The World Bank has issued a digital bond that will be settled with wholesale central bank digital currency showing that tokenization of bonds is becoming mainstream, with transactions of significant size and tenor and the involvement of a number of institutional investors.

Amar Amiani, head of the Goldman Sachs digital assets team in EMEA, said on a panel at City Week 2024 on 21 May in London that bonds are furthest ahead in the tokenization of real world assets.

“We are definitely at the point where we are seeing significant size and tenor being done,” said Amiani. “I think the most recent issuance was the World Bank issuing on SDX platform.”

On May 15 The World Bank priced the first Swiss Franc digital bond by an international issuer which will settle using Swiss Franc wholesale central bank digital currency (wCBDC).

The seven-year CHF 200m digital bond is listed on the traditional SIX Swiss Exchange and also its digital asset arm, the blockchain-based SIX Digital Exchange. On SDX the bond will initially settle using the Swiss National Bank’s wCBDC as part of the Project Helvetia initiative, in which the central bank has been collaborating with financial institutions to develop digital financial markets.

The bond’s subsequent coupon and redemption payments will be made using tokenized CHF on the SDX. SDX also connects to traditional settlement systems such as Euroclear and Clearstream allowing investors to hold the digital bond through their usual custodians.

The World Bank said in a statement that the bond was placed mainly in Switzerland, with banks, bank treasuries and corporates representing the majority share of allocations at 60%, followed by asset managers, insurance companies and pension funds at 39%. The remainder was placed with central banks and official institutions. Commerzbank was the sole lead manager and is also the paying and issuer agent for the transaction.

David Newns, head SIX Digital Exchange, said in a statement: “Being able to settle wholesale transactions in tokenized central bank money is a critical, foundational requirement for the adoption of a blockchain based capital markets infrastructure.”

Zahid Mustafa, head of digital asset custody at State Street Digital, said on the panel that using wholesale CBDC for the World Bank bond was interesting.

“These models give me hope, because it brings the asset and cash record on the same ledger,” Mustafa added.

Amiani continued that in the past 18 to 24 months the tokenization market has moved from proof of concept and small bond transactions to big size, the participation of a lot of investors and the ability to finance these positions in repo or securities lending transactions.

“Digital bonds are continuing to lead the way and are progressing to become more mainstream,” Amiani added.

He expects money market funds to follow, and then the tokenization of illiquid assets such as real estate and private equity, with a lot of projects coming into fruition in the coming months and to start to scale.

“One caveat is that a lot of real world assets will first have to be tokenized in a debt, equity or fund structure,” he added. “For example, in real estate, would you look at putting a land registry on blockchain ?”

Nikhil Sharma, the Hong Kong-based head of growth for Onyx Digital Assets, described JP Morgan’s digital assets platform as a unified ledger which can represent the tokenization of different assets with the native integration of JPM Coin.

“JPM Coin is a regulated fiat payment mechanism so we have cash and tokens flowing together on the same ledger, which is when we start to see efficiencies,” Sharma said.

Sharma continued that when JP Morgan started to think about tokenization, it anchored on collateral as an initial use case – i.e.by tokenizing traditional assets to be used in repos on an intraday basis. The product has since been expanded to term repo and overnight repo.

The idea was to compress execution and settlement and to see efficiencies in terms of operations, transparency, control and precision around how repos are transacted.

“In both these use cases, the common denominator is that they involve the liquid spectrum of assets,” Sharma added. “A couple of weeks ago we moved onto issuing, transacting and settling bonds on a blockchain.”

JP Morgan intends to move onto tokenizing illiquid real world assets, beginning with alternative investment funds, and has conducted some technical tests.

“At the moment we are looking to scale Onyx and make it a high-utility connected platform that provides investors with what they need today,” Sharma said. “Public blockchains are young and maturity will come with time, and we are not completely averse to them.”

Onyx is built on a private permissioned blockchain, rather than a public chain, which Sharma said was for compliance reasons. He highlighted that in 2022 the bank tested a live spot foreign exchange trade of Singapore dollars against Japanese yen on the public Polygon chain as part of the Monetary Authority of Singapore’s Project Guardian. The project is a collaborative initiative between the regulator and market participants to test the feasibility of asset tokenization applications in regulated financial markets.

However, the test was not scaled up to a product for compliance reasons, including the lack of a persistent infrastructure that is always available.

“Tokenization is the foundation for a Lego brick structure to democratize access, create operational efficiencies, balance sheet optimization, and new products,” Sharma added. “There will be an incremental journey towards the open innovation that is enabled by a public blockchain.”

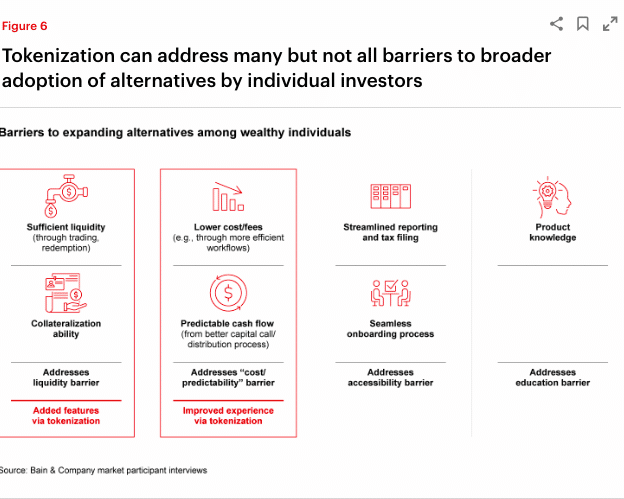

Onyx and consultancy Bain & Company estimated in a paper last year that tokenization could potentially unlock $400nn in additional annual revenue for the alternatives industry. The paper said the alternative asset management industry, which has traditionally focused on institutional investors, could provide access to wealthy individuals as tokenization can streamline, automate, and simplify most stages of alternative investments.

Sharma said: “Our thesis is that tokenization could also improve liquidity and collateralization, automate capital calls, and enable portfolio customization but there are a number of things that need to be done before we get there. The primary thing you need to have is tokenized funds existing on chain.”

Goldman Sachs launched its tokenization platform, GS DAP, in November 2022. Amiani said this was in response to client demand led by the European Investment Bank, who wanted to issue bonds on blockchain technology.

“Since then we have seen that acceleration across bonds but there is also demand across other asset classes,” Amiani added. “There is also demand for using assets as collateral.”

Amiani continued that the bank is building the platform because there will be a lot of efficiency gains from reducing risk, which can reduce capital costs and increase liquidity.