting robust security and scalability requirements. DTCC is also opening up the sandbox to individual companies who do not have the means or the time to set up their own technology stack, so they can assess how digital technology can impact their operating models.

“We believe that an “Airbnb” concept of Launchpad will allow mid-range companies to easily get access to this technology,” added Chakar.

The sandbox’s first proof of concept is expected in the second quarter of 2025 and will be undertaken in consultation with members and the industry. Chakar said: “We are open to considering any great ideas!”

She continued that DTCC is deliberately trying to focus on the hardest problems and getting the best industry minds to think together, work collaboratively and break the challenges into manageable bites.

“At the end of 2025, we want to be judged on how we progressed digital asset initiatives from concept to production – not that we oversaw hundreds of concepts,” added Chakar.

A recent proof of concept on DTCC Digital Launchpad was led by Japan Securities Clearing Corporation (JSCC). The clearinghouse of Japan Exchange Group explored using tokenization to optimize collateral management. JSCC examined using digital assets and smart contracts to automate how margin calls can be automatically executed on a distributed ledger when certain conditions are met.

Konuma Yasuyuki, president and chief executive of JSCC, said in a statement: “By leveraging DTCC’s reusable blockchain-based infrastructure, we were able to jump-start our proof-of-concept, easily issuing digital assets such as cash, stocks, and bonds without needing to develop our own infrastructure. This allowed us to shift our focus to the initiative’s impact on our own business processes.”

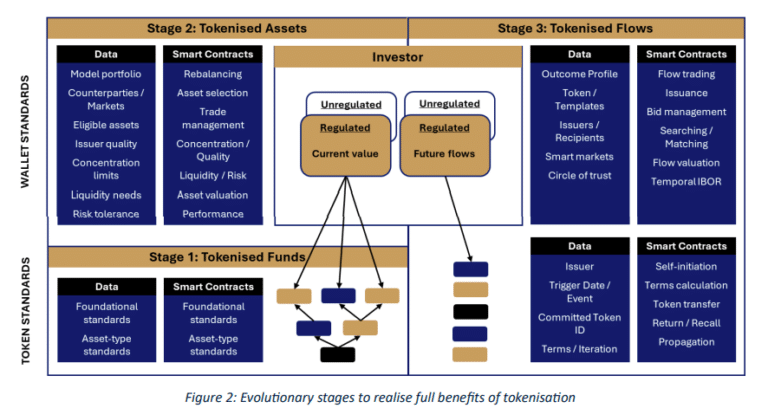

Tokenization

Chakar believes that DTCC Digital Launchpad will help accelerate real world asset tokenization because it is providing a space for all market participants to operate on the same infrastructure and share ideas.

Boston Consulting Group estimated in 2022 that tokenized real world assets would reach $16 trillion by 2030. Chakar said the reality is that not all assets will be tokenized. DTCC will only tokenize assets where there is a clear value proposition for the client, such as better and faster distribution, revenues, cost or capital savings.

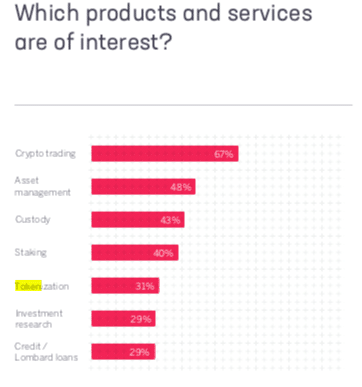

One third of institutional and professional investors who are active in the crypto market expressed interest in tokenization, ranging from tokenized funds to equity and debt instruments, according to the second edition of the Future Finance Report from Sygnum, the regulated Swiss digital asset banking group.

The bank surveyed more than 400 market participants from 27 countries who have an average of more than 10 years of investment experience. The respondents included banks, hedge funds, multi and single-family offices, DLT foundations, funds and asset managers.

Sygnum said: “Tokenization interest has risen since last year’s report, likely driven by an increasing number of leading traditional finance (TradFi) institutions launching their own tokenization platforms and products.”

The bank added that supportive regulation around the tokenization of real-world asset may reinforce this trend.

“It is our position that tokenized real world assets, rather than cryptocurrencies, carry the same risks as traditional securities and should adhere to the same regulation, with minor adjustments,” added Chakar. “Whether the asset is digital or traditional, we are not going to compromise on the resiliency, scalability or secure functioning of global financial markets.”

DTCC is highly regulated, which Chakar said is an advantage in helping the firm innovate in partnership with clients, the industry and regulators. She believes that Digital Launchpad will also allow DTCC to equip regulators with proof points to get them more comfortable with the work being done. For example, regulators prefer traditional institutions to use private, permissioned blockchains rather than public chains, which they view as more risky. Chakar said that the industry can get to a stage where public blockchains may make sense, but there is a lot of work to do to get the regulators comfortable.

“Our ambition is for DTCC to become the global digital market infrastructure,” she said. “DTCC should be able to deliver the same efficiencies with digital assets tomorrow as we do in traditional markets today, while ensuring proper market functioning, transparency and liquidity.”