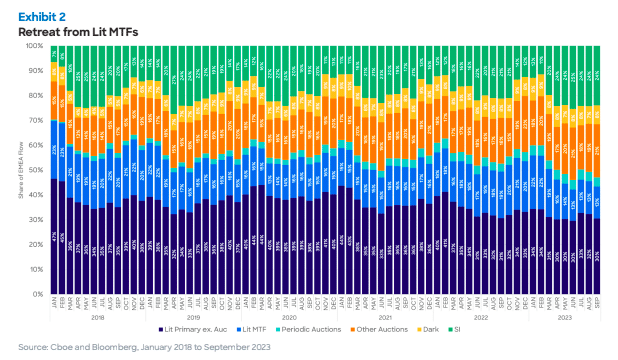

European equity trading volumes on primary venues dropped to just 30% in the third quarter, highlighting the need for technology in order to source increasingly fragmented liquidity and trade at the best price.

One of the aims of introducing MiFID II regulations in the European Union was to boost lit volumes in the region. However, in the third quarter of this year daily turnover in the European equity market was an average of €42.1bn, a decline of 13% from the preceding quarter, according to Liquidnet’s Q3 2023 Liquidity Landscape: Moving on from MiFID. The third quarter’s lit continuous primary venue share (not including closing auctions) was lowest in September, when it accounted for 30.49% of overall volumes according to Liquidnet, just above the levels in the second quarter.

“July, August, and September all saw their lowest average daily turnover since the Covid-era summer of 2020 as markets digested broad economic uncertainty,” added the report.

Closing auction activity also rose to an average of 27.2% of overall lit market activity in the third quarter, similar to levels in the second quarter. The monthly record was set in June this year at 29.95% of volume, with September just behind at 29.84%. In the previous three years monthly averages for closing auctions was between 20% and 23%, but the rise in passive investing means more activity is forced to trade at market close in order to benchmark performance which reduces continuous secondary market activity in both primary venues and dark pools.

Liquidnet said: “Reduced overall continuous activity results in clear outcomes to protect end investors – a stronger reliance on technology to source and generate liquidity and the need to trade in size in the dark.”

Technology at a crossroads

Technology is also required as asset managers are continuing to shift to multi-asset class trading in order to diversify returns in a macroeconomic environment of rising rates, inflation and uncertain geopolitics.

“In addition, as technology moves to incorporate AI, the industry is standing at a crossroads,” added Liquidnet. “We cannot turn our back on technology but the question of how trading can best embrace technology with minimal risk is one that requires further industry clarification and regulatory reassurance.”

There is regulatory concern globally that AI may be used to manipulate markets so Liquidnet expects far greater regulation over technology, data providers and users across all assets, markets, and participants.

“This will lead to a whole new interpretation of extraterritoriality as third-party firms – often US-based – increasingly fall under European and UK regulators,” added Liqudinet. “The debate over technology in trading is just getting started.”

The report said that as electronic trading volume is increasing, the area of most current consternation is differentiation between a transmission of “interest to trade” and what is “executable.” Another area of focus is whether the increase in automated indication of interests (IOIs) may require bilateral activity to be formalized on a trading venue.

“The question remains as to whether this is technological transmission of information to assist with trading, rather than bringing together buyers and sellers to execute,” said Liquidnet.

T+1

In addition to increased fragmentation making it harder to source liquidity, the industry faces the challenge of the US and Canada cutting their settlement cycle next year. The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1 on 28 May 2024 in the US and on the previous day in Canada. The US Securities and Exchange Commission said the aim is to reduce latency, lower risk and promote efficiency and greater liquidity.

The move has global ramifications due to the size of overseas investments in US securities. ESMA is consulting on the costs and benefits of a possible reduction of the settlement cycle in the European Union and whether any regulatory action is needed to smoothen the impact for EU market participants of T+1. Due to time zone differences, Asian back offices will be handling the majority of their cross-border volumes on what is effectively a trade-date basis once T+1 goes live, while settlement can currently take several days. Liquidnet highlighted that foreign investors have no direct access to the primary US clearing house, the NSCC.

“The benefits of technology to bring together disparate systems to communicate across the trade lifecycle—along with use of AI—to achieve greater operational efficiencies appears obvious,”added Liquidnet. “Market participants are of the view that the reduction in settlement time will lead to more trading falling out of automated settlement cycles despite the introduction of initiatives such as DTCC Match to Instruct given the increased likelihood of missed cut off times due to time zone differences.”

In September DTCC said 350 investment managers are now using its central trade matching (CTM’s) automated trade affirmation capabilities to accelerate the post-trade lifecycle, as firms prepare for the move to T+1. The CTM platform automates the trade confirmation process across multiple asset classes, such as equities, fixed income and repos for both cross-border and domestic US transactions.

In October State Street announced that it is offering an automated workflow solution and integration with DTCC within State Street’s foreign exchange trading service, StreetFX, in order to help the transition to T+1. When used in conjunction with the Match to Instruct workflow, StreetFX executes the necessary FX trade shortly after the affirmation of the securities trade and staging at the DTCC for T+1 settlement.