The digital assets market is set for exponential growth, driven by breakthroughs in blockchain technology, tokenization and regulatory clarity according to David Mercer, chief executive of LMAX Group, which operates institutional execution venues for foreign exchange and digital assets trading.

Mercer said in an email that the ability to tokenize assets and make trading efficient, fungible, and accessible will revolutionise capital markets. He expects the integration of digital assets with traditional finance (TradFi) to gather pace as the wider ecosystem becomes more established. and believes that stablecoins and other digital fungible collateral, backed by reputable frameworks will fuel this transformation by serving as a bridge between fiat and digital currencies.

Stablecoins have been used in digital finance to transfer value and liquidity 24/7/365 seamlessly around the globe, in contrast to a fiat currency such as the US dollar that is used in traditional banking. They are backed by collateral to maintain a stable price over time by pegging value to a reference asset such as a fiat currency or a commodity.

Market maker Wintermute said in a report that crypto market structure transformed in 2024, fueled by institutional-grade products, deeper market liquidity, and increased regulatory clarity.

“The SEC’s approval of spot Bitcoin and Ethereum ETFs, alongside growing bipartisan support for crypto frameworks, removed key barriers for traditional finance players, driving unprecedented institutional engagement and capital inflows,” added Wintermute.

The bitcoin and ether exchange-traded funds approved in 2024 are a reminder of investor appetite for digital assets said Mercer, but he noted that these are traditional financial products wrapped around a new underlying asset.

“That’s a start, but for the market to really take off, we will need to see development of derivatives, an efficient repo market and effective margin products across all of the underlying tokens,”added Mercer.

There has been progress in the infrastructure for crypto derivatives where the existing bilateral markets are often fully or over-collateralized which creates capital inefficiencies, with the use of tri-party agents for collateral management adding cost. Digital Asset, the enterprise blockchain provider, said in January 2025 that it will introduce on-chain collateral and margin management solution using the Canton Network’s privacy capabilities. On-chain collateral agreements will be encoded as smart contracts to allow automatic execution and enforcement of terms in line with ISDA CSA margin compliance requirements.

In the US Bitnomial, a digital asset derivatives exchange company, said in a statement it was launching Bitnomial Clearinghouse, a CFTC registered derivatives clearing organization and stablecoin clearinghouse, on 30 January 2025. Bitnomial said this is only the fourth US clearinghouse to clear margined, physically-settled, and cash-settled derivatives contracts.

“This is not just a milestone for Bitnomial, but also a game-changer for the broader $100bn average daily volume global crypto derivatives market, 95% of which has operated offshore until now,” added Bitnomial.

Michael Dunn, president of Bitnomial Exchange, said in a statement that traditional clearing infrastructure has not met the needs of the digital asset market as spot positions are not recognized.

“Our clearinghouse will eliminate these inefficiencies by accepting digital asset collateral to margin futures and options trading, subject to all necessary regulatory approvals, which is unprecedented in the US,” added Dunn.

Mercer added there will be greater participation from real money when systemic risks such as market concentration and regulatory uncertainties are also addressed. In the US the incoming administration is viewed as favourable to the crypto industry and has named David Sachs, Paypal’s founding era COO, as the White House AI & crypto czar.

“In terms of wholesale institutional interest, we’ll have to wait and see what regulatory changes are introduced to encourage this,” said Mercer. “The repeal of SAB 121 will be key, which prevented banks from providing crypto custody solutions. That should be an accelerant for the whole crypto market.”

In the US, the SEC’s SAB 121 ruling still requires custodians to recognise all digital assets as liabilities on their balance sheets, which is a significant burden.

LMAX Group

If the US establishes a regulatory framework for the digital asset industry, then more traditional institutions are likely to enter the space.

Mercer argued that LMAX Group is uniquely positioned in terms of the completeness of its offering across traditional finance and digital assets as LMAX supports all major FX currency pairs, NDFs, swaps, market data and analytics. In addition. The group has a broker and one of the largest institutional digital assets’ exchanges under the same roof according to Mercer.

“There aren’t many institutions out there that have the completeness of our global exchange infrastructure in London, New York, Singapore and Tokyo, all types of trading protocols as well as offering digital assets trading and infrastructure all built on world leading, low latency proprietary technology,” he added.

LMAX’s main competitive advantage is that the firm entered on the ground floor of this transition, working alongside clients to help them navigate the fusion of tradFi and deFi (decentralized finance), said Mercer. The firm launched digital assets trading and custody in 2018 and Mercer said it is continuing to build “something unique” in terms of new-world DeFi market access based on established tradFi capabilities, that will future-proof its business.

Mercer believes that Institutions that once relied on traditional market infrastructure will increasingly adopt solutions for every transaction, so a micro-payment or a large-scale trade can occur seamlessly on-chain. Therefore, the winners will be those who can develop their business models to harness the parallel opportunities offered by real-world TradFi and tokenized or blockchain solutions.

“We’re closer than anyone else to that fusion,” said Mercer. “Ultimately, this is a very exciting time for us with great opportunities ahead, as we continue our pace of innovation and investment.”

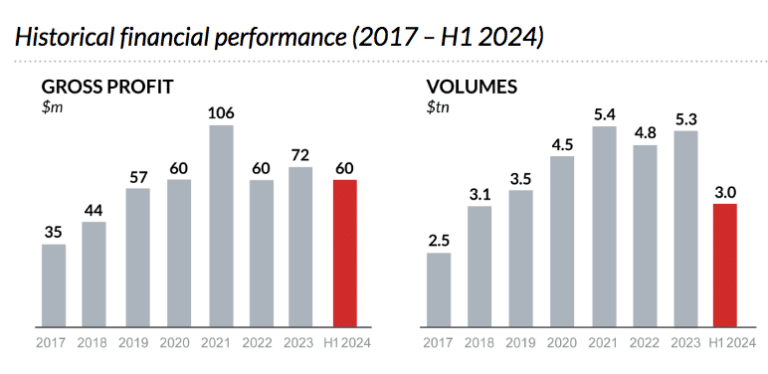

For the first six months of 2024 LMAX Group reported a gross profit of $60m and record half-year trading volumes of $3 trillion. LMAX Digital volumes increased 74% from the second half of 2023, which the firm said was the strongest since the second half of 2021.

“The transition to a truly globally interconnected financial system is not slowing down,” said Mercer. “We’ve expanded our FX offering significantly both organically and via acquisitions, now reaching the real-money client segment with a diverse set of FX products.”

Fidelity Digital Assets said in its 2025 Look Ahead that the total nominal amount of real world assets on-chain sits at $14bn, up from $8bn in 2023. In financial services, Fidelity Digital Assets expects big banks and asset managers to continue to put traditional assets such as bonds, credit, and funds on-chain, with burgeoning applications also coming to market.

“If $14bn of real world assets are on-chain right now, and if demand for this niche use of blockchain technology continues to expand throughout 2025, it would not be surprising to see this value approach $30bn by the end of 2025,” added Fidelity.