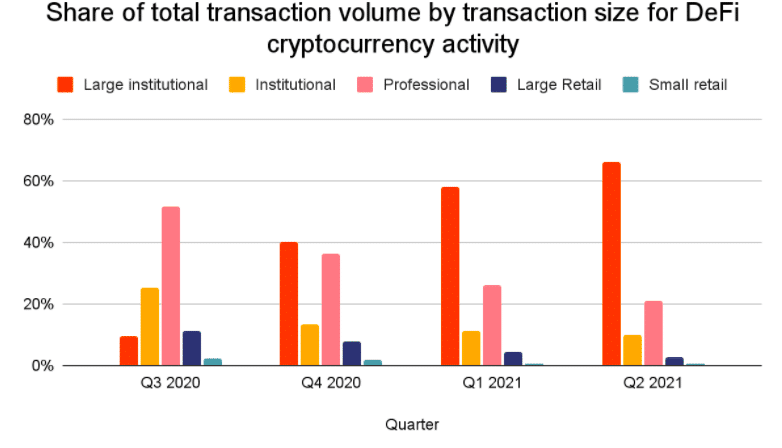

Large institutional transactions above $10m (€8.5M) made up the majority of DeFi transactions in the second quarter of this year.

Chainalysis, which provides data-driven content on cryptocurrency markets and regulation, said in a blog that transactions larger than $10m accounted for more than 60% of DeFi transactions in the second quarter of this year, compared to under 50% for all cryptocurrency transactions.

Decentralized finance, DeFi, or Open Finance, uses smart contracts automatically executing on blockchains. Information on a blockchain is immutable, it cannot be changed without consensus, and trusted information can then be tokenized and traded.This allows any user on a blockchain to stake digital assets as collateral and provide services such as lending or liquidity without the involvement of a traditional financial intermediary such as a banks, brokers or an exchange.

“The data shows that large transactions make up a much bigger share of DeFi activity, suggesting that DeFi is disproportionately popular for bigger investors compared to cryptocurrency as a whole,” added Chainalysis. “Professional, large retail, and small retail-sized transactions also accounted for a bigger percentage of all cryptocurrency activity compared to DeFi activity in that same time period.”

Source: Chainalysis.

Global DeFi Adoption Index

Chainalysis has launched a geographic index ranking 154 countries by DeFi adoption as it represents one of the fastest-growing and most innovative sectors of the cryptocurrency economy.

Most countries ranking high on our DeFi Adoption Index are ones that already had strong crypto markets and high over all tx volumes. This makes intuitive sense: Users with a prior crypto background would be more likely to embrace an innovation like DeFi. https://t.co/Sm5N6ZDg9K

— Chainalysis (@chainalysis) August 24, 2021

“The data suggests that while grassroots cryptocurrency adoption generally is highest in emerging markets, DeFi adoption is strongest in high-income countries that already had substantial cryptocurrency usage, especially amongst traders and institutional investors,” said Chainalysis.

The United States, China, Vietnam, the UK, and several other Western European countries that ranked highly on the DeFi Adoption Index.

Between April 2019 and June 2020, the vast majority of web traffic to DeFi protocols came from North America, with Western Europe adding a substantial and growing percentage starting around September 2019 according to Chainalysis.

“Around June 2020, we see more and more traffic from other regions, especially Central and Southern Asia, as total value sent to DeFi platforms begins to explode,” said Chainalysis. “Though China has become one of the biggest single countries for DeFi transaction volume, East Asia’s regional share of DeFi protocol web traffic remains low in comparison to its share of traffic to centralized cryptocurrency services.”

Bloomberg Galaxy DeFi Index

The growth in DeFi was also demonstrated by Bloomberg and Galaxy Digital, launching an index for the sector.

The benchmark is designed to measure the performance of the largest decentralized finance protocols by market value that offer financial services without a central financial intermediary, such as brokerages, exchanges, or banks. https://t.co/pK4IbvoFme

— Bloomberg LP (@Bloomberg) August 20, 2021

Alan Campbell, head of product management for Bloomberg’s multi-asset index business, said in a statement: “Decentralized finance is growing as the next major investment theme within crypto. As liquidity and institutional custody solutions continue to grow, DeFi has become an increasingly compelling option for institutional investors, and we’ll continue working with Galaxy to expand our crypto index offering.”